- United States

- /

- Health Care REITs

- /

- NYSE:VTR

How Investors May Respond To Ventas (VTR) Analyst Upgrades and Notable Insider Share Sale

Reviewed by Sasha Jovanovic

- Ventas Inc (NYSE:VTR) recently drew significant attention as analysts highlighted its position as an attractive healthcare REIT, with Morningstar awarding a four-star rating and Diamond Hill Mid Cap Strategy taking a new stake in early 2025 due to favorable demographics and competitive advantages in senior housing.

- In addition, a prominent insider transaction occurred when company officer Debra Cafaro sold 219,520 shares worth US$15.66 million in October 2025, further increasing investor focus on the company.

- We'll explore how growing institutional interest, spurred by analyst endorsements and new fund positions, influences Ventas's investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Ventas Investment Narrative Recap

To own Ventas, you need to believe in the long-term demand for senior housing and healthcare properties, supported by demographic trends and limited new supply. Recent analyst endorsements and new institutional positions, such as Diamond Hill’s investment, reflect these themes but may not meaningfully affect the most important short-term catalyst, continued occupancy improvements in senior housing. The biggest risk remains operator execution within the growing SHOP segment, as ongoing occupancy volatility or weak operator performance could weigh on earnings, though these news events do not materially change that risk.

Out of the recent announcements, the Q2 2025 earnings release is especially relevant, showing Ventas has returned to profitability with net income growing to US$68.26 million from US$19.39 million a year ago. This supports the positive narrative around improving fundamentals and stable revenue streams, which are key catalysts as investors wait to see continued earnings and occupancy progress in upcoming quarters.

However, in contrast to these positives, investors should be aware that persistent low occupancy in the SHOP segment could challenge margin expansion and...

Read the full narrative on Ventas (it's free!)

Ventas' outlook anticipates $6.9 billion in revenue and $443.6 million in earnings by 2028. This implies a 9.3% annual revenue growth rate and a $252.4 million earnings increase from current earnings of $191.2 million.

Uncover how Ventas' forecasts yield a $77.39 fair value, a 10% upside to its current price.

Exploring Other Perspectives

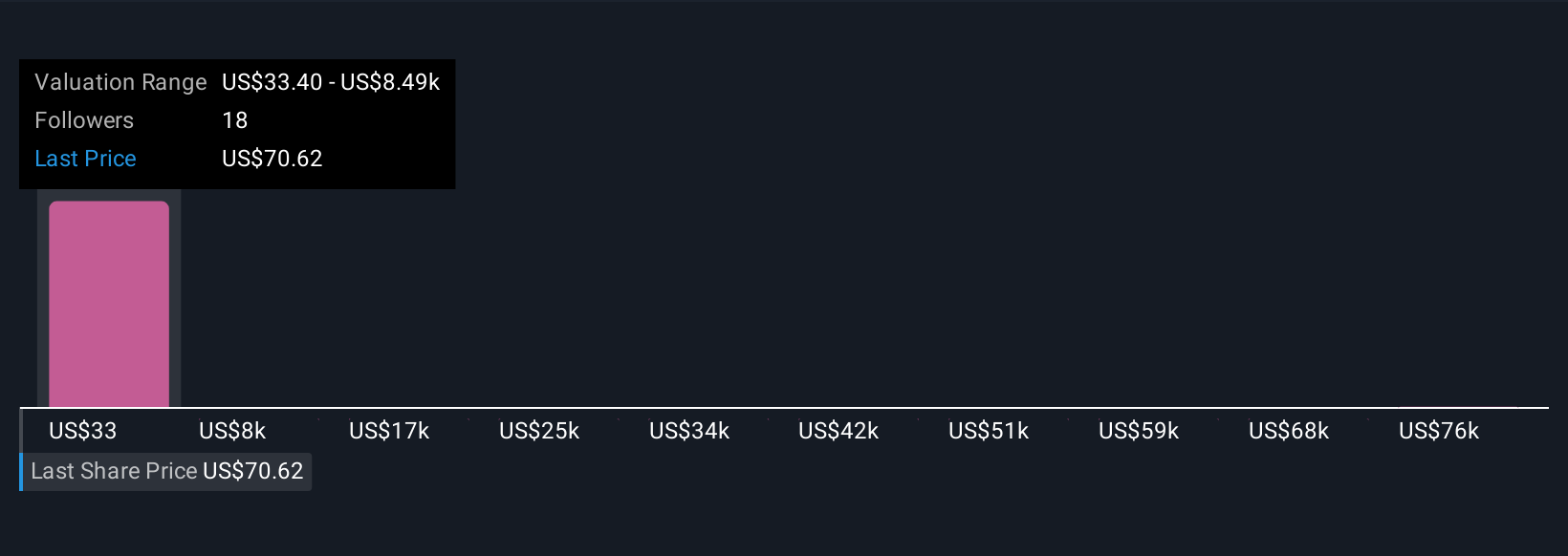

Simply Wall St Community members produced five independent fair value estimates for Ventas ranging from US$33.40 to US$84,622.13. While opinions differ widely, the company’s ongoing reliance on operator execution in senior housing continues to be a central theme shaping expectations for future results.

Explore 5 other fair value estimates on Ventas - why the stock might be a potential multi-bagger!

Build Your Own Ventas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ventas research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ventas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ventas' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTR

Ventas

Ventas, Inc. (NYSE: VTR) is a leading S&P 500 real estate investment trust enabling exceptional environments that benefit a large and growing aging population.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives