- United States

- /

- Specialized REITs

- /

- NYSEAM:PW

The Power REIT (NYSEMKT:PW) Share Price Is Up 592% And Shareholders Are Delighted

Long term investing can be life changing when you buy and hold the truly great businesses. And we've seen some truly amazing gains over the years. Don't believe it? Then look at the Power REIT (NYSEMKT:PW) share price. It's 592% higher than it was five years ago. If that doesn't get you thinking about long term investing, we don't know what will. And in the last month, the share price has gained 12%. This could be related to the recent financial results that were recently released - you could check the most recent data by reading our company report.

We love happy stories like this one. The company should be really proud of that performance!

Check out our latest analysis for Power REIT

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

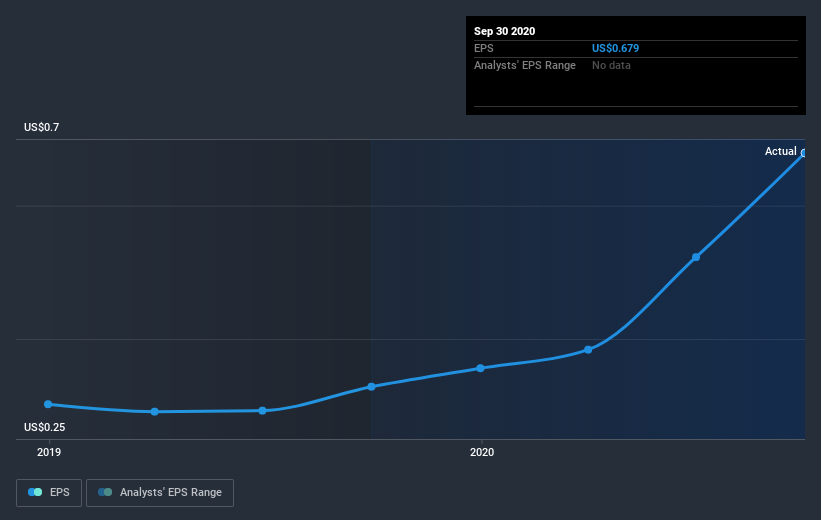

During the last half decade, Power REIT became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the Power REIT share price is up 350% in the last three years. Meanwhile, EPS is up 62% per year. This EPS growth is remarkably close to the 65% average annual increase in the share price (over three years, again). That suggests that the market sentiment around the company hasn't changed much over that time. There's a strong correlation between the share price and EPS.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

It's nice to see that Power REIT shareholders have received a total shareholder return of 244% over the last year. That's better than the annualised return of 47% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 5 warning signs we've spotted with Power REIT (including 1 which is makes us a bit uncomfortable) .

But note: Power REIT may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Power REIT or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSEAM:PW

Power REIT

Power REIT (ticker: PW) is a real-estate investment trust (REIT) that owns real estate related to properties for Controlled Environment Agriculture (greenhouses), Renewable Energy and Transportation.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives