- United States

- /

- Health Care REITs

- /

- NYSE:VTR

A Look at Ventas (VTR) Valuation Following Q3 Earnings Beat and Analyst Upgrades

Reviewed by Simply Wall St

Ventas (VTR) beat both earnings and revenue forecasts in its third quarter, a move that inspired several analysts to increase their ratings and remain optimistic on the company’s future prospects. Investors are now weighing what this performance boost could mean.

See our latest analysis for Ventas.

Ventas’s share price has gained solid ground lately, up 10.45% over the past month and now trading at $78.00. This upward momentum was further supported by robust third-quarter results and a streak of analyst upgrades, which have helped reinforce broader confidence in the company. If you zoom out, the long-term story is even stronger. Ventas has delivered a remarkable 96.54% total shareholder return over three years, showing that recent gains are just the latest phase in a long-running uptrend.

If you’re inspired by Ventas’s renewed momentum, now could be the moment to broaden your perspective and discover fast growing stocks with high insider ownership

But with shares nearing analysts’ price targets and high expectations now built in, investors have to ask: is Ventas still trading at a discount, or has the market already baked in all the good news?

Most Popular Narrative: 2.4% Undervalued

The most widely followed narrative currently estimates Ventas is trading below its calculated fair value of $79.90, with the recent close at $78.00 indicating modest undervaluation. Attention now shifts to the crucial assumptions behind this narrative that distinguish it from other valuation models.

Ongoing active portfolio management, such as converting underperforming triple-net assets to SHOP, strategic acquisitions focused on high-performing newer assets in strong-demographic markets, and expanding relationships with best-in-class operators, creates a runway for outsized top-line revenue and FFO per share growth.

Want to know what’s fueling this surprising fair value? Hint: Unconventional growth moves, significant demographic tailwinds, and bold earnings projections are at the narrative’s core. Which metric could influence the entire calculation? See the full story to uncover the precise assumptions that led to this premium valuation.

Result: Fair Value of $79.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition for acquisitions and persistent labor cost pressures could challenge Ventas’s growth assumptions and may potentially shift the current value narrative.

Find out about the key risks to this Ventas narrative.

Another View: The Multiples Approach

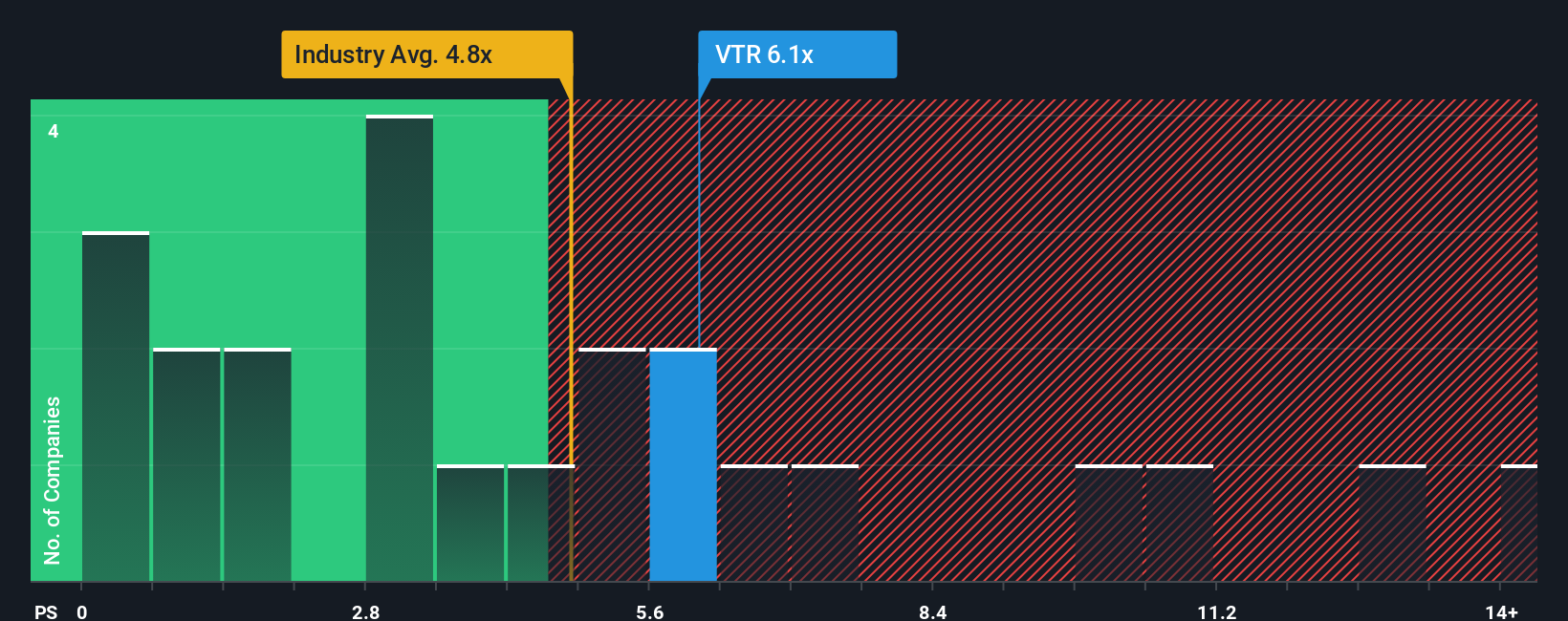

While the fair value narrative points to understated potential, a closer look at Ventas’s price-to-sales ratio offers a new perspective. Shares trade at 6.6x sales, which is notably higher than the US Health Care REITs industry average of 4.8x and also above the peer average of 5.5x. Compared to the fair ratio of 5.6x, this premium suggests the valuation risk could be higher than it appears. Will investors continue to pay this premium, or could the share price face some pressure to return closer to market norms?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ventas Narrative

If you feel your perspective differs from these narratives or want to dive deeper into the data yourself, you can quickly craft your own in just a few minutes: Do it your way

A great starting point for your Ventas research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Great opportunities are emerging beyond Ventas. Don’t let tomorrow’s winners pass you by. Take charge now and expand your search.

- Boost your passive income with steady payouts by reviewing these 16 dividend stocks with yields > 3% offering yields over 3% and strong fundamentals.

- Catch the next tech revolution by tapping into artificial intelligence gains with these 25 AI penny stocks, where innovation meets rapid growth possibilities.

- Position yourself ahead of the curve with these 894 undervalued stocks based on cash flows, identifying stocks trading below their true worth based on solid cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTR

Ventas

Ventas, Inc. (NYSE: VTR) is a leading S&P 500 real estate investment trust enabling exceptional environments that benefit a large and growing aging population.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives