- United States

- /

- Health Care REITs

- /

- NYSE:WELL

Welltower (WELL): Examining Valuation After Recent Surge in Healthcare Real Estate Momentum

Reviewed by Simply Wall St

See our latest analysis for Welltower.

Welltower’s share price has been building momentum, up nearly 42% year-to-date, as investor optimism grows around the company’s sustained growth in healthcare real estate. With a 1-year total shareholder return of 30.2% and an impressive 224% over three years, the stock’s strong long-term gains are fueling positive sentiment despite the occasional minor pullback.

If you’re watching healthcare real estate’s surge, you can uncover more opportunities with our latest See the full list for free..

But with Welltower’s impressive run so far, investors might wonder if the stock is now undervalued and poised for further gains, or if the current price reflects all of its expected growth ahead.

Most Popular Narrative: 5.6% Undervalued

With Welltower’s last close at $176.96 and the narrative fair value at $187.43, followers see more upside potential in the stock based on expectations for future performance, despite its recent strong run.

Welltower has launched a private fund management business and advanced its Welltower Business System, which is expected to enhance operational efficiencies and drive future revenue growth. Significant acquisition activity, including the Amica Senior Living acquisition, is anticipated to provide value through acquisition at a discount and drive revenue growth.

Curious what’s fueling this optimistic outlook? The narrative is underpinned by bold assumptions on rapid earnings expansion, margin improvement, and a premium future valuation multiple. Want to see how these ambitious expectations shape the verdict? Dive into the full narrative for the surprising details.

Result: Fair Value of $187.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising macroeconomic uncertainty and potential challenges to occupancy or revenue growth could quickly shift investor sentiment and put Welltower’s growth story to the test.

Find out about the key risks to this Welltower narrative.

Another View: Market Ratios Tell a Different Story

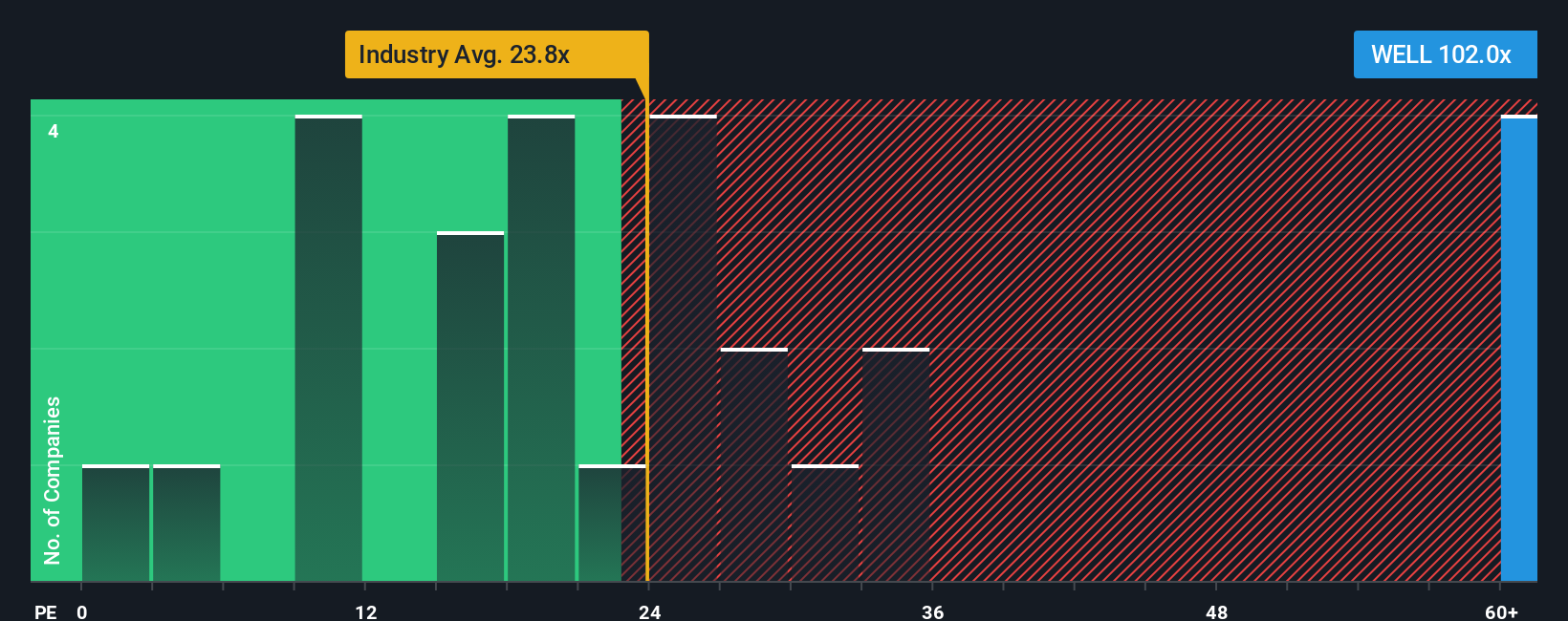

Looking at market ratios, Welltower appears expensive compared to both its industry and peers. Its current price-to-earnings ratio stands at 123.7x, more than double the peer average of 62.2x and well above the fair ratio of 44.6x. This wide gap could mean heightened valuation risk if market expectations shift, prompting investors to question how sustainable today's premium is.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Welltower Narrative

If you have a different viewpoint or want to dig deeper into the numbers, you can quickly craft your own narrative and see where your insights take you. Do it your way.

A great starting point for your Welltower research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t miss out on stocks that could transform your results this year. Uncover new strategies, boost your portfolio’s potential, and get ahead of the next big trend.

- Boost your passive income with these 21 dividend stocks with yields > 3%, focusing on companies delivering reliable yields above 3% for steady growth.

- Ride the artificial intelligence boom by acting on these 26 AI penny stocks, with opportunities to invest in pioneers harnessing AI across innovative industries.

- Seize potential undervalued winners using these 856 undervalued stocks based on cash flows, bringing you to the forefront of stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Welltower might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WELL

Welltower

Welltower Inc. (NYSE: WELL), an S&P 500 company, is one of the world's preeminent residential wellness and healthcare infrastructure companies.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives