- United States

- /

- Retail Distributors

- /

- NasdaqGM:EDUC

Should You Be Adding Educational Development (NASDAQ:EDUC) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Educational Development (NASDAQ:EDUC), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Educational Development

How Fast Is Educational Development Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. As a tree reaches steadily for the sky, Educational Development's EPS has grown 29% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

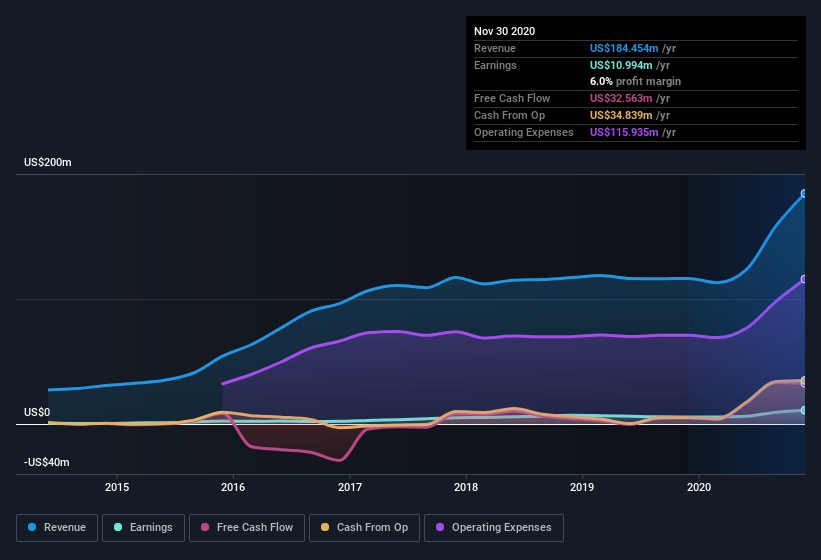

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Educational Development maintained stable EBIT margins over the last year, all while growing revenue 58% to US$184m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Educational Development isn't a huge company, given its market capitalization of US$150m. That makes it extra important to check on its balance sheet strength.

Are Educational Development Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

For the sake of balance, I do note Educational Development insiders sold -US$8.8k worth of shares last year. But this is outweighed by the Independent Director Joshua Peters who spent US$177k buying shares, at an average price of around around US$14.77.

On top of the insider buying, it's good to see that Educational Development insiders have a valuable investment in the business. To be specific, they have US$36m worth of shares. That's a lot of money, and no small incentive to work hard. That amounts to 24% of the company, demonstrating a degree of high-level alignment with shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Randall White is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like Educational Development with market caps between US$100m and US$400m is about US$974k.

The CEO of Educational Development only received US$346k in total compensation for the year ending . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Educational Development Deserve A Spot On Your Watchlist?

For growth investors like me, Educational Development's raw rate of earnings growth is a beacon in the night. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So it's fair to say I think this stock may well deserve a spot on your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Educational Development , and understanding it should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Educational Development, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Educational Development, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Educational Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:EDUC

Educational Development

Distributes children's books, educational toys and games, and related products in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

DroneShield: Structural Tailwind, Execution Still the Real Test

ISRG Riding the Lightning

Duolingo (DUOL): The AI Learning Architect – Trading Profits for a 100M User Vision

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion