- United States

- /

- Office REITs

- /

- NYSE:VNO

The Bull Case for Vornado Realty Trust (VNO) Could Change Following Wharton’s Major Lease at 555 California

Reviewed by Sasha Jovanovic

- The Wharton School of the University of Pennsylvania recently announced it signed a long-term lease to occupy approximately 80,000 square feet within The Cube at the 555 California complex in San Francisco, a property managed by Vornado Realty Trust.

- This lease more than doubles Wharton's West Coast footprint and underscores demand for high-quality, amenity-rich office space in major urban centers.

- We'll review how Wharton's substantial lease commitment at The Cube could influence Vornado's investment narrative and prospects for occupancy growth.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Vornado Realty Trust Investment Narrative Recap

Shareholders in Vornado Realty Trust need to believe in the continued desirability of high-quality, amenity-rich office spaces in top urban markets and the firm's ability to capitalize on limited new supply. Wharton's long-term lease at The Cube reaffirms demand for premier assets, but its direct impact on Vornado's short-term catalyst, leasing momentum across its Manhattan trophy properties, appears limited, while the company’s largest risk remains its exposure to changing office utilization trends in core markets.

Of recent announcements, Vornado’s completed acquisition and planned redevelopment of 623 Fifth Avenue is especially relevant, as it addresses the catalyst of capturing demand for premium office space through repositioning underutilized assets. This redevelopment aim aligns with broader trends toward upgraded workspaces but will test both Vornado’s execution capabilities and ongoing tenant demand at higher rental rates.

In contrast, investors should be aware of how sustained remote work trends might impact demand for even the most centrally located, high-quality office assets...

Read the full narrative on Vornado Realty Trust (it's free!)

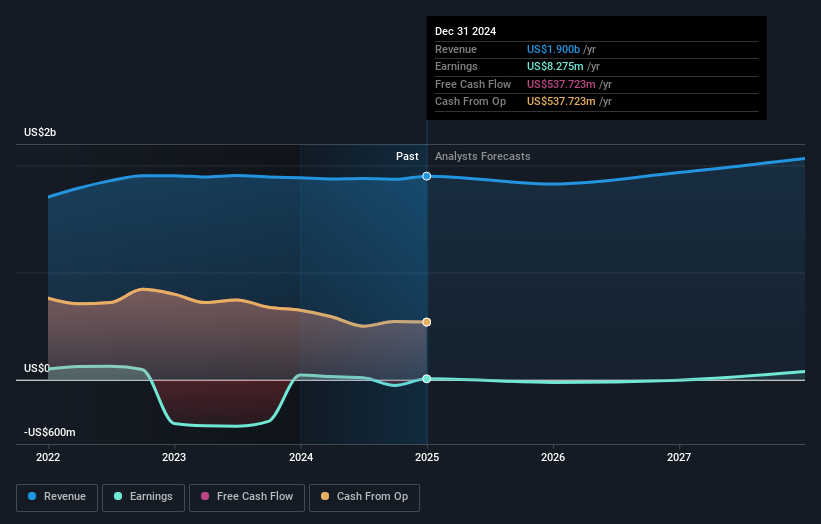

Vornado Realty Trust's outlook calls for $2.1 billion in revenue and $21.9 million in earnings by 2028. This projection assumes 3.0% annual revenue growth, but a steep $790.8 million decrease in earnings from current earnings of $812.7 million.

Uncover how Vornado Realty Trust's forecasts yield a $39.67 fair value, in line with its current price.

Exploring Other Perspectives

Two recent community fair value estimates for Vornado Realty Trust fall between US$38.59 and US$39.67 per share, reflecting closely aligned yet distinct opinions from Simply Wall St Community members. The significance of fresh long-term tenant commitments may affect these perspectives as expectations for urban office demand and leasing recovery remain in focus.

Explore 2 other fair value estimates on Vornado Realty Trust - why the stock might be worth just $38.59!

Build Your Own Vornado Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vornado Realty Trust research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Vornado Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vornado Realty Trust's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VNO

Vornado Realty Trust

Vornado Realty Trust (“Vornado”) is a fully-integrated real estate investment trust (“REIT”) and conducts its business through, and substantially all of its interests in properties are held by, Vornado Realty L.P.

Moderate risk with proven track record.

Similar Companies

Market Insights

Community Narratives