- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Did Amazon.com’s (AMZN) Cloud and AI Surge Just Reshape Its Long-Term Investment Story?

Reviewed by Sasha Jovanovic

- Amazon.com recently reported third quarter earnings, revealing revenue of US$180.17 billion and net income of US$21.19 billion, both significantly higher than a year ago, with robust performance in its cloud unit, Amazon Web Services (AWS), and strong guidance for the fourth quarter.

- Industry observers have highlighted renewed investor enthusiasm driven by AWS’s impressive cloud and artificial intelligence momentum, supported by major infrastructure investments and key customer partnerships.

- We'll explore how Amazon’s strong quarterly cloud performance and focus on AI innovation could shape its long-term investment case.

Find companies with promising cash flow potential yet trading below their fair value.

Amazon.com Investment Narrative Recap

At its core, being an Amazon.com shareholder means believing in the company’s ability to drive sustainable earnings growth, mainly through AWS’s continued expansion in cloud and AI services, while managing risks like heightened legal and regulatory challenges. The recent patent lawsuit filed by InterDigital against Amazon over video compression and HDR technology used in its devices and streaming services does not appear to materially shift the most important short-term catalyst, AWS’s cloud and AI-driven momentum, but it does keep legal risk in focus as a key concern.

Of the recent announcements, the new Verizon-AWS partnership stands out as highly relevant, strengthening AWS’s infrastructure for advanced AI applications and reinforcing the growth catalyst behind Amazon’s cloud business. Collaborations like this highlight Amazon’s push to maintain technical leadership in cloud and generative AI, underpinning the investment thesis amid sector competition and ongoing legal uncertainties. Yet, with legal disputes mounting across multiple regions, investors should be conscious of how unresolved intellectual property issues could affect…

Read the full narrative on Amazon.com (it's free!)

Amazon.com's narrative projects $905.9 billion revenue and $111.9 billion earnings by 2028. This requires 10.6% yearly revenue growth and a $41.3 billion earnings increase from $70.6 billion today.

Uncover how Amazon.com's forecasts yield a $287.57 fair value, a 16% upside to its current price.

Exploring Other Perspectives

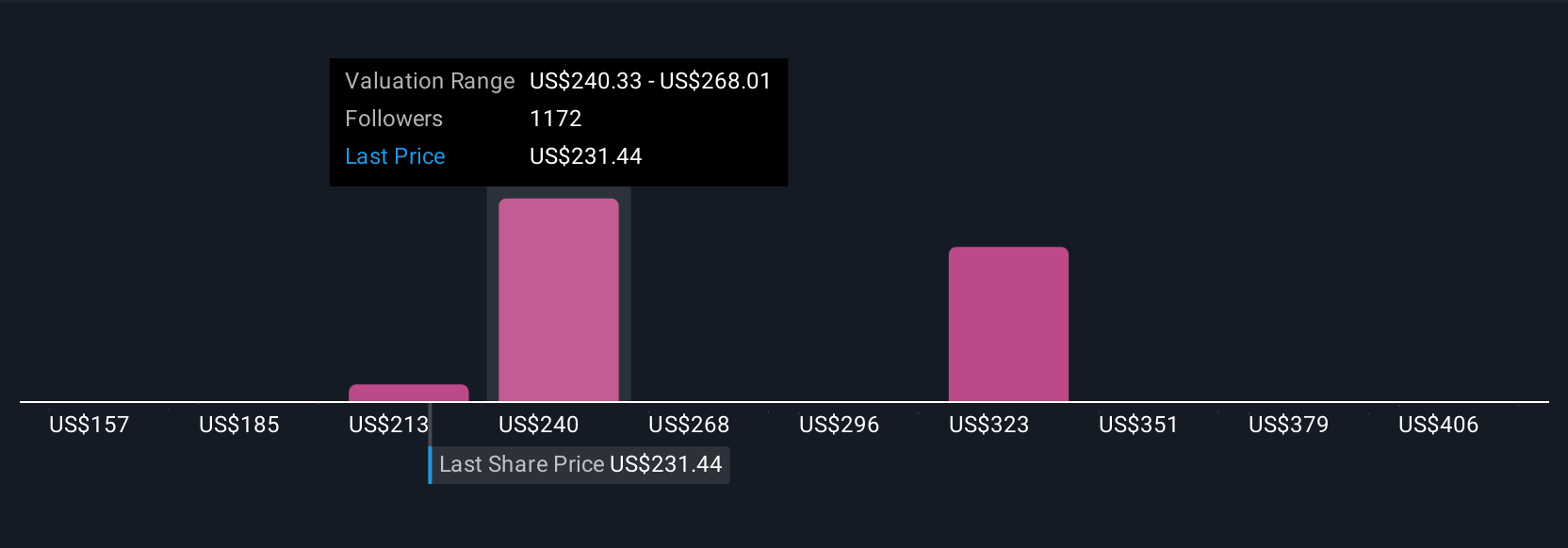

Community fair value estimates for Amazon.com span from US$175 to US$294, with input from 141 members of the Simply Wall St Community. Against this breadth of opinion, legal and regulatory risks continue to shape the broader discussion about the company’s long-term earnings potential.

Explore 141 other fair value estimates on Amazon.com - why the stock might be worth as much as 18% more than the current price!

Build Your Own Amazon.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amazon.com research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amazon.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amazon.com's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives