- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqCM:HOUR

Is Hour Loop (NASDAQ:HOUR) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Hour Loop, Inc. (NASDAQ:HOUR) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

What Is Hour Loop's Debt?

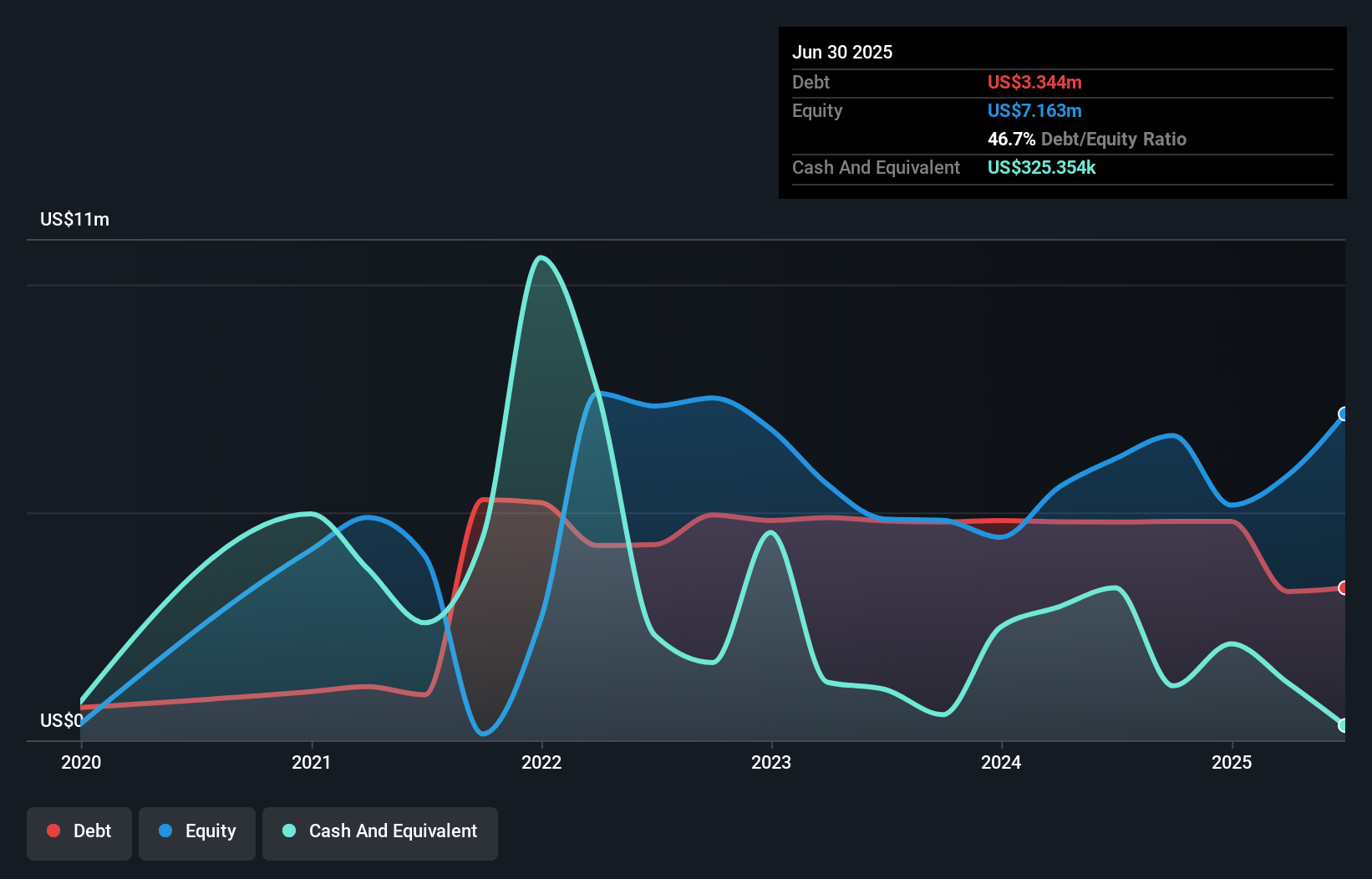

You can click the graphic below for the historical numbers, but it shows that Hour Loop had US$3.34m of debt in June 2025, down from US$4.79m, one year before. However, it does have US$325.4k in cash offsetting this, leading to net debt of about US$3.02m.

How Strong Is Hour Loop's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Hour Loop had liabilities of US$15.7m due within 12 months and liabilities of US$80.8k due beyond that. Offsetting these obligations, it had cash of US$325.4k as well as receivables valued at US$478.0k due within 12 months. So it has liabilities totalling US$15.0m more than its cash and near-term receivables, combined.

Hour Loop has a market capitalization of US$67.9m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

Check out our latest analysis for Hour Loop

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Hour Loop has a debt to EBITDA ratio of 3.5 and its EBIT covered its interest expense 3.7 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Worse, Hour Loop's EBIT was down 59% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Hour Loop will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Looking at the most recent two years, Hour Loop recorded free cash flow of 26% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

We'd go so far as to say Hour Loop's EBIT growth rate was disappointing. Having said that, its ability to handle its total liabilities isn't such a worry. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Hour Loop stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 6 warning signs we've spotted with Hour Loop (including 4 which are significant) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Hour Loop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HOUR

Hour Loop

An online retailer, engages in e-commerce retailing business in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

This strategic transformation of TTE? Significant re-rating potential

Q3 Outlook modestly optimistic

Okamoto Machine Tool Works focus on profitability

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.