- United States

- /

- Health Care REITs

- /

- NYSE:VTR

Ventas (VTR) One-Off $75M Loss Clouds Profit Turnaround, Fuels Valuation Scrutiny

Reviewed by Simply Wall St

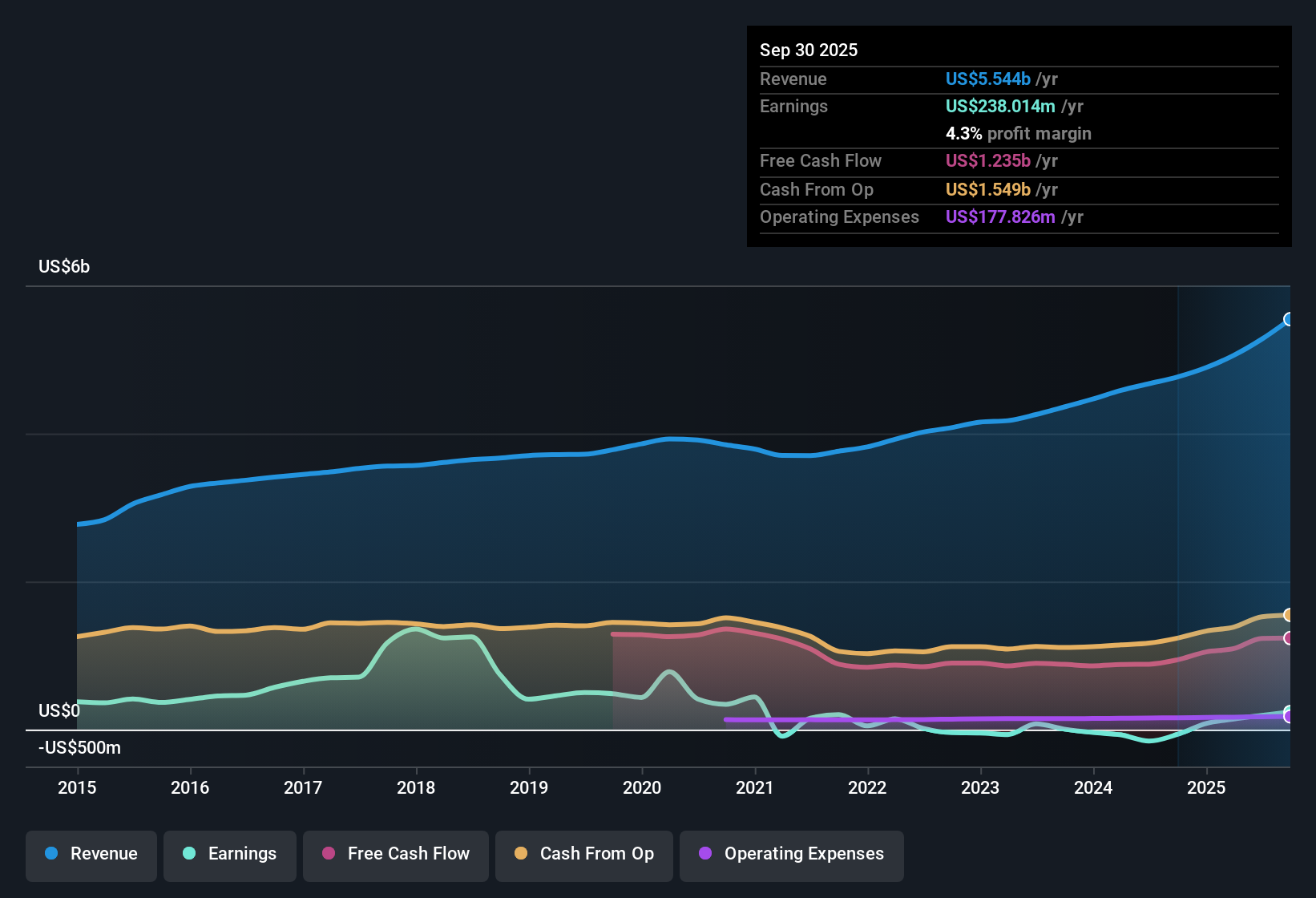

Ventas (VTR) delivered a notable turning point as the company became profitable, following several years of declines. Looking ahead, earnings are forecast to grow 24.24% per year, outpacing both the US market’s anticipated 15.7% annual earnings growth and Ventas’s own projected revenue growth of 11.1%, which also sits above the national average of 10.3%. A single, non-recurring $75.0 million loss weighed on results for the past twelve months, making year-over-year comparisons tricky for investors seeking to read the underlying earnings narrative.

See our full analysis for Ventas.Next, we will see how these headline numbers compare to the broader market narratives and community takes. Some assumptions may be reinforced, but others could face new scrutiny in light of Ventas’s recent results.

See what the community is saying about Ventas

Margins Target 6.4% Amid Shifting Portfolio

- Analysts expect Ventas’s profit margin to grow from 3.6% today to 6.4% within three years, as ongoing changes like converting underperforming assets and strategic acquisitions drive operating leverage.

- According to the analysts' consensus view, operational improvements and strong balance sheet flexibility are set to support margin expansion. However, intensifying competition and labor cost pressures may slow progress.

- Favorable demographic trends and higher occupancy in senior housing are expected to widen margins. New operator risks and exposure to volatile biotech tenants could offset some gains.

- Persistent labor cost inflation, while "in line with expectations," poses an ongoing risk to achieving margin goals if shortages worsen or expenses increase faster than revenue growth.

Acquisitions and Share Growth: Double-Edged Sword

- Ventas plans to increase its acquisitions pipeline to $2.0 billion in 2025, alongside a 7.0% expected annual rise in shares outstanding over the next three years. These moves bring growth opportunities but heightened complexity.

- Analysts' consensus narrative highlights that scaling through acquisitions and issuing new shares could amplify earnings growth, but also raises significant integration and shareholder dilution risks.

- Expanding with large, high-quality assets in top markets may support steady revenue and FFO per share growth. However, failure to integrate or deliver targeted returns could impact results and delay payoffs.

- The strategy’s success depends on disciplined portfolio management and operator execution as Ventas’s exposure to SHOP and external acquisitions increases potential for both outperformance and pitfalls.

Valuation: Discount to DCF but Premium to Peers

- The current share price of $74.36 sits below the DCF fair value of $104.48, suggesting upside, but trades at a steep 141.9x price-to-earnings ratio compared to the peer average of 23.6x.

- As the analysts' consensus narrative points out, the attractive discount to DCF fair value supports a longer-term growth story. Yet, the high PE ratio reflects that investors are already paying up for anticipated earnings. Any negative surprises could result in sharp valuation resets.

- Consensus maintains a price target of $77.85, only about 4.7% above today’s price, signaling a moderate near-term return even as long-term forecasts remain constructive.

- This valuation tension—cheap relative to intrinsic value but expensive versus sector—keeps scrutiny on Ventas’s ability to convert forecasts into sustained bottom-line gains.

See what the community is saying about Ventas

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ventas on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Thinking about these results from another angle? Share your insights by building a narrative in just minutes and shape your own interpretation. Do it your way

A great starting point for your Ventas research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Ventas faces high valuation pressures and potential shareholder dilution as acquisitions and rising costs create uncertainty around sustainable growth per share.

If you want stronger value opportunities with less risk of overpaying, check out these 850 undervalued stocks based on cash flows to target companies trading below their intrinsic worth and avoid surprise resets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTR

Ventas

Ventas, Inc. (NYSE: VTR) is a leading S&P 500 real estate investment trust enabling exceptional environments that benefit a large and growing aging population.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives