- United States

- /

- Specialty Stores

- /

- NasdaqGS:EYE

A Look at National Vision Holdings (EYE) Valuation After Outlining Bold Growth Targets and Expansion Plans

Reviewed by Simply Wall St

National Vision Holdings (EYE) laid out its investment roadmap and growth targets this week, unveiling new plans to accelerate store openings and confirming multi-year guidance through 2030. This clarity may be fueling investor interest.

See our latest analysis for National Vision Holdings.

National Vision Holdings’ share price has more than doubled so far this year with a year-to-date gain of 120.1%. This dramatic turnaround coincides with its upbeat guidance and expansion plans. Recent momentum reflects a shift in investor confidence, even as longer-term total shareholder returns remain well below water after a tough few years.

If you’re interested in spotting the next breakout, now’s an ideal moment to check out fast growing stocks with high insider ownership.

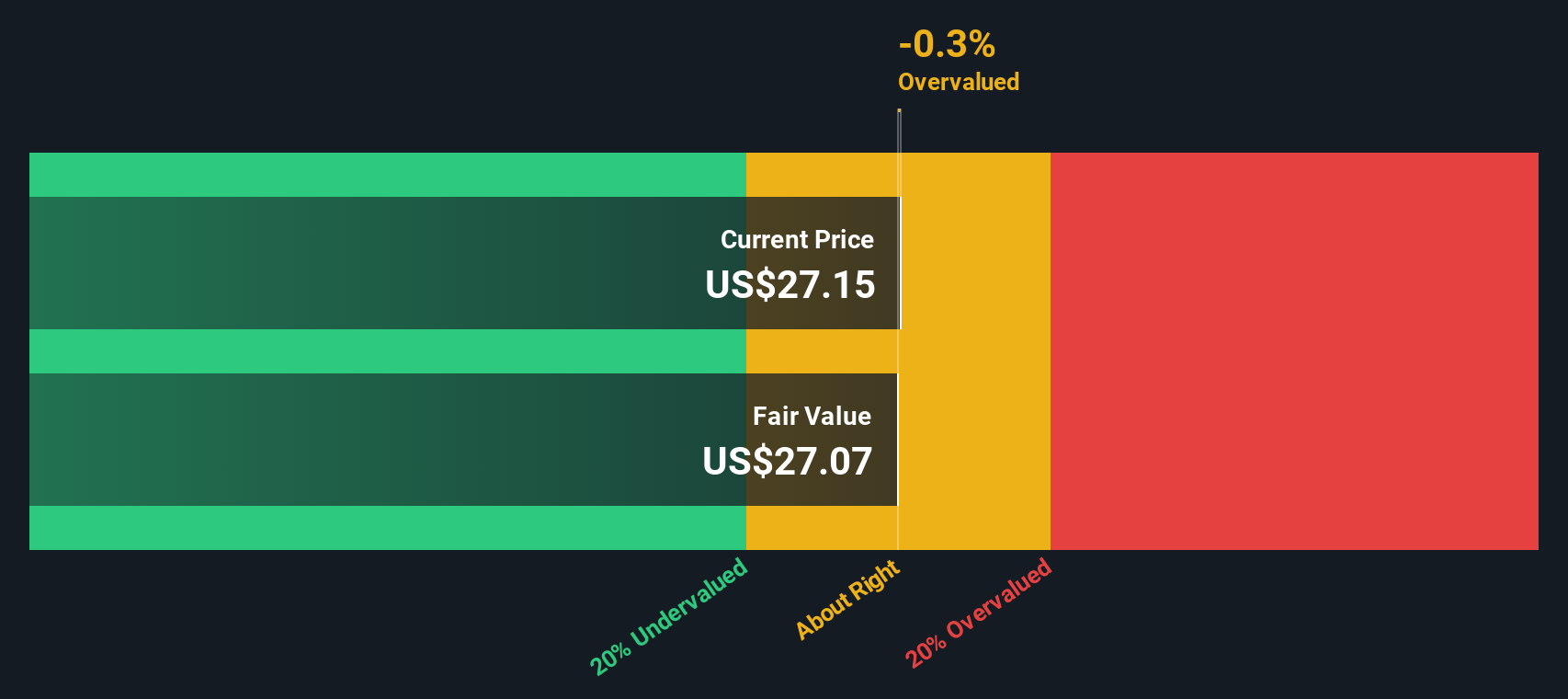

Given these ambitious growth targets and a share price that has already soared in 2025, the central question now is whether National Vision Holdings remains undervalued or if the market is already factoring in all this future expansion.

Most Popular Narrative: 20.5% Undervalued

National Vision Holdings’ most popular narrative assigns it a notably higher fair value than its current market price, suggesting significant upside according to consensus projections. This perspective sets the groundwork for fresh debate around whether upside surprises can continue as the company executes its plan.

Expansion of managed care customer base and broader vision insurance adoption is accelerating, as evidenced by the double-digit managed care comp growth and ongoing initiatives to capture more insured customers. This directly supports higher and more resilient patient volumes, expanding top-line revenue and increasing average ticket per transaction.

How are analysts arriving at such a bold target? The answer lies in a chain reaction of projected gains in revenue, margins, and a significantly increased profit multiple. What are the crucial numbers that could make or break this narrative? Find out exactly which forecasts could shift the valuation story.

Result: Fair Value of $29.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting consumer habits towards online eyewear and industry-wide optometrist shortages could challenge National Vision Holdings’ growth and cast doubt on bullish forecasts.

Find out about the key risks to this National Vision Holdings narrative.

Another View: Discounted Cash Flow Signals a Different Story

While analysts point to upside based on forward earnings, the SWS DCF model offers a more cautious perspective. Our DCF estimate puts National Vision Holdings’ fair value closer to $21.94 per share. This makes the current price appear slightly overvalued at the moment. How should investors reconcile this split between analyst optimism and the DCF’s conservative stance?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out National Vision Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own National Vision Holdings Narrative

If you find yourself at odds with these outlooks or are inclined toward your own analysis, you can quickly construct your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding National Vision Holdings.

Looking for more investment ideas?

You don't want to miss out on the sharpest opportunities the market has to offer. Use the Simply Wall Street Screener to build a smart watchlist for what's next.

- Unlock steady income potential by viewing these 16 dividend stocks with yields > 3% with yields above 3% that could add stability to your portfolio.

- Catch the AI wave early by exploring these 26 AI penny stocks making major moves in artificial intelligence, automation, and data analytics.

- Capitalize on underappreciated market gems by searching for these 904 undervalued stocks based on cash flows based on robust cash flow analyses and demonstrated long-term potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Vision Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EYE

National Vision Holdings

Through its subsidiaries, operates as an optical retailer in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives