- United States

- /

- Specialized REITs

- /

- NYSE:VICI

How Do Recent Acquisitions Impact VICI Properties’ Valuation After This Month’s 8.8% Drop?

Reviewed by Bailey Pemberton

- Wondering if VICI Properties might be a hidden value opportunity, or just another real estate stock? Let’s dive in and see what the numbers actually say.

- The stock has moved down 5.0% this week and is off 8.8% this month, but it’s still up 2.4% for the year. There’s a mix of caution and optimism from the market right now.

- Recently, headlines have highlighted VICI’s strategic property acquisitions and partnerships with leading hospitality operators. These developments are reshaping investor sentiment and may help explain why the stock’s price has seen some volatility as the market reacts to future growth expectations and risk.

- On traditional valuation checks, VICI Properties scored a 6 out of 6 for being undervalued, suggesting it passes all six measures we typically use. However, just looking at scores doesn’t paint the full picture. Next, we’ll break down how valuation is calculated and introduce a better way to understand VICI’s value by the end of the article.

Approach 1: VICI Properties Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and then discounting them back to their present value. For VICI Properties, the model uses adjusted funds from operations as the foundation for its valuation, capturing the real cash earnings generated by the company.

VICI Properties reported free cash flow of $2.37 billion for the last twelve months. According to analysts, annual free cash flows are expected to grow steadily, reaching $2.94 billion by 2028. Beyond 2028, projections continue to climb, with Simply Wall St's extrapolated estimates pushing free cash flow close to $3.8 billion by 2035. These projections reflect not just expectations from Wall Street, but also a reasonable extension of recent trends using internal models.

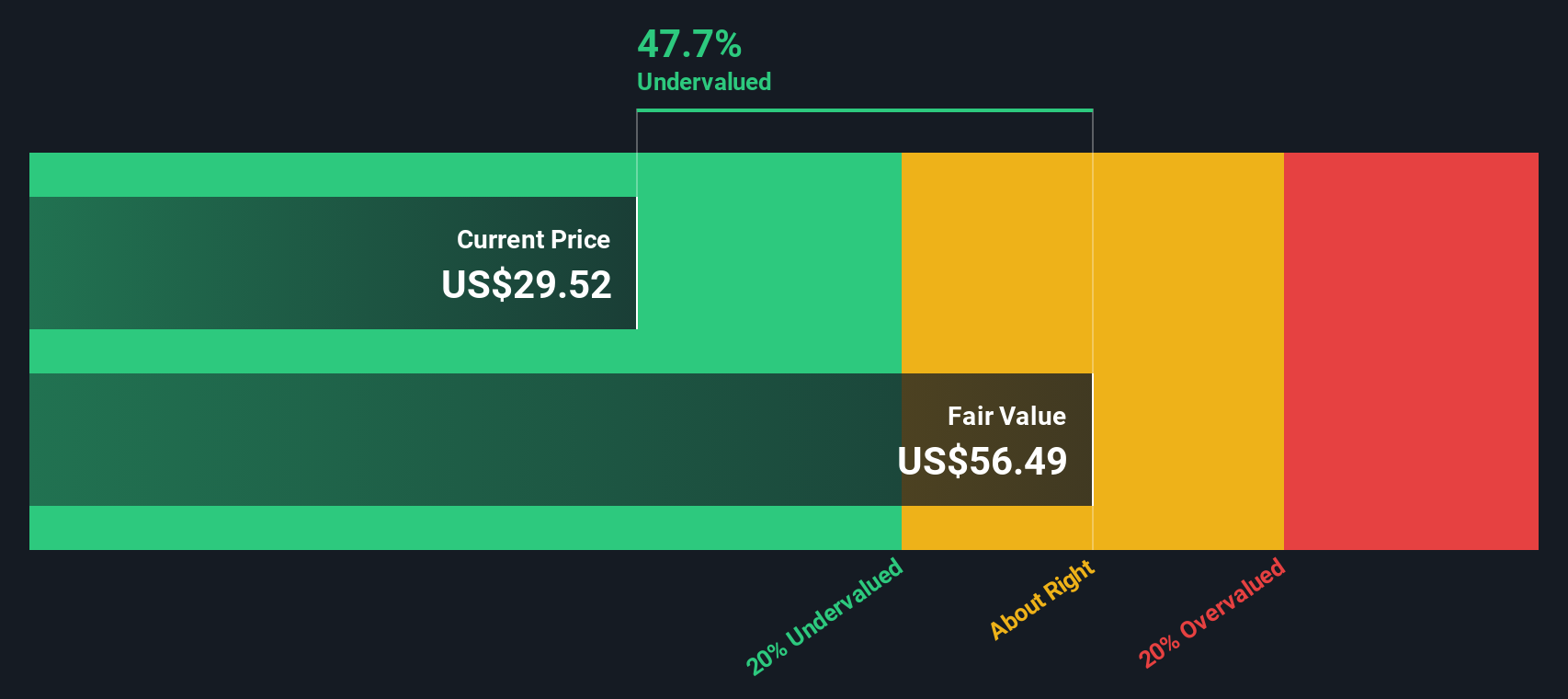

Based on these projections and discounting them to their present value, the DCF analysis calculates an intrinsic value for VICI Properties stock of $56.57 per share. This result suggests that, with a discount of 47.5 percent versus the current market price, the stock appears significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests VICI Properties is undervalued by 47.5%. Track this in your watchlist or portfolio, or discover 853 more undervalued stocks based on cash flows.

Approach 2: VICI Properties Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most common methods for valuing profitable real estate investment trusts like VICI Properties. It helps investors understand how much the market is willing to pay for each dollar of the company’s earnings, making it particularly useful when consistent profits and steady cash flows are present.

Growth expectations and risk play a big role in determining what a “normal” or “fair” PE ratio should be. Higher expected earnings growth or lower perceived risks typically justify a higher PE multiple, while slow growth or higher risk generally lead to lower multiples. This context is key when comparing PE ratios across peers and the industry.

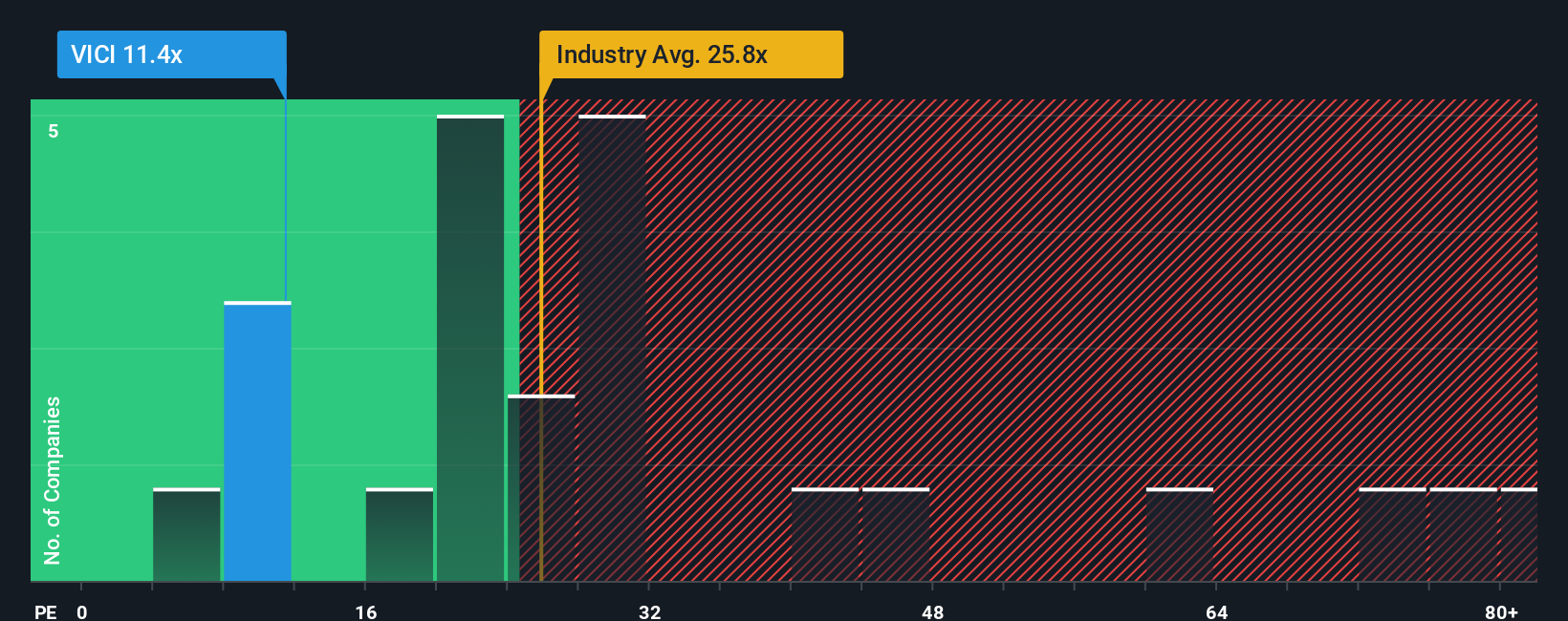

VICI Properties currently trades at an 11.5x PE ratio. That is noticeably below both the industry average of 17.7x and the peer average of 23x. However, just looking at averages can miss important details about VICI's growth and risk profile.

This is where Simply Wall St’s “Fair Ratio” offers a sharper lens. The Fair Ratio adjusts for VICI’s growth prospects, risk exposure, profit margins, and its standing within the Specialized REITs segment, providing a custom benchmark. For VICI Properties, the Fair Ratio is 32.4x, which is much higher than both its current multiple and the averages. This suggests the stock is attractively valued, as the market is not yet pricing in the full potential reflected in the Fair Ratio.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1394 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose Your VICI Properties Narrative

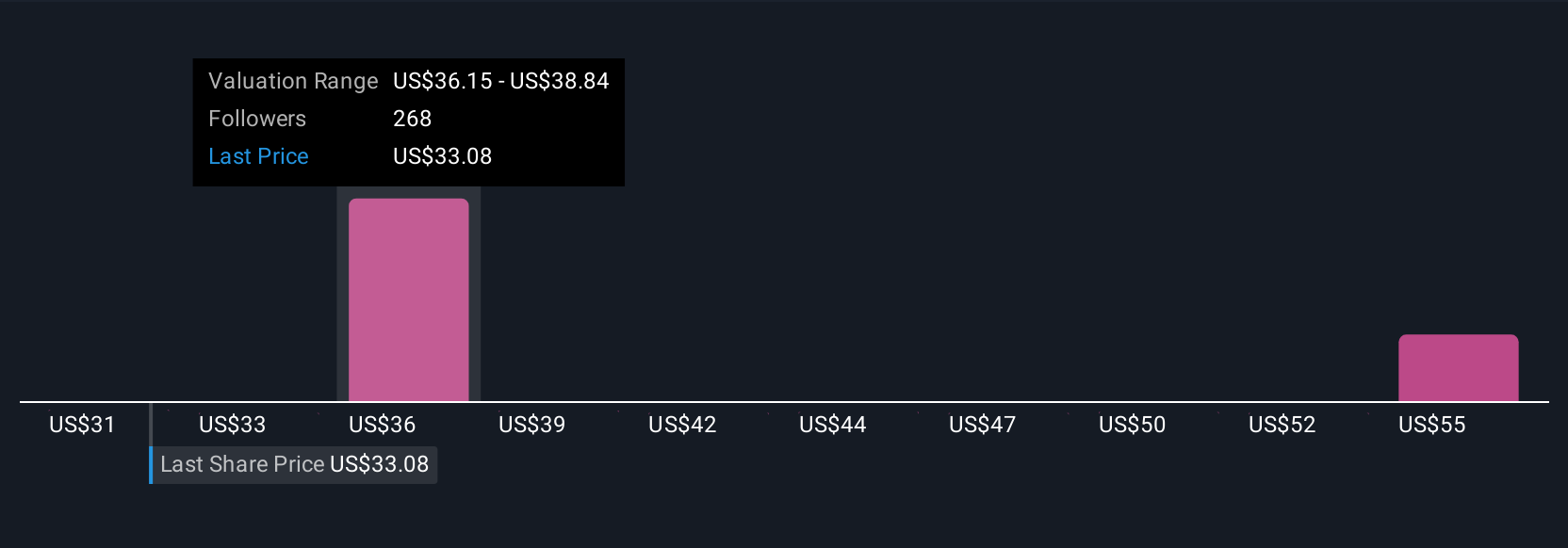

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a story you create behind the raw numbers, linking your perspective on a company’s future, such as assumptions on fair value, revenue growth, and margins, to an actual financial forecast and ultimately a fair value for the stock.

Narratives go beyond just crunching numbers. They help you connect why you think VICI Properties should be worth more or less and allow you to test your point of view. On Simply Wall St's Community page, millions of investors use Narratives as an intuitive, accessible tool to share and compare their investment stories, see exactly how their forecast stacks up, and instantly calculate a personal fair value based on their beliefs.

By comparing your Narrative's fair value to the current price, you can more confidently decide if it is the right time to buy or sell. Plus, Narratives update automatically as new information arrives, such as news or earnings, so your view always stays relevant.

For example, one investor with an optimistic Narrative for VICI Properties might assume high revenue growth and robust margins, landing at a fair value of $44.00 per share. A more conservative investor, looking at slower growth and higher risks, could justify a fair value as low as $34.00. This demonstrates just how powerful Narratives can be for reaching your own informed decision.

Do you think there's more to the story for VICI Properties? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VICI

VICI Properties

An S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality, wellness, entertainment and leisure destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

Very undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives