- United States

- /

- Health Care REITs

- /

- NYSE:VTR

Brookdale's Lease Decision Challenges Ventas (NYSE:VTR) Amid Growth and Market Opportunities

Reviewed by Simply Wall St

Ventas (NYSE:VTR) is navigating a complex environment with recent developments, including Brookdale Senior Living Inc.'s decision not to renew a master lease for 120 communities, highlighting ongoing cash flow challenges. Despite these hurdles, Ventas continues to leverage its strategic investments in senior housing, reporting a 7% increase in normalized FFO per share, driven by strong occupancy and revenue growth. The following discussion will explore Ventas's financial performance, strategic growth initiatives, and the competitive pressures it faces.

See the full analysis report here for a deeper understanding of Ventas.

Core Advantages Driving Sustained Success for Ventas

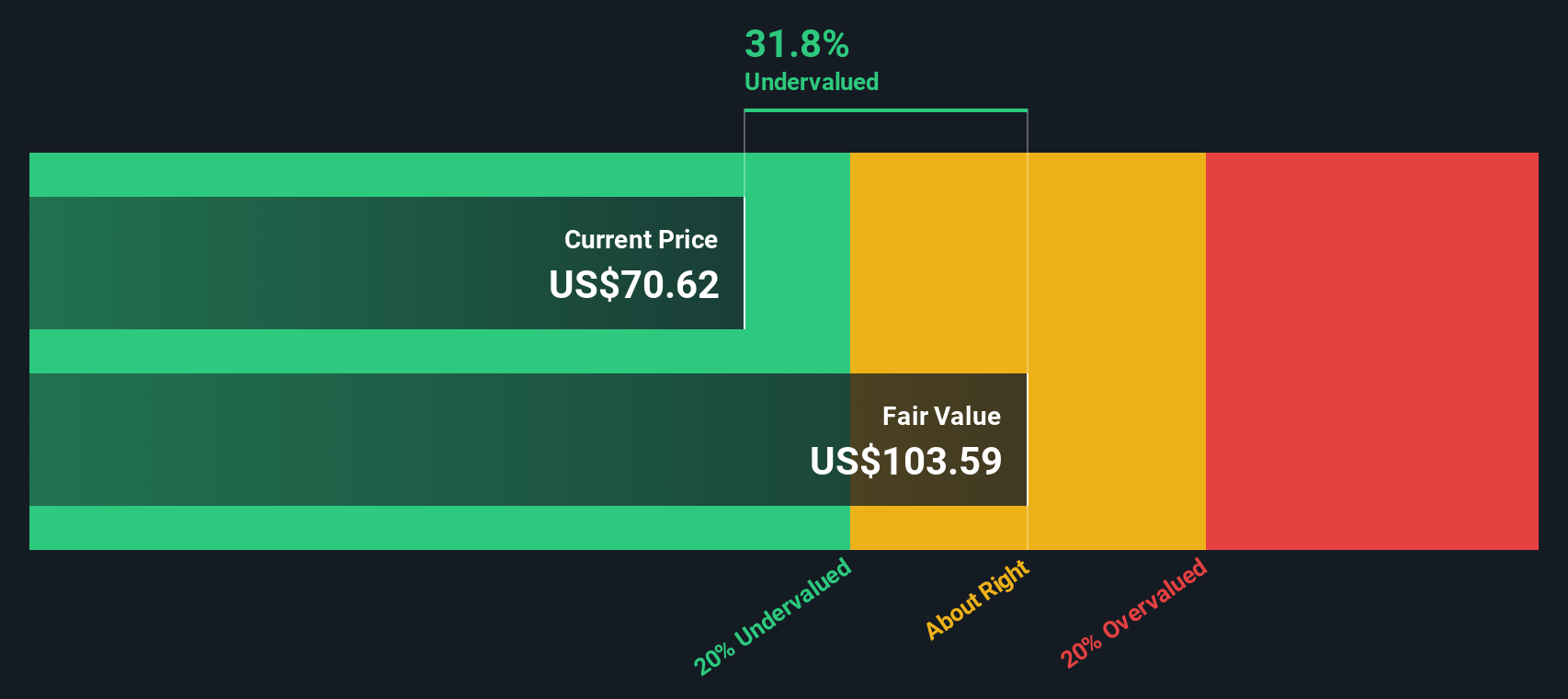

Ventas has reported a 7% increase in normalized FFO per share, reaching $0.80, driven by strong occupancy and revenue outperformance. This reflects the company's strategic focus on enhancing its senior housing operating portfolio (SHOP), which achieved a 15% increase in cash NOI, marking the ninth consecutive quarter of double-digit NOI growth. CEO Debra Cafaro emphasized the strategic investments of $1.7 billion in senior housing, expected to boost SHOP NOI by 12 percentage points. These initiatives underscore Ventas's commitment to leveraging market opportunities and optimizing asset performance. Furthermore, the company is trading below its estimated fair value, suggesting its market position is potentially undervalued, aligning with its growth metrics.

Internal Limitations Hindering Ventas's Growth

Challenges persist in Ventas's financial structure, with a high net debt to equity ratio of 123.7%. The company's current unprofitability, marked by a negative return on equity of -0.54%, highlights the need for improved earnings growth. Seasonal expense pressures have also impacted margins, as noted by CFO Robert Probst, due to insurance renewals and other cyclical costs. Additionally, the decision by Brookdale Senior Living Inc. not to renew a master lease covering 120 communities, due to historically significant cash flow deficits, reflects operational inefficiencies that Ventas must address to enhance its financial stability.

Growth Avenues Awaiting Ventas

Opportunities abound for Ventas in the evolving senior housing market, bolstered by favorable supply-demand dynamics and demographic trends. The company is actively pursuing acquisitions of high-performing communities, which promise significant NOI growth potential. EVP Justin Hutchens highlighted the use of data analytics through the Ventas OI platform to optimize portfolio performance, leveraging over 1 billion operational and financial data points. Such strategic moves position Ventas to capitalize on emerging market opportunities and enhance its competitive edge.

Competitive Pressures and Market Risks Facing Ventas

The potential reemergence of supply in the senior housing market poses a risk to sustained growth. Regulatory and economic uncertainties, particularly those linked to the upcoming election season, could impact the healthcare sector, as noted by Debra Cafaro. Additionally, while Ventas currently benefits from limited competition, there is a looming threat of increased competition from private equity firms as market conditions evolve. These external factors necessitate vigilant strategic planning to safeguard Ventas's market share and growth trajectory.

Conclusion

Ventas's strategic focus on enhancing its senior housing operating portfolio has driven significant financial improvements, as evidenced by a 7% increase in normalized FFO per share. This growth is supported by strategic investments and a 15% rise in cash NOI, underscoring the company's ability to capitalize on favorable market dynamics. However, internal challenges such as high debt levels and unprofitability highlight the need for financial restructuring and operational efficiencies to sustain growth. Ventas's proactive acquisition strategy and data-driven optimization efforts position it well to leverage emerging opportunities in the senior housing market. Furthermore, trading below its estimated fair value suggests that Ventas's market potential remains promising, offering a compelling opportunity for investors as the company navigates competitive pressures and regulatory uncertainties.

Where To Now?

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTR

Ventas

Ventas, Inc. (NYSE: VTR) is a leading S&P 500 real estate investment trust enabling exceptional environments that benefit a large and growing aging population.

Undervalued with moderate growth potential.