- United States

- /

- Hotel and Resort REITs

- /

- NYSE:XHR

Is Xenia’s (XHR) Aggressive Share Buyback Offsetting Houston Headwinds and Lowered Guidance?

Reviewed by Sasha Jovanovic

- Xenia Hotels & Resorts recently reported third-quarter 2025 earnings, showing a net loss of US$13.74 million with sales and revenue declines compared to the previous year, reaffirmed ongoing operational challenges in the Houston market, and slightly lowered full-year guidance due to macroeconomic uncertainty.

- Despite headwinds, the company highlighted strong group booking momentum, major property investments such as the Grand Hyatt Scottsdale renovation, and completed a significant share buyback totaling nearly 24% of its outstanding shares since 2015.

- We'll explore how ongoing share repurchases and upbeat group demand may now influence Xenia's medium-term investment outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Xenia Hotels & Resorts Investment Narrative Recap

To own shares of Xenia Hotels & Resorts, investors need confidence in a recovery in group and business travel, as well as management’s ability to offset pressures from softer leisure demand. The recent Q3 results, with a net loss and lower guidance, do not materially alter the near-term focus on group booking momentum as the most important catalyst, while the biggest risk remains a sustained slump in leisure demand that could pressure margins and revenues.

The recent announcement that Xenia bought back nearly 1 million shares in Q3, pushing total buybacks to almost 24% of shares outstanding since 2015, is especially relevant. While this underscores management’s commitment to shareholder returns, the timing coincides with operational headwinds from the Houston market and ongoing labor cost pressures, factors likely to keep investor attention on earnings quality and margin trends.

By contrast, investors should also be aware that a persistent drop in leisure travel could further challenge Xenia’s revenue growth if group demand weakens...

Read the full narrative on Xenia Hotels & Resorts (it's free!)

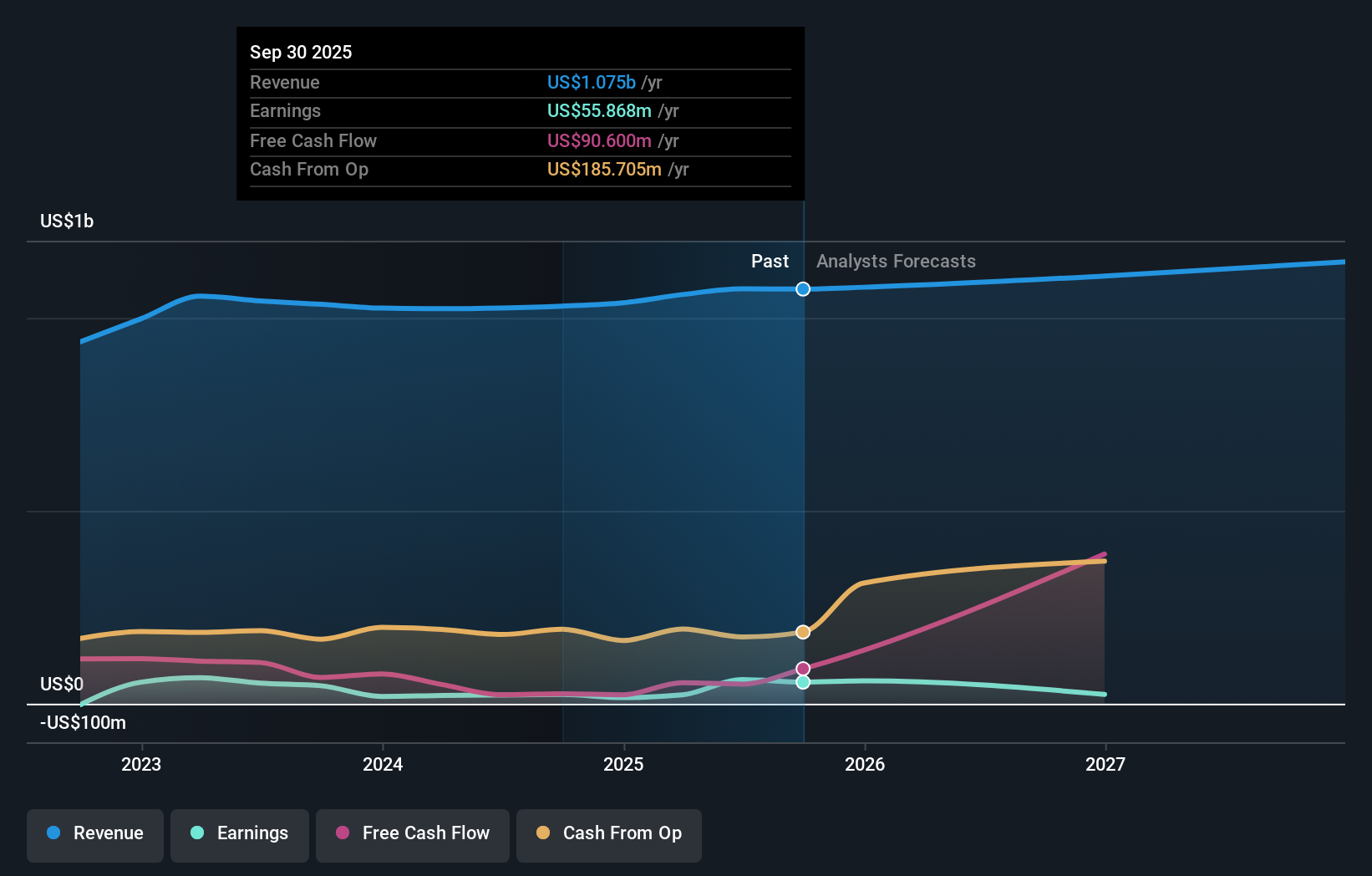

Xenia Hotels & Resorts' outlook forecasts $1.1 billion in revenue and $4.1 million in earnings by 2028. This implies a 1.8% annual revenue growth rate, but a substantial earnings decline of $58.4 million from the current $62.5 million.

Uncover how Xenia Hotels & Resorts' forecasts yield a $15.00 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for Xenia ranging from US$15 to US$23.04 per share, reflecting wide differences in outlook. Group booking trends continue to act as the central performance indicator, so consider how resilient demand must be in the face of recent earnings volatility.

Explore 2 other fair value estimates on Xenia Hotels & Resorts - why the stock might be worth just $15.00!

Build Your Own Xenia Hotels & Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xenia Hotels & Resorts research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Xenia Hotels & Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xenia Hotels & Resorts' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XHR

Xenia Hotels & Resorts

A self-advised and self-administered REIT that invests in uniquely positioned luxury and upper upscale hotels and resorts with a focus on the top 25 lodging markets as well as key leisure destinations in the United States.

Proven track record with slight risk.

Market Insights

Community Narratives