- United States

- /

- Specialty Stores

- /

- NasdaqCM:EM

Smart Share Global Limited's (NASDAQ:EM) 29% Share Price Surge Not Quite Adding Up

Smart Share Global Limited (NASDAQ:EM) shares have continued their recent momentum with a 29% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 20% over that time.

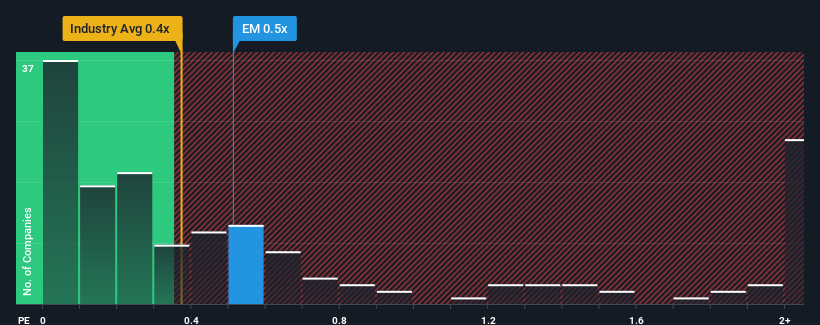

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Smart Share Global's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Specialty Retail industry in the United States is also close to 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Smart Share Global

How Has Smart Share Global Performed Recently?

Smart Share Global's revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on Smart Share Global will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think Smart Share Global's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

Smart Share Global's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.2% last year. The solid recent performance means it was also able to grow revenue by 5.3% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 5.3% per year as estimated by the dual analysts watching the company. With the industry predicted to deliver 5.6% growth per year, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Smart Share Global's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Smart Share Global's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

While Smart Share Global's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Before you settle on your opinion, we've discovered 1 warning sign for Smart Share Global that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EM

Smart Share Global

A consumer tech company, provides mobile device charging services through online and offline network in the People's Republic of China.

Adequate balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026