- United States

- /

- Specialty Stores

- /

- NasdaqGS:FIVE

Is Five Below Still a Good Deal After 53% Rally and Store Expansion News?

Reviewed by Bailey Pemberton

- Wondering if Five Below is worth a spot in your portfolio or if its current share price leaves little room for upside? You are not alone. Many investors are taking a closer look at how much value is left on the table.

- The stock has had an impressive year, climbing 53.7% year-to-date and 76.5% over the past 12 months. However, it dipped slightly by 3.2% last week.

- Five Below recently announced an expansion of its store footprint and updates to its product assortment. The company aims to attract more value-seeking shoppers. These announcements have contributed to renewed interest from both analysts and investors and have likely fueled the strong momentum in the stock’s price.

- Despite the excitement, Five Below scores just 1/6 on our undervaluation checks, meaning it only ticks one box when it comes to traditional value signals. Let’s dig into what methods investors use to judge value and why there may be an even deeper story to uncover by the end of this article.

Five Below scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Five Below Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its expected future cash flows and then discounting them back to today's value using a suitable rate. This helps investors determine whether a stock is undervalued or overvalued relative to its fundamentals.

For Five Below, the latest reported Free Cash Flow was $224.7 million. Analysts forecast steady growth, projecting annual free cash flows to reach $309 million by 2029. Projections further into the future, based on Simply Wall St's extrapolations, suggest moderate increases through 2035. All estimates and calculations are provided in US Dollars ($).

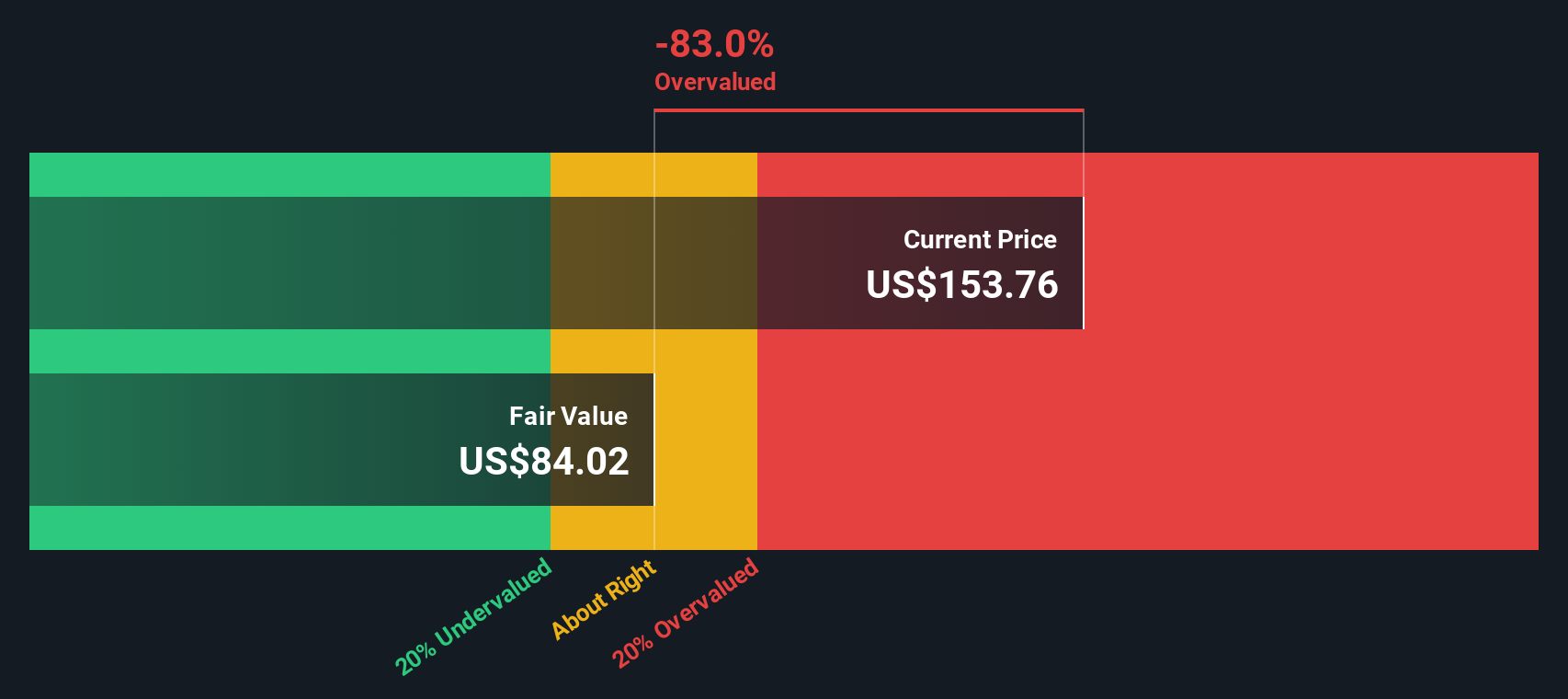

The DCF model used a 2 Stage Free Cash Flow to Equity approach, factoring in analysts' five-year estimates and then extending those trends in later years. According to this analysis, Five Below's intrinsic value comes in at $86.72 per share. Given the current stock price, this implies the shares are trading at a 75.6% premium to their calculated intrinsic value.

In summary, while Five Below's growth outlook is positive, the DCF model suggests the market price is far above what fundamentals support, based on today’s cash flow projections and reasonable future growth assumptions.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Five Below may be overvalued by 75.6%. Discover 870 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Five Below Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially for profitable companies like Five Below. It gives investors an idea of how much they are paying for each dollar of company earnings and is particularly helpful for comparing companies within the same industry.

A company's PE ratio reflects not only its recent profitability but also growth prospects and perceived risk. Higher expected growth or lower business risk usually justifies a higher PE multiple. Conversely, slower growth or above-average risk would lead the market to apply a lower multiple.

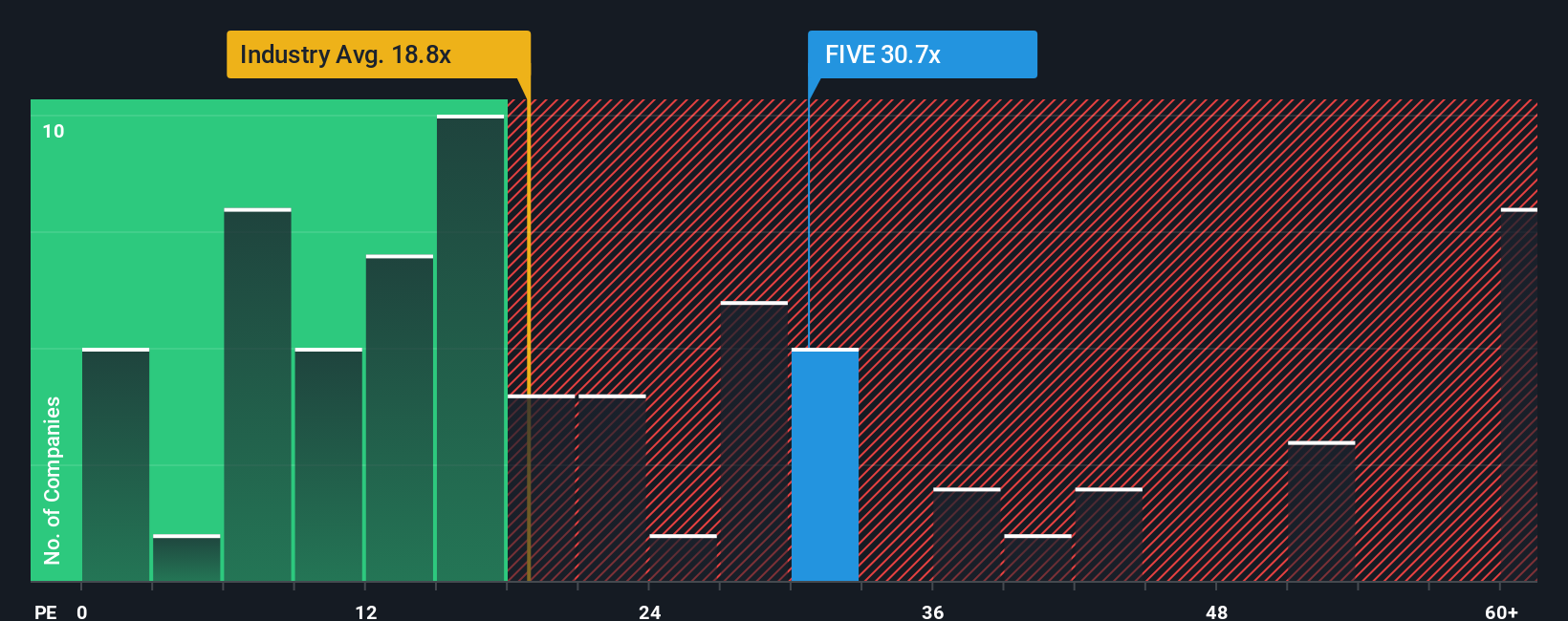

Five Below currently trades at a PE ratio of 30.8x. For context, the average PE ratio across specialty retail peers is 33.3x, while the industry as a whole sits at 18.4x. However, Simply Wall St also calculates a “Fair Ratio,” which considers company-specific factors like growth, profit margins, market cap, and risks, beyond just peer numbers. Five Below’s Fair Ratio is 19.2x, significantly below both its current multiple and its peer average.

By relying on this Fair Ratio, investors get a more tailored gauge of what the market should reasonably pay for Five Below’s earnings. This approach paints a sobering picture. It suggests that the stock is priced well above what fundamentals justify, even after accounting for company strengths and growth.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Five Below Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective about a company, combining your assumptions on Five Below’s fair value, future revenue, earnings, and profit margins, all grounded in your understanding of the business’s outlook and risks.

Unlike static valuation models, Narratives connect the dots between a company’s actual story, your financial forecasts, and an up-to-date estimate of fair value. They transform complex investment decisions into a clear, accessible process. They are available right now on Simply Wall St’s Community page, where millions of investors share their views. Narratives are dynamic: when new news, earnings reports, or market changes arrive, your Narrative updates automatically, so your outlook and fair value are always relevant.

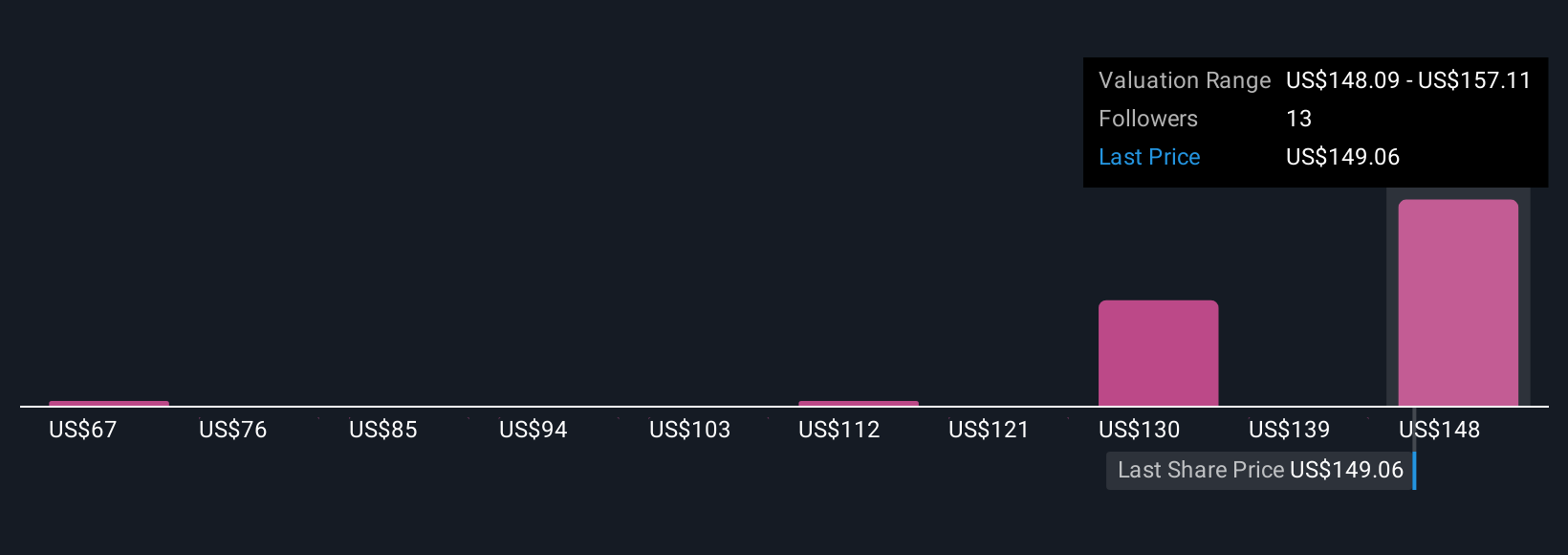

By comparing your Fair Value to the current share price, Narratives help you decide when to buy or sell based on your conviction and evolving information. For example, one investor may highlight Five Below’s expanding customer base and efficiency gains to support a bullish fair value of $185 per share, while another cautions about rising costs and industry competition and sets a bearish value near $90. Both perspectives are reflected and updated as the story unfolds.

Do you think there's more to the story for Five Below? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIVE

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives