- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (NasdaqGS:AMZN) Collaborates With CSG To Enhance AWS Cloud Transformation

Reviewed by Simply Wall St

Amazon.com (NasdaqGS:AMZN) recently experienced a 10% price move over the past quarter, buoyed by its strategic collaboration with AWS to enhance cloud services with potential cost savings of up to 60%. This collaboration underscores the company's focus on cloud transformation, aligning well with the broader market's steady performance. Additional collaborations, such as partnerships with Rebag for sustainable shopping and Elastic N.V. for AI-driven transitions, further highlight Amazon's innovative pursuits. Amidst geopolitical tensions and market volatility, these initiatives have lent weight to Amazon's positive trajectory within the tech sector's general upward trend.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

The recent collaboration between Amazon and AWS could enhance the company's narrative around operational efficiency and margin stability, potentially impacting future revenue and earnings. The focus on cloud transformation and sustainability initiatives may align well with Amazon's strategy to leverage AI and fulfillment optimization for cost-effectiveness. Over the past three years, Amazon's total shareholder return was very large, reflecting a significant appreciation in share value. During the recent year alone, Amazon matched the US Multiline Retail industry's performance, underscoring its resilience amid market volatility.

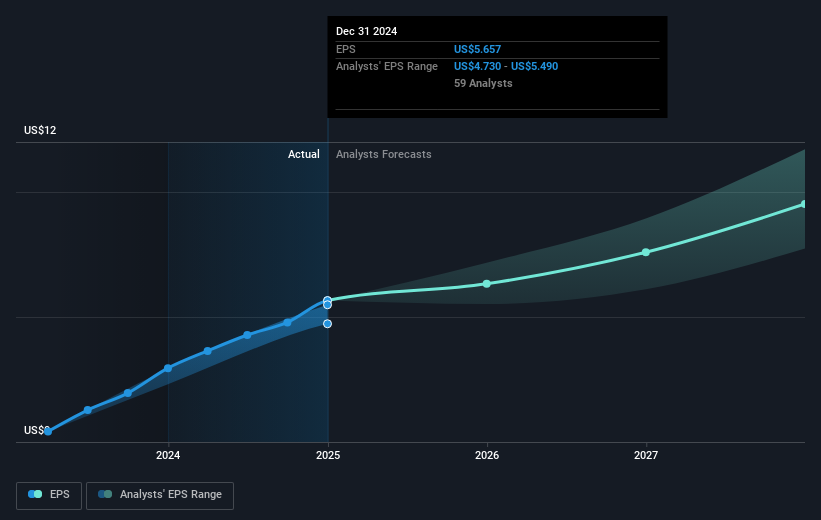

Amazon's share performance, with its current price standing at US$185.01, presents an 11.7% discount to the consensus analyst price target of approximately US$239.33. This suggests potential upside if expectations for revenue and earnings growth materialize. The company's expected revenue growth of 8.9% annually may accelerate through initiatives like cloud and AI expansion. However, projected earnings margins need careful monitoring against competitive pressures and market dynamics. The anticipated earnings of US$103.60 billion by 2028 highlight a bullish outlook, yet the diverse forecasts reflect potential uncertainties. As such, investors should independently assess these projections against market conditions and Amazon's strategic initiatives.

Evaluate Amazon.com's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives