- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:GLBE

Global-E Online (GLBE) Is Up 5.1% After Acquiring Return Go and Securing New Brand Partnerships - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Global-E Online has been recognized for its leadership in cross-border e-commerce, achieving profitability for two consecutive quarters and expanding its footprint to support transactions in 200 countries.

- Recent developments include new partnerships with brands like Skylrk and Bally, and the acquisition of AI-powered returns platform Return Go, which further strengthens its merchant service offerings.

- We'll explore how Global-E Online's acquisition of Return Go and new brand partnerships impact its investment narrative and future growth prospects.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Global-E Online Investment Narrative Recap

To be a shareholder of Global-E Online, you need to believe in the continued globalization of direct-to-consumer e-commerce and the company's ability to retain large enterprise partners while navigating complex regulatory risks and tariffs. Recent partnerships and acquisitions, including Return Go, reinforce Global-E’s footprint, but do not fundamentally shift the biggest short-term catalyst, successful onboarding of major new brands globally, or address the largest risk: merchant concentration and trade policy uncertainty, which remain core considerations.

Among the recent announcements, the three-year renewal of Global-E’s strategic commercial agreements with DHL stands out given the company’s reliance on seamless global logistics for merchant success. This renewed commitment with a key logistics partner solidifies the service network necessary for scaling the global transaction volume central to Global-E’s growth ambitions and catalyzes merchant confidence in maintaining and expanding their cross-border operations.

However, despite recent expansions, investors should be especially aware that should a key enterprise partnership change or be lost...

Read the full narrative on Global-E Online (it's free!)

Global-E Online's narrative projects $1.7 billion revenue and $328.6 million earnings by 2028. This requires 25.6% yearly revenue growth and a $357 million earnings increase from -$28.4 million.

Uncover how Global-E Online's forecasts yield a $47.69 fair value, a 31% upside to its current price.

Exploring Other Perspectives

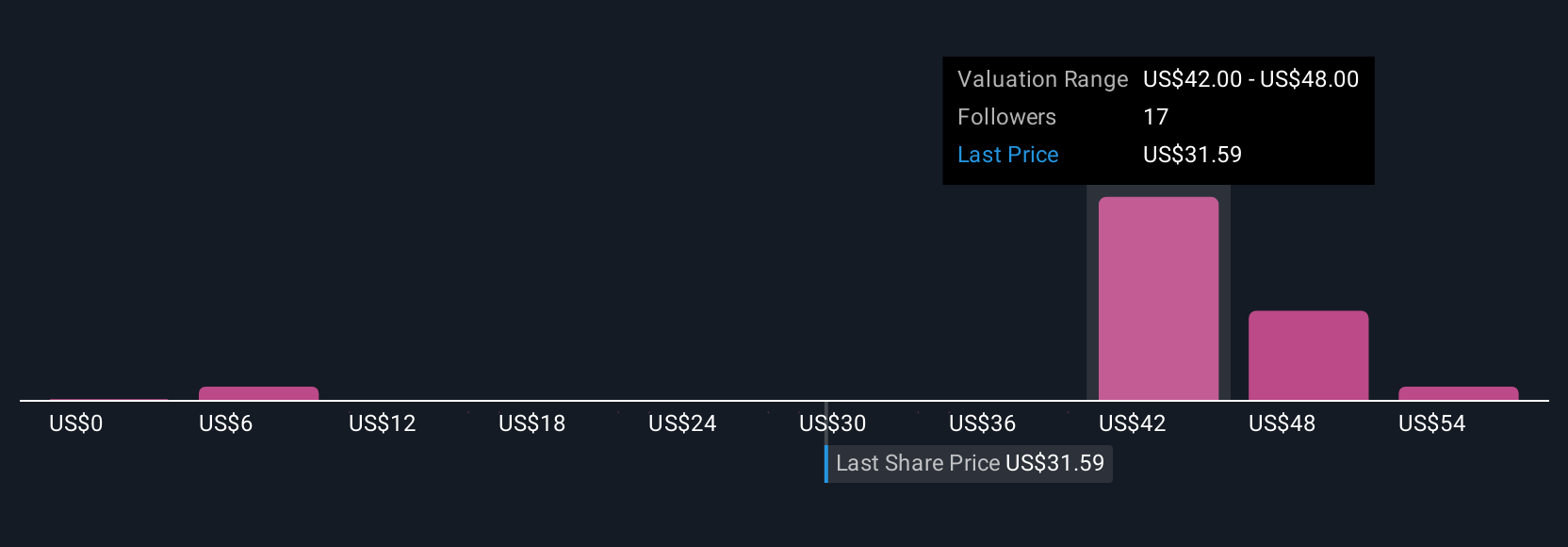

The Simply Wall St Community presents 11 distinct fair value estimates for Global-E, spanning from US$11.82 to US$118.19 per share. While opinions differ sharply, the importance of Global-E’s ongoing ties with leading merchants and logistics partners could have far-reaching effects on earnings stability and market sentiment. Explore these viewpoints for a broader perspective on the stock.

Explore 11 other fair value estimates on Global-E Online - why the stock might be worth less than half the current price!

Build Your Own Global-E Online Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global-E Online research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Global-E Online research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global-E Online's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 23 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLBE

Global-E Online

Provides direct-to-consumer cross-border e-commerce platform in Israel, the United Kingdom, the United States, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives