- United States

- /

- Specialty Stores

- /

- NasdaqGS:EYE

Are Shares of National Vision Attractive After 169% Rally and Strategic Partnerships in 2025?

Reviewed by Bailey Pemberton

- Wondering if National Vision Holdings is attractively priced right now? Let’s dig into what’s driving interest in this stock and what the numbers may be signaling for value-minded investors.

- This year alone, shares have risen 169.4%. They are also up 134.3% over the last 12 months, indicating notable shifts in how the market perceives the company's prospects.

- Recent coverage has highlighted an uptick in consumer demand along with renewed optimism about the U.S. retail sector. Some analysts have pointed to new strategic partnerships and expansion plans as important factors behind the share price rally. Additionally, discussions about changing industry trends and competitive positioning are making headlines.

- National Vision Holdings currently scores 3 out of 6 on our valuation checks. We will break down exactly how those numbers are calculated using several common approaches, but be sure to check our detailed view at the end of the article.

Approach 1: National Vision Holdings Discounted Cash Flow (DCF) Analysis

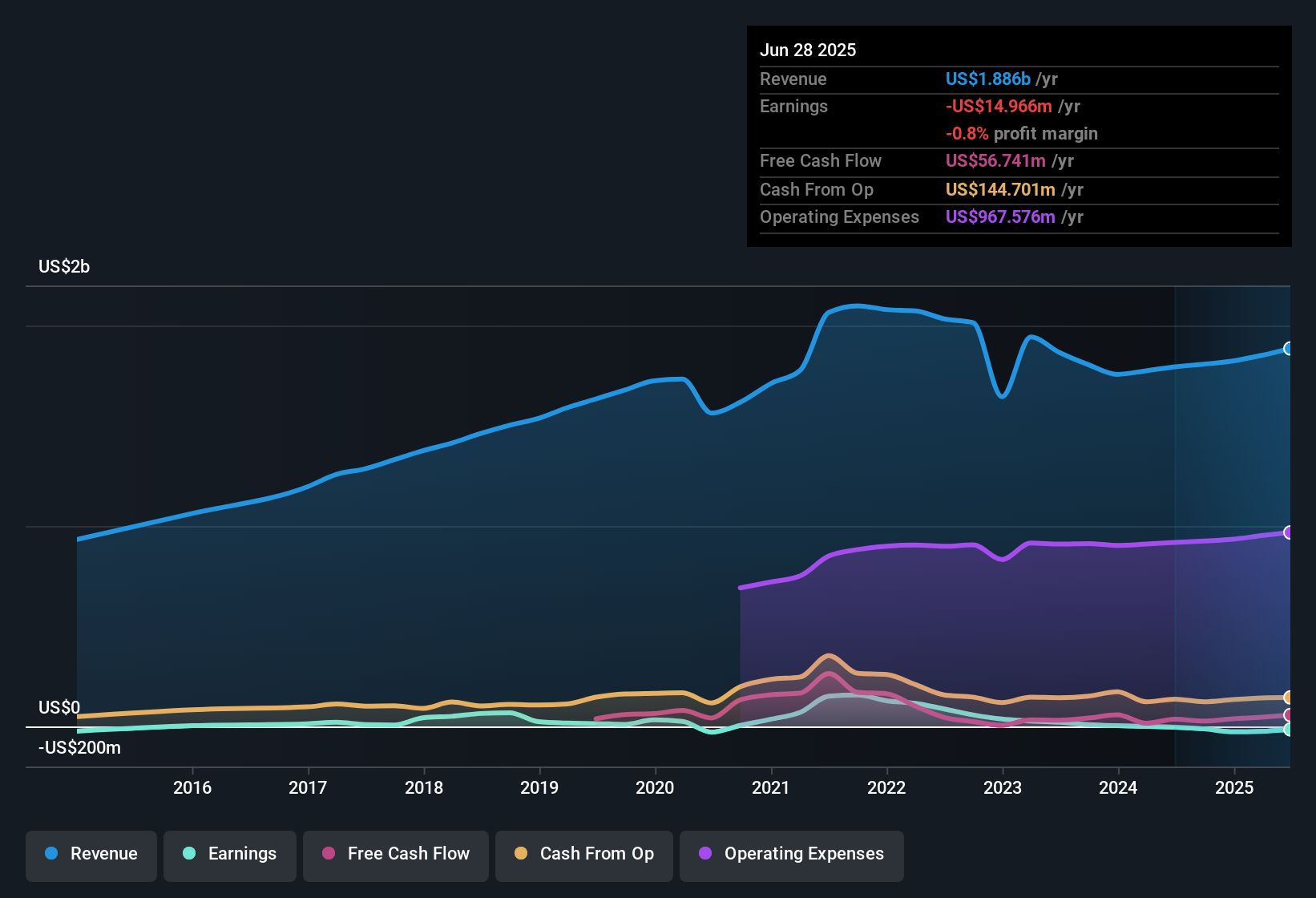

A Discounted Cash Flow (DCF) model estimates a company's fair value by projecting its future cash flows and discounting them back to today to account for the time value of money. For National Vision Holdings, this analysis starts by looking at their current Free Cash Flow, which stands at $64 million. Analysts forecast this figure to rise annually, with projections reaching $104.5 million by the end of 2026. Looking further ahead, Simply Wall St extrapolates these forecasts and estimates that annual Free Cash Flow could reach $267 million by 2035.

The DCF model applied here uses a two-stage Free Cash Flow to Equity approach, reflecting both analyst estimates and longer-term assumptions. Based on these calculations, the intrinsic value of National Vision Holdings comes out to $40.36 per share. This is approximately 28.1% higher than the current trading price, which suggests the market may be undervaluing the company at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests National Vision Holdings is undervalued by 28.1%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: National Vision Holdings Price vs Sales

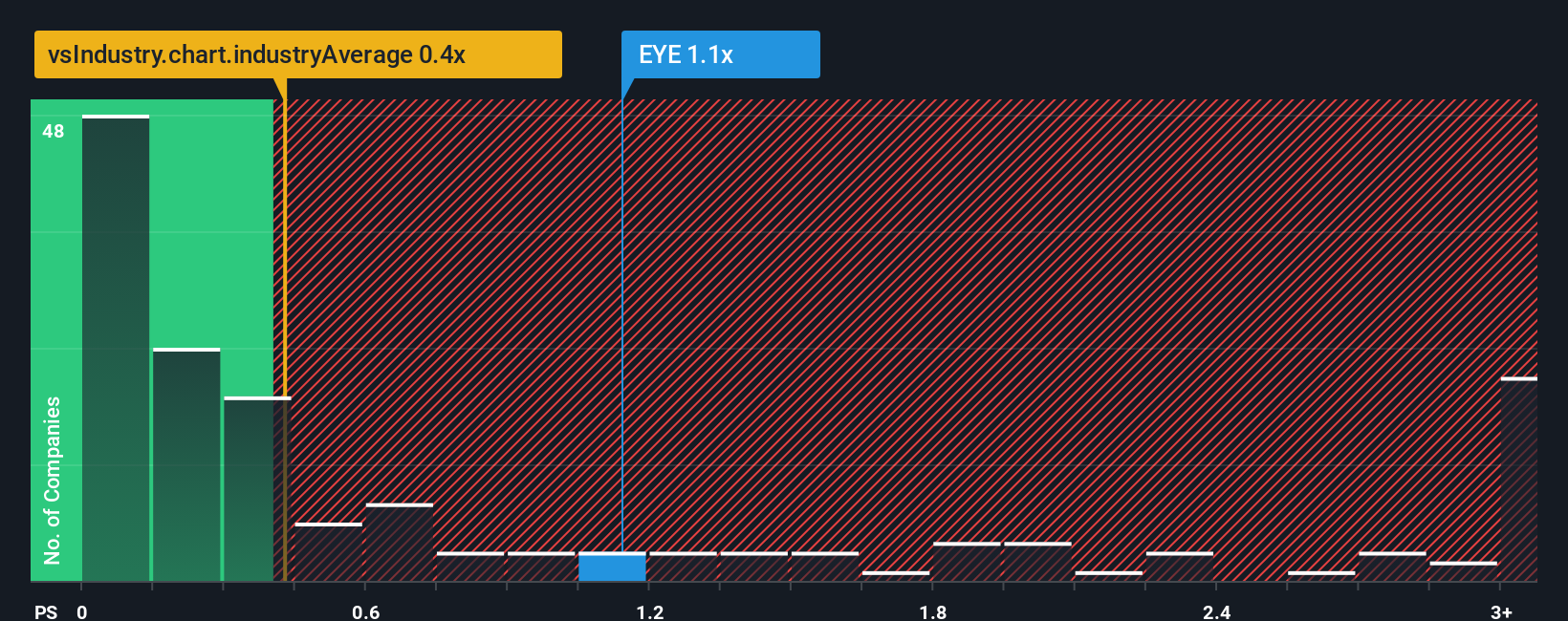

For companies like National Vision Holdings that are not currently generating positive earnings, the Price-to-Sales (PS) ratio is often the preferred valuation metric. This is because it allows investors to compare similar companies regardless of their current profitability, focusing instead on the sales being generated. Growth expectations and company-specific risks play a significant role in what is considered a "normal" or "fair" PS ratio. Fast-growing, lower-risk companies typically deserve a higher multiple, while those facing challenges might trade at a discount.

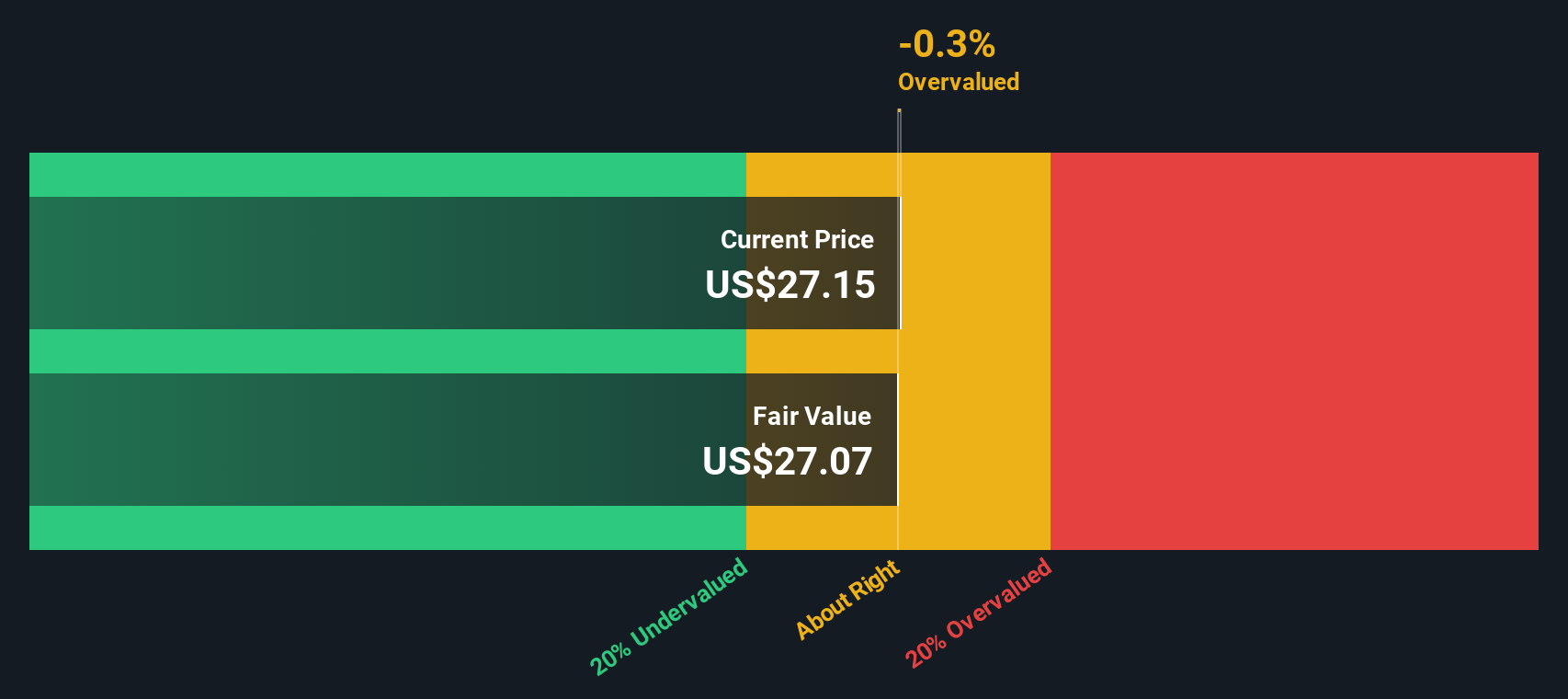

National Vision Holdings currently trades at a PS ratio of 1.20x. This sits above the Specialty Retail industry average of 0.48x, yet well below the peer average of 5.38x. To provide a tailored benchmark, Simply Wall St calculates a "Fair Ratio" based on factors like earnings growth forecasts, profit margins, market capitalization, and business risks. For National Vision Holdings, the Fair Ratio is estimated at 1.07x.

This Fair Ratio is considered a more comprehensive benchmark than the raw industry or peer averages, as it accounts for the company’s unique financial characteristics and sector dynamics. By adjusting for growth outlook, risk profile, and profitability, the Fair Ratio gives investors a more precise gauge of whether the shares are mispriced relative to fundamentals and not just compared to the group.

Given that National Vision Holdings’ current PS ratio is very close to the Fair Ratio (1.20x vs. 1.07x), the stock appears to be valued about right based on this approach.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your National Vision Holdings Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives provide a simple, yet powerful method to bridge the story you believe about a company with concrete financial forecasts and an actionable estimate of what the stock is worth today. Through Narratives, you share your perspective, your unique view on National Vision Holdings’ growth potential, challenges, and future financials. This is then translated into numbers like estimated revenue, profit margins, or fair value.

This approach links the company’s real-world situation to financial models, so every investor can see exactly how their story stacks up against the current share price. Narratives are easy to create and update right on the Simply Wall St Community page, where millions of investors exchange insights. They are dynamic as well, meaning if something material changes, such as key earnings, major news, or industry headwinds, your Narrative updates, helping you stay ahead and decide whether to buy, hold, or sell.

For example, one investor’s Narrative might suggest National Vision’s ambitious store expansion and margin growth could justify a fair value near the recent price target high of $36. Another, more cautious Narrative could point to competitive threats and slower growth, estimating fair value at $22. Your decisions become smarter when you invest with your own Narrative.

Do you think there's more to the story for National Vision Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Vision Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EYE

National Vision Holdings

Through its subsidiaries, operates as an optical retailer in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success