- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon (AMZN): A Fresh Look at Valuation as Share Gains Cool

Reviewed by Simply Wall St

See our latest analysis for Amazon.com.

After a modest uptick this month, Amazon.com's 1-year total shareholder return sits just under 10 percent. This reflects steady growth as momentum tempers a bit from earlier highs. While the latest share price is $222.69, the longer-term total return picture remains robust thanks to strong e-commerce and cloud fundamentals.

Wondering what else investors are keeping an eye on? This could be a great moment to broaden your perspective and discover fast growing stocks with high insider ownership

But with shares trading at a sizable discount to analyst price targets and solid growth metrics, the real question becomes: is Amazon.com’s true value being overlooked, or is the market already factoring in what comes next?

Most Popular Narrative: 5.1% Undervalued

With a fair value of $234.75, according to Zwfis, Amazon.com’s share price of $222.69 suggests room for upside ahead. The narrative behind this view stands on specific catalysts rather than mere market speculation.

"Their E-commerce platform is the undisputed leader, especially with its robust options for customers and the scale of its logistics network. AWS is one of the best cloud services available to companies, especially with a growing need for this industry. It continues to validate this segment of the business."

Want to know which key drivers unlock this fair value? The real story blends rock-solid growth assumptions and high conviction in core business segments. There is a bold outlook for Amazon’s next phase baked into these numbers, but only a full look reveals what makes this price target tick.

Result: Fair Value of $234.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cloud competition and uncertainty around Amazon's AI roadmap remain potential catalysts that could challenge even the most optimistic outlooks.

Find out about the key risks to this Amazon.com narrative.

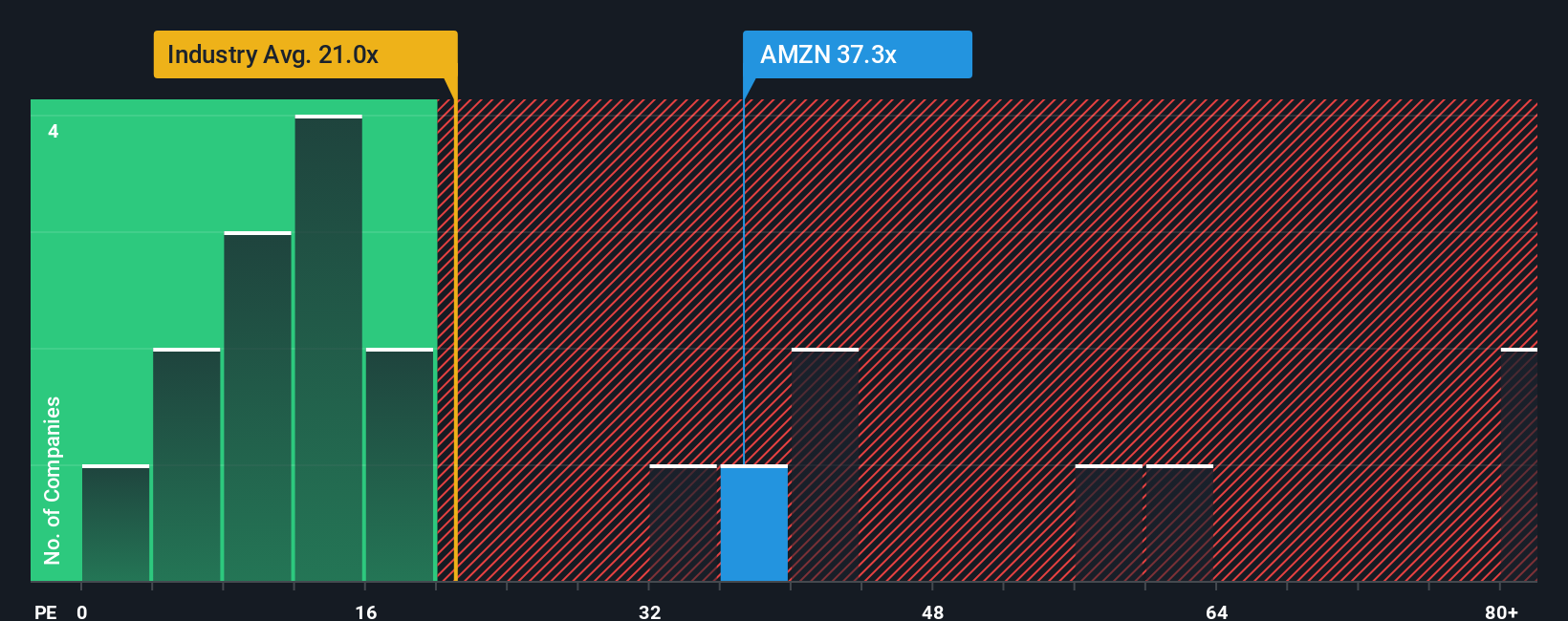

Another View: Multiples Send a Different Signal

Taking a closer look at how Amazon.com is valued compared to its peers offers a more cautious perspective. Its price-to-earnings ratio sits at 31.1x, richer than the industry average of 19x, though below close competitors at 34.8x. While this suggests Amazon is more expensive than the broader industry, it is still below its so-called fair ratio of 36.4x. This is a level the market could potentially gravitate toward. Does this premium mean Amazon is a safe bet, or is it a warning sign for buyers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amazon.com Narrative

If you have another perspective or want to dig deeper into the numbers on your own, building your own narrative can take less than three minutes. So why not Do it your way?

A great starting point for your Amazon.com research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock even more opportunities by taking a closer look at stocks on the rise. Find your next big winner from these standout categories before others do.

- Capture high yields and consistent returns by checking out these 15 dividend stocks with yields > 3% with strong income potential and reliable payout histories.

- Explore the AI revolution and discover promising upstarts in automation, data, and machine learning by reviewing these 27 AI penny stocks.

- Spot tomorrow's breakthrough companies and strong turnaround stories when you scan these 897 undervalued stocks based on cash flows that are flying under Wall Street’s radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives