- United States

- /

- Residential REITs

- /

- NYSE:VRE

Veris Residential (VRE): $104.8M One-Off Gain Clouds Profitability Narrative

Reviewed by Simply Wall St

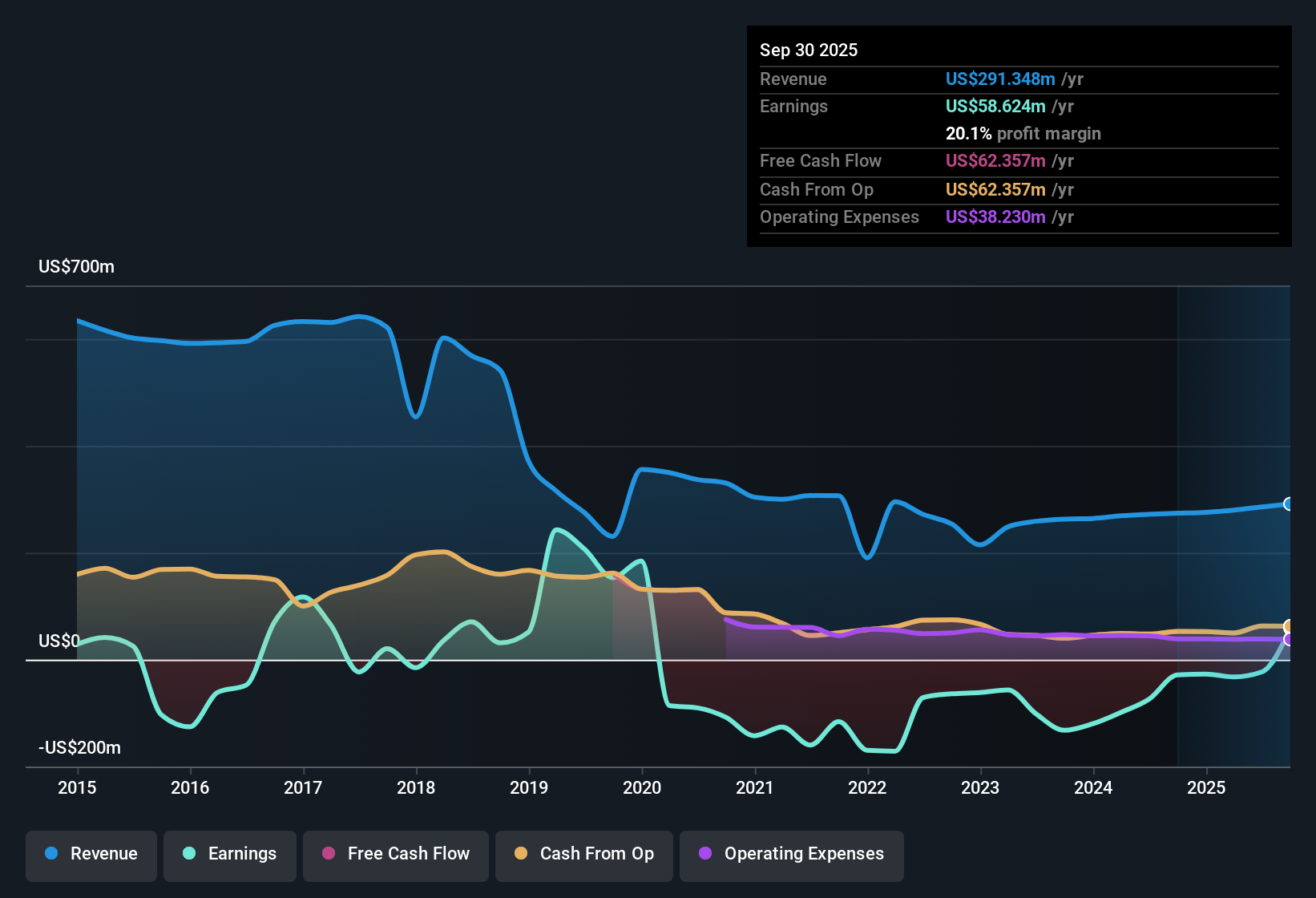

Veris Residential (VRE) has recently swung to profitability, posting average earnings growth of 30.3% per year over the past five years, with the turnaround to profit coming in the last twelve months. However, the latest results were inflated by a one-off gain of $104.8 million, which is not expected to return and clouds the picture of ongoing operations. While revenue is forecast to grow at just 2.1% per year, well behind the estimated 10% annual pace of the broader US market, earnings are set to contract by 47.4% per year over the next three years, putting future margins and profitability under pressure.

See our full analysis for Veris Residential.Now, let's see how these earnings results measure up against the market’s running narratives and whether the new numbers confirm or contradict the crowd’s expectations.

See what the community is saying about Veris Residential

Leverage Remains High at 11.4x Net Debt/EBITDA

- Veris Residential’s net-debt-to-EBITDA ratio currently stands at 11.4x, a level that could restrict financial flexibility as the company looks to adapt to slower revenue growth and ongoing renovations at key properties.

- Analysts' consensus view highlights that although strategic asset sales of $300 million to $500 million are planned to improve the debt position over the next one to two years, high leverage remains a top concern.

- This leverage could limit the company’s ability to fund expansions or weather market downturns, especially if anticipated revenue growth of 2.1% per year does not occur.

- Consensus narrative also notes that elevated debt levels could cause pressure on interest expenses and overall financial stability, which are important factors to monitor given ambitious plans for operational improvements.

- Read the full consensus narrative to see how analysts weigh these debt challenges against the company’s turnaround story. 📊 Read the full Veris Residential Consensus Narrative.

One-Off Gains Drive Short-Term Profit

- The recent $104.8 million one-off gain contributed heavily to Veris Residential’s swing into profitability, a boost not expected to be repeated in future periods and one that complicates the true picture of ongoing earnings power.

- Consensus narrative cautions investors that the quality of earnings is in question due to these non-recurring gains.

- Reported profitability may appear strong, but underlying operational results are less robust once this extraordinary item is removed.

- This places heightened importance on future core FFO and rental income trends, especially with analysts forecasting an annual earnings decline of 47.4% over the next three years.

Valuation Attractive Versus Peers, But Not the Broader Industry

- Veris Residential is trading at a price-to-earnings (P/E) ratio of 23.9x, which is considerably below the US peer average of 82.9x, but still a premium compared to the global residential REIT average of 20.2x.

- Consensus narrative points out that while this relative undervaluation versus US peers may appeal to value-focused investors, the higher-than-average multiple compared to global REIT benchmarks limits the case for a broad-based value opportunity.

- With the current share price at $14.99 and a DCF fair value of $16.97, there is modest upside on a discounted cash flow basis, but investors should balance this with weaker future earnings growth and lingering debt concerns.

- Analysts also highlight the need to validate these metrics with personal assumptions, as sentiment is split between cautious and bullish views regarding Veris Residential’s true worth in the current environment.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Veris Residential on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spotting a different angle in the latest results? Take just a few moments to build your perspective and shape your personalized view of Veris Residential. Do it your way.

A great starting point for your Veris Residential research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Explore Alternatives

Veris Residential faces notable risks from high leverage and anticipated earnings declines. This raises questions about its ongoing financial stability and future profitability.

If you want to focus on companies with stronger balance sheets and less debt risk, start your search with solid balance sheet and fundamentals stocks screener (1984 results) to discover businesses built for resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRE

Veris Residential

A forward-thinking real estate investment trust (REIT) that primarily owns, operates, acquires and develops premier Class A multifamily properties in the Northeast.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives