- United States

- /

- Health Care REITs

- /

- NYSE:WELL

Welltower (WELL): Profit Margin Miss Challenges Bullish Growth Narrative

Reviewed by Simply Wall St

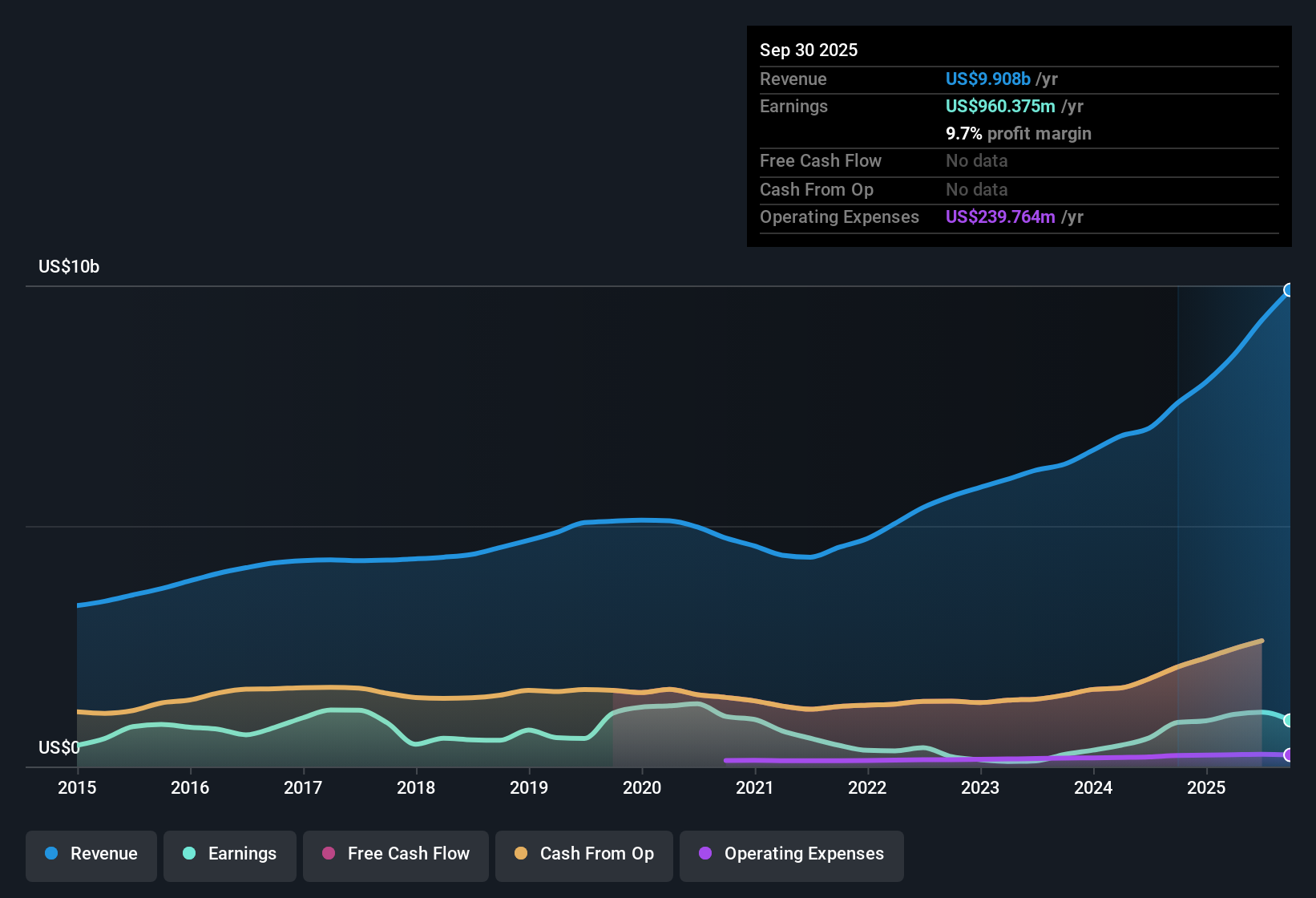

Welltower (WELL) posted earnings growth of 4.9% this year, which falls below its solid 9.4% annualized pace over the past five years. Net profit margins slipped to 9.7% from 12.1% a year ago, and shares are currently trading at $179.7, notably above the estimated fair value of $170.23. Despite this, forecasts call for annual earnings growth of 24.4% and revenue to climb 14.5% per year, both comfortably ahead of the broader US market. However, questions remain about elevated valuation multiples and margin declines.

See our full analysis for Welltower.We are about to see how the new results stack up against widely followed narratives in the market. Some expectations may get confirmed, while others could be upended.

See what the community is saying about Welltower

Margin Recovery in Analysts' Sights

- Analysts expect profit margins to climb from 12.2% today to 13.8% within three years, anticipating steady operational improvement despite the recent dip to 9.7% reported in the latest filing.

- Analysts' consensus view considers Welltower's enhanced credit rating and Welltower Business System upgrades as levers for long-term cost savings, with two specific accelerators:

- The company's operational focus targets margin expansion and aims to reverse last year's drop in profitability.

- Consensus sees better efficiency as key to unlocking a projected $2.0 billion in earnings by 2028, up from $1.1 billion currently.

- Curious if these margin targets can withstand industry headwinds? Find out what the consensus really says at 📊 Read the full Welltower Consensus Narrative.

Heightened Acquisition Activity Boosts Growth, But Leverage Rises

- Welltower's business expansion includes significant acquisitions such as Amica Senior Living, with forecasts calling for annual revenue growth of 16.3% and a 7.0% yearly increase in shares outstanding over the next three years.

- Analysts' consensus view notes growth potential from acquisitions but flags two pressure points:

- While integration efforts are designed to increase efficiency and occupancy, the recent wave of investments is increasing leverage, which requires careful balance sheet management.

- Consensus commentary notes that higher leverage could challenge future net margin improvements, especially if market conditions or asset prices shift unexpectedly.

Valuation Remains Rich Versus Industry Benchmarks

- Welltower's current share price of $179.70 is 5.6% above the DCF fair value of $170.23, while the company's P/E ratio of 128x far exceeds the industry average of 24.5x.

- Analysts' consensus perspective questions whether the premium is justified given the current margin slip:

- Premium valuation suggests investors are factoring in ambitious growth forecasts and margin recovery as projected.

- The gap versus DCF fair value indicates limited upside in the near term unless guidance surpasses expectations or industry peers experience a sudden shift in performance.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Welltower on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot things others might have missed? Shape your perspective into a unique narrative of your own in just a few minutes. Do it your way.

A great starting point for your Welltower research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite robust growth forecasts, Welltower faces pressure from elevated valuation multiples and rising leverage. These factors could constrain future margin improvements.

If you want to focus on companies trading below fair value with stronger upside potential, check out these 868 undervalued stocks based on cash flows to spot opportunities that may offer better risk-reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Welltower might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WELL

Welltower

Welltower Inc. (NYSE: WELL), an S&P 500 company, is one of the world's preeminent residential wellness and healthcare infrastructure companies.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives