- United States

- /

- Specialty Stores

- /

- NasdaqGS:FIVE

Is the Stanley Tumbler Lawsuit Changing the Investment Story for Five Below (FIVE)?

Reviewed by Sasha Jovanovic

- In early November 2025, Pacific Market International filed a lawsuit in California accusing Five Below of selling unauthorized copies of Stanley-branded insulated tumblers, alleging trademark and patent infringement.

- This legal dispute introduces potential litigation and reputational risks for Five Below, especially as it relates to a popular product category that has broad consumer recognition.

- We'll examine how the lawsuit's potential impact on Five Below's product assortment and brand image may influence its investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Five Below Investment Narrative Recap

Five Below’s investment narrative hinges on its ability to drive consistent transaction and revenue growth through an expanding lineup of value-driven, on-trend products for younger and budget-focused shoppers, while carefully managing margin pressure from tariffs and competition. The recent lawsuit over Stanley-branded tumblers introduces new short-term reputational and litigation risks, but does not appear likely to materially impact the company’s biggest growth catalysts or its primary risks around margins and store productivity at this time.

Among Five Below’s recent initiatives, the launch of its holiday assortment, including partnerships with top brands and thousands of gifts priced at $5 or below, is especially relevant as it emphasizes the company’s focus on affordable, trending products that drive seasonal store traffic. This focus is aligned with the company’s growth catalysts and highlights how merchandise assortment impacts perception during critical shopping periods.

On the other hand, as the legal process unfolds, investors should be aware that potential changes in Five Below’s product selection or any negative publicity could...

Read the full narrative on Five Below (it's free!)

Five Below's outlook anticipates revenue of $5.7 billion and earnings of $352.1 million by 2028. This is based on an expected annual revenue growth rate of 10.6% and a $79 million increase in earnings from the current $273.1 million.

Uncover how Five Below's forecasts yield a $161.86 fair value, a 6% upside to its current price.

Exploring Other Perspectives

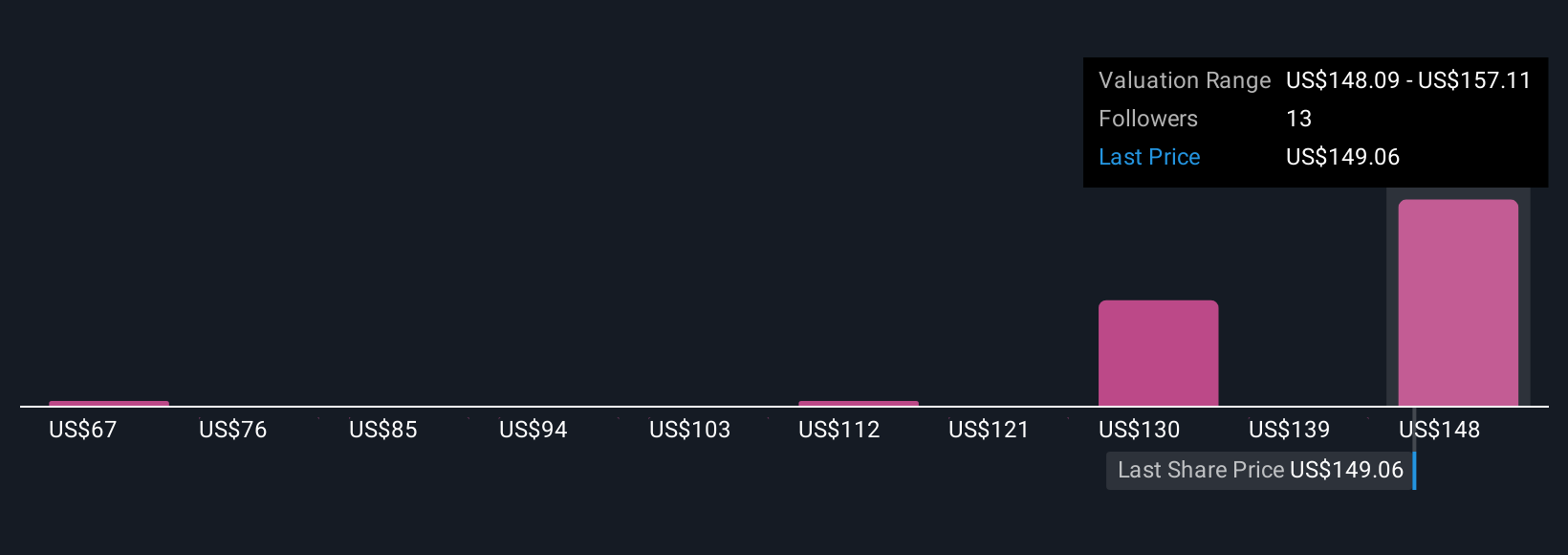

Three Simply Wall St Community members valued FIVE between US$86.38 and US$161.86, showing a wide gap in expectations. As product assortment risks come into sharper focus, you may want to explore differing views before making any decisions.

Explore 3 other fair value estimates on Five Below - why the stock might be worth 43% less than the current price!

Build Your Own Five Below Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Five Below research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Five Below research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Five Below's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIVE

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives