- United States

- /

- Specialty Stores

- /

- NasdaqCM:EM

Discover Smart Share Global Among 2 Other Prominent US Penny Stocks

Reviewed by Simply Wall St

Major U.S. stock indexes recently experienced mixed performance, with the Dow Jones and S&P 500 on track to end their six-week winning streaks amid a backdrop of critical economic data and earnings reports. In such a fluctuating market, identifying stocks that offer potential growth opportunities is key, especially when considering investments in smaller or newer companies often categorized as penny stocks. Despite being an outdated term, penny stocks still represent intriguing possibilities for investors who focus on those with strong financial health and clear growth trajectories.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7553 | $5.71M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.15 | $526.12M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.60 | $2.03B | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.43 | $147.91M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.58 | $53.13M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.68 | $112.23M | ★★★★★★ |

| MIND C.T.I (NasdaqGM:MNDO) | $1.88 | $39.99M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.05 | $96.23M | ★★★★★☆ |

Click here to see the full list of 760 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Smart Share Global (NasdaqCM:EM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Smart Share Global Limited is a consumer tech company offering mobile device charging services in the People's Republic of China, with a market cap of $184.40 million.

Operations: The company generates revenue from its Rental & Leasing segment, amounting to CN¥1.96 billion.

Market Cap: $184.4M

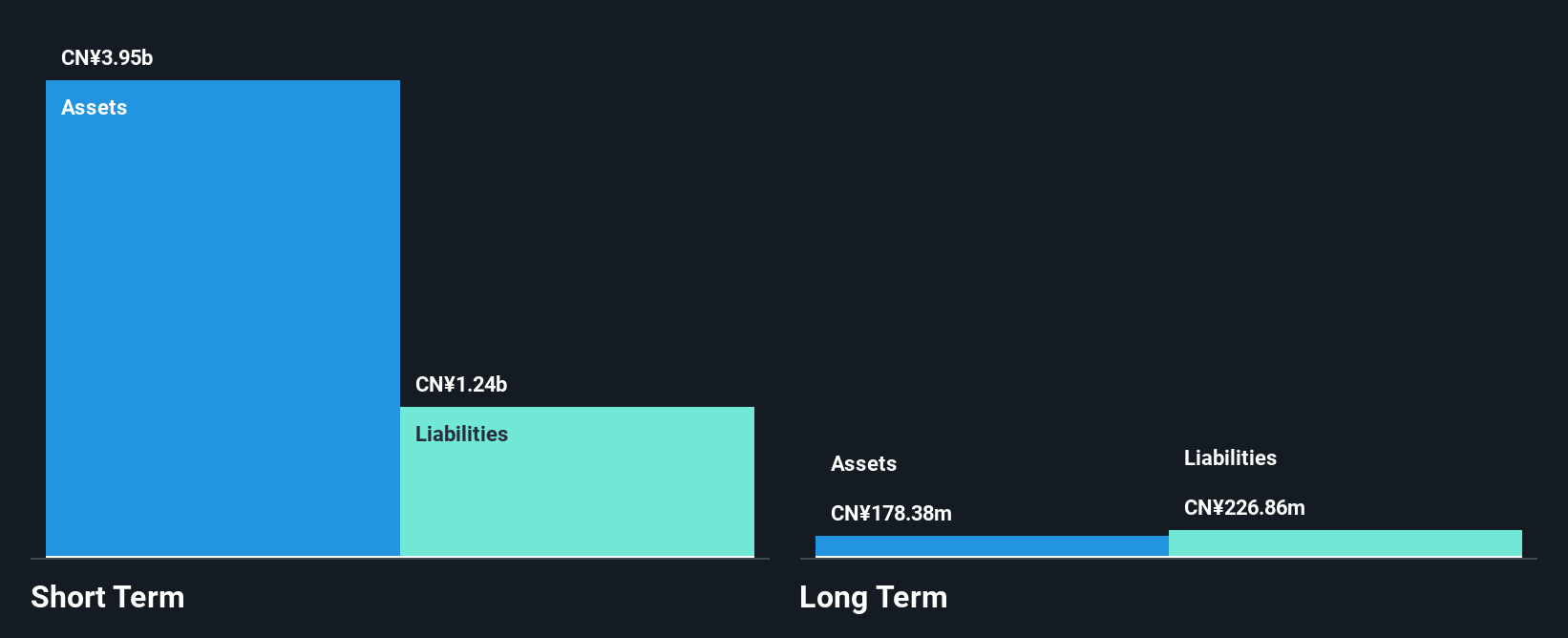

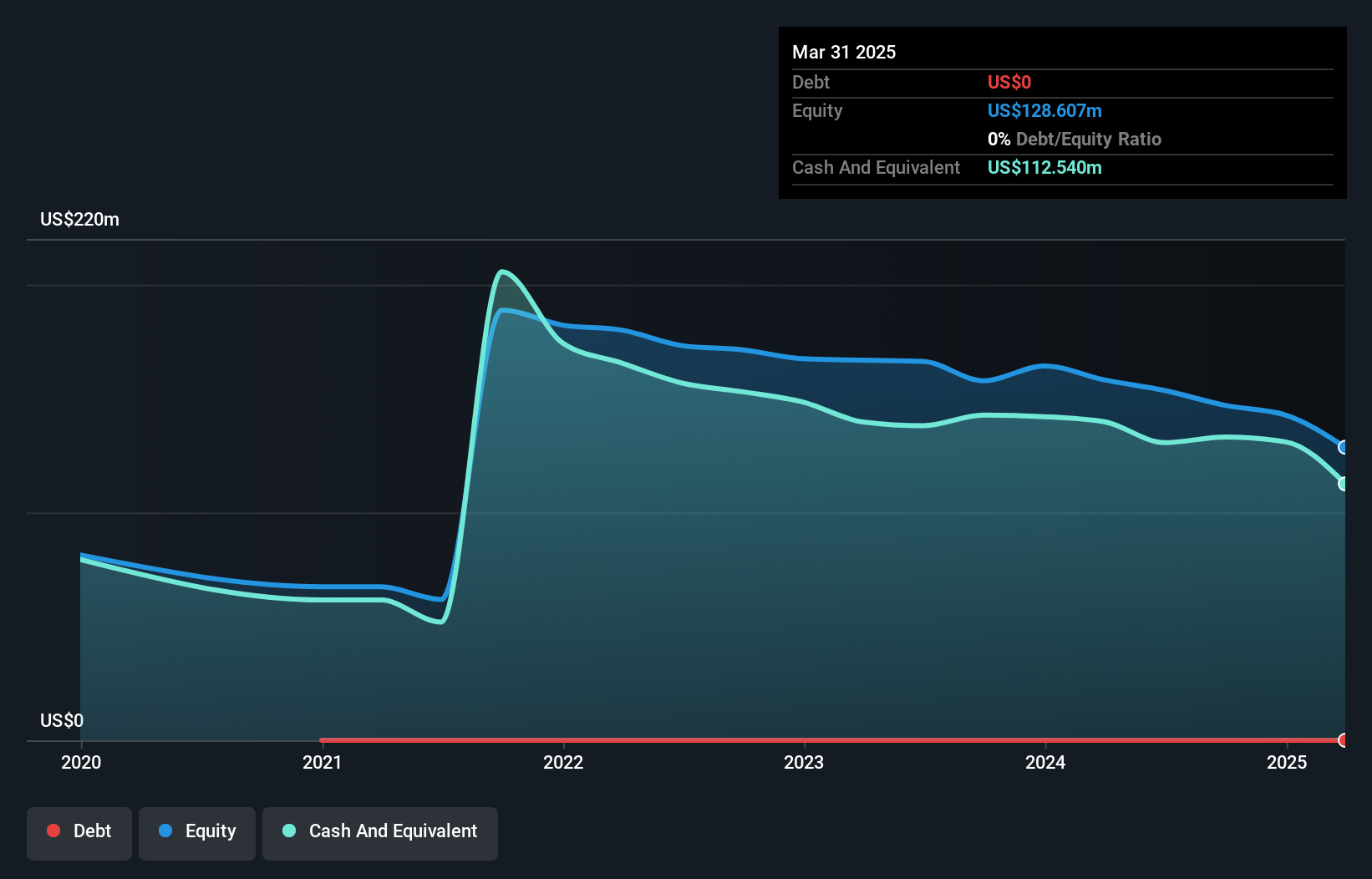

Smart Share Global has recently become profitable, which marks a significant turnaround for the company. Despite this, its earnings growth is difficult to compare with past performance due to recent profitability. The company's shares are trading significantly below estimated fair value, suggesting potential undervaluation. However, recent financial results show a decline in revenue and net income compared to the previous year, indicating challenges in maintaining growth momentum. With no debt and experienced management, Smart Share Global's short-term assets comfortably cover both short and long-term liabilities. Its board of directors also brings seasoned leadership to navigate current market volatility.

- Navigate through the intricacies of Smart Share Global with our comprehensive balance sheet health report here.

- Gain insights into Smart Share Global's future direction by reviewing our growth report.

Lumos Pharma (NasdaqGM:LUMO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lumos Pharma, Inc. is a clinical-stage biopharmaceutical company dedicated to developing and commercializing products for rare diseases, with a market cap of $35.42 million.

Operations: The company's revenue is primarily derived from preclinical and clinical research in the biopharmaceutical industry, totaling $1.49 million.

Market Cap: $35.42M

Lumos Pharma is currently navigating a challenging financial landscape as a clinical-stage biopharmaceutical company with limited revenue, reporting US$0.65 million for the first half of 2024 and ongoing net losses. The company has faced shareholder dilution and maintains less than a year of cash runway, emphasizing its precarious financial position. Recently, Double Point Ventures announced an acquisition agreement to purchase Lumos Pharma for approximately US$36.9 million, offering shareholders US$4.25 per share in cash plus contingent value rights based on future milestones. This transaction could provide strategic direction amidst its current volatility and unprofitability challenges.

- Unlock comprehensive insights into our analysis of Lumos Pharma stock in this financial health report.

- Explore Lumos Pharma's analyst forecasts in our growth report.

Valens Semiconductor (NYSE:VLN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Valens Semiconductor Ltd. provides semiconductor products for the audio-video and automotive industries, with a market cap of approximately $195.31 million.

Operations: The company generates revenue from its Automotive segment, which accounts for $20.43 million, and its Audio-Video segment, contributing $40.83 million.

Market Cap: $195.31M

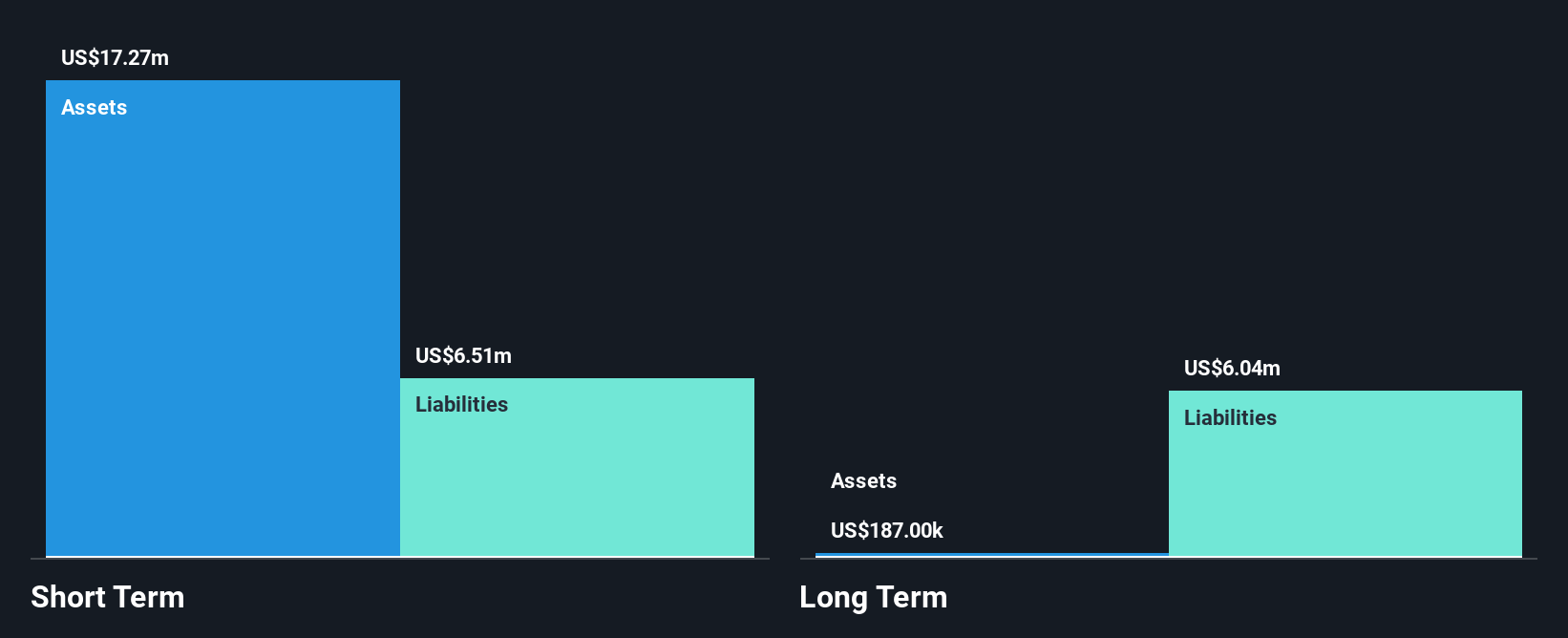

Valens Semiconductor, with a market cap of US$195.31 million, is unprofitable but has shown potential through strategic developments in the automotive and industrial machine vision markets. Recent wins include three design agreements with European OEMs for its VA7000 MIPI A-PHY chipsets, expected to generate over US$10 million annually upon production ramp-up. Despite a decline in recent sales to US$13.6 million for Q2 2024 from US$24.18 million a year ago and increased net losses, Valens remains debt-free with sufficient cash runway exceeding three years, positioning it well amidst volatility typical of penny stocks.

- Jump into the full analysis health report here for a deeper understanding of Valens Semiconductor.

- Assess Valens Semiconductor's future earnings estimates with our detailed growth reports.

Key Takeaways

- Unlock more gems! Our US Penny Stocks screener has unearthed 757 more companies for you to explore.Click here to unveil our expertly curated list of 760 US Penny Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EM

Smart Share Global

A consumer tech company, provides mobile device charging services in the People's Republic of China.

Flawless balance sheet and good value.