- United States

- /

- Retail Distributors

- /

- NasdaqCM:JL

Investors Continue Waiting On Sidelines For J-Long Group Limited (NASDAQ:JL)

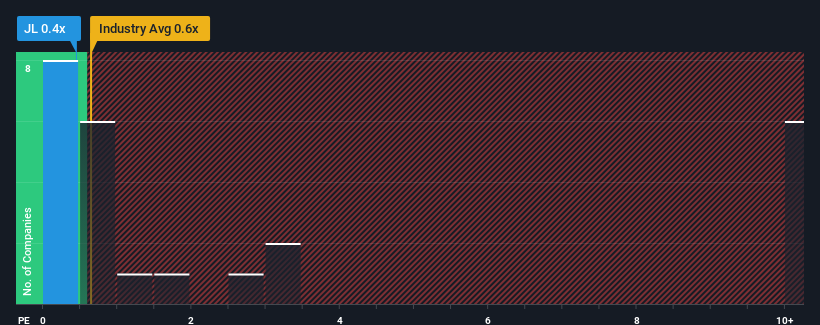

There wouldn't be many who think J-Long Group Limited's (NASDAQ:JL) price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S for the Retail Distributors industry in the United States is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for J-Long Group

What Does J-Long Group's Recent Performance Look Like?

As an illustration, revenue has deteriorated at J-Long Group over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for J-Long Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For J-Long Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like J-Long Group's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 26%. Regardless, revenue has managed to lift by a handy 21% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 2.8% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that J-Long Group's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On J-Long Group's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We didn't quite envision J-Long Group's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with J-Long Group (at least 3 which are a bit unpleasant), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:JL

J-Long Group

Distributes reflective and non-reflective garment trims in Asia, Hong Kong, the People’s Republic of China, and internationally.

Adequate balance sheet slight.

Market Insights

Community Narratives