- United States

- /

- Specialty Stores

- /

- NasdaqCM:NEGG

Newegg (NEGG): Assessing Valuation After Fresh 2025 Financial Projections Spark Investor Excitement

Reviewed by Simply Wall St

Newegg Commerce (NEGG) just released its financial projections for the full year ending December 31, 2025. The company is guiding net sales between $1.38 billion and $1.42 billion, with an expected net loss of $10 million to $16 million.

See our latest analysis for Newegg Commerce.

Newegg Commerce's latest earnings outlook appears to have energized the market, with the share price soaring 40.85% in a single day and notching an impressive 648.49% return year-to-date. Despite this rapid rebound, the one-year total shareholder return stands at 425.77%, suggesting short-term momentum is building on top of a longer-term turnaround story.

If Newegg's surge has you scanning for other fast movers, now is a great moment to branch out and discover fast growing stocks with high insider ownership

With such explosive gains and fresh guidance in hand, investors now face a pivotal question: Is Newegg Commerce still undervalued, or are the company’s prospects already fully reflected in its current share price?

Price-to-Sales Ratio of 1x: Is it justified?

With Newegg Commerce trading at a price-to-sales (P/S) ratio of 1x and a closing share price of $66.72, the company looks more expensive than its industry peers on this key metric.

The price-to-sales ratio measures how much investors are paying for each dollar of revenue generated by the company. In the specialty retail sector, where Newegg operates, this is often used to compare businesses even when earnings are negative or volatile, since it focuses purely on sales performance regardless of current profitability.

Right now, Newegg’s P/S ratio outpaces the US Specialty Retail industry average of 0.5x. This implies the market is pricing in superior growth or unique potential relative to its competitors. However, when compared to peer companies with an average P/S of 1.2x, Newegg appears more attractively valued within that group. This potentially reflects mixed expectations for the company’s turnaround efforts and the uncertainty around future earnings. If the market’s assumptions about Newegg’s turnaround prove true, the P/S multiple may find support near peer group levels. Without robust growth, it could move closer to the industry average.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 1x (OVERVALUED)

However, ongoing net losses and uncertain revenue growth remain key risks that could challenge Newegg Commerce’s valuation and future turnaround prospects.

Find out about the key risks to this Newegg Commerce narrative.

Another View: Discounted Cash Flow Perspective

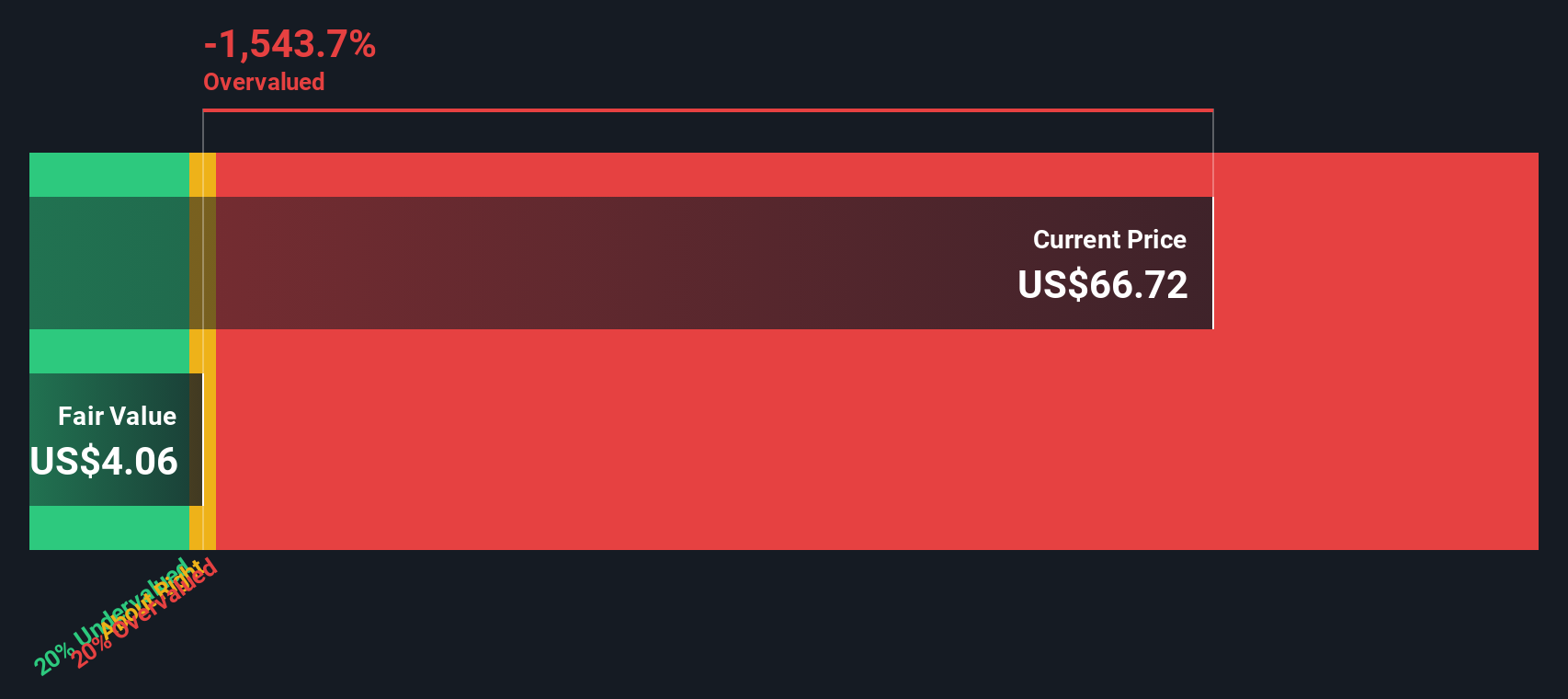

While the price-to-sales ratio suggests Newegg Commerce may be overvalued, our DCF model provides an even starker comparison. With shares trading at $66.72, the DCF approach calculates a fair value of $4.06, implying the stock could be significantly overvalued based on future cash flow projections. Which perspective will prove more accurate as the story unfolds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Newegg Commerce for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Newegg Commerce Narrative

If you want to dive deeper or have your own insights, you can examine the numbers and craft a personal narrative in just a few minutes. Do it your way

A great starting point for your Newegg Commerce research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your next investment win by checking out hidden gems, state-of-the-art disruptors, and reliable dividend payers with the Simply Wall Street Screener. Take the lead with these handpicked opportunities before others catch on.

- Seize the chance to catch undervalued stocks ready for a potential rebound by using these 878 undervalued stocks based on cash flows.

- Tap into the growth wave as artificial intelligence transforms entire industries. Start with these 27 AI penny stocks.

- Accelerate your portfolio’s income by targeting companies with impressive yields through these 17 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newegg Commerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NEGG

Newegg Commerce

Operates as an electronics-focused e-retailer in the United States, Canada, and internationally.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives