- United States

- /

- Retail REITs

- /

- NYSE:UE

The Bull Case For Urban Edge Properties (UE) Could Change Following Q3 Earnings Beat and Dividend Announcement

Reviewed by Sasha Jovanovic

- Urban Edge Properties recently declared a regular quarterly dividend of US$0.19 per common share, payable on December 31, 2025, to shareholders of record as of December 15, 2025.

- The company also reported third-quarter 2025 earnings that surpassed analyst expectations and raised its full-year net income guidance, highlighting improved operational performance.

- We'll explore how the upward revision in earnings guidance influences Urban Edge Properties' investment narrative and future outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Urban Edge Properties Investment Narrative Recap

To be a shareholder in Urban Edge Properties, you need to believe that demand for necessity-based retail in densely populated Northeast and Mid-Atlantic markets will outweigh challenges posed by e-commerce and demographic shifts. The recently raised earnings guidance and another steady dividend do reinforce the near-term catalyst of improved operational performance, but do not materially reduce exposure to tenant risk, which remains the most important short-term concern.

The upward revision of full-year earnings guidance stands out, signaling management’s confidence in recent operational gains. While this supports optimism around rental revenues and margin improvement, it does not alter the ongoing risk tied to tenant stability and retail sector disruptions.

However, keep in mind that exposure to big box retailer bankruptcies remains a risk that investors should be aware of if…

Read the full narrative on Urban Edge Properties (it's free!)

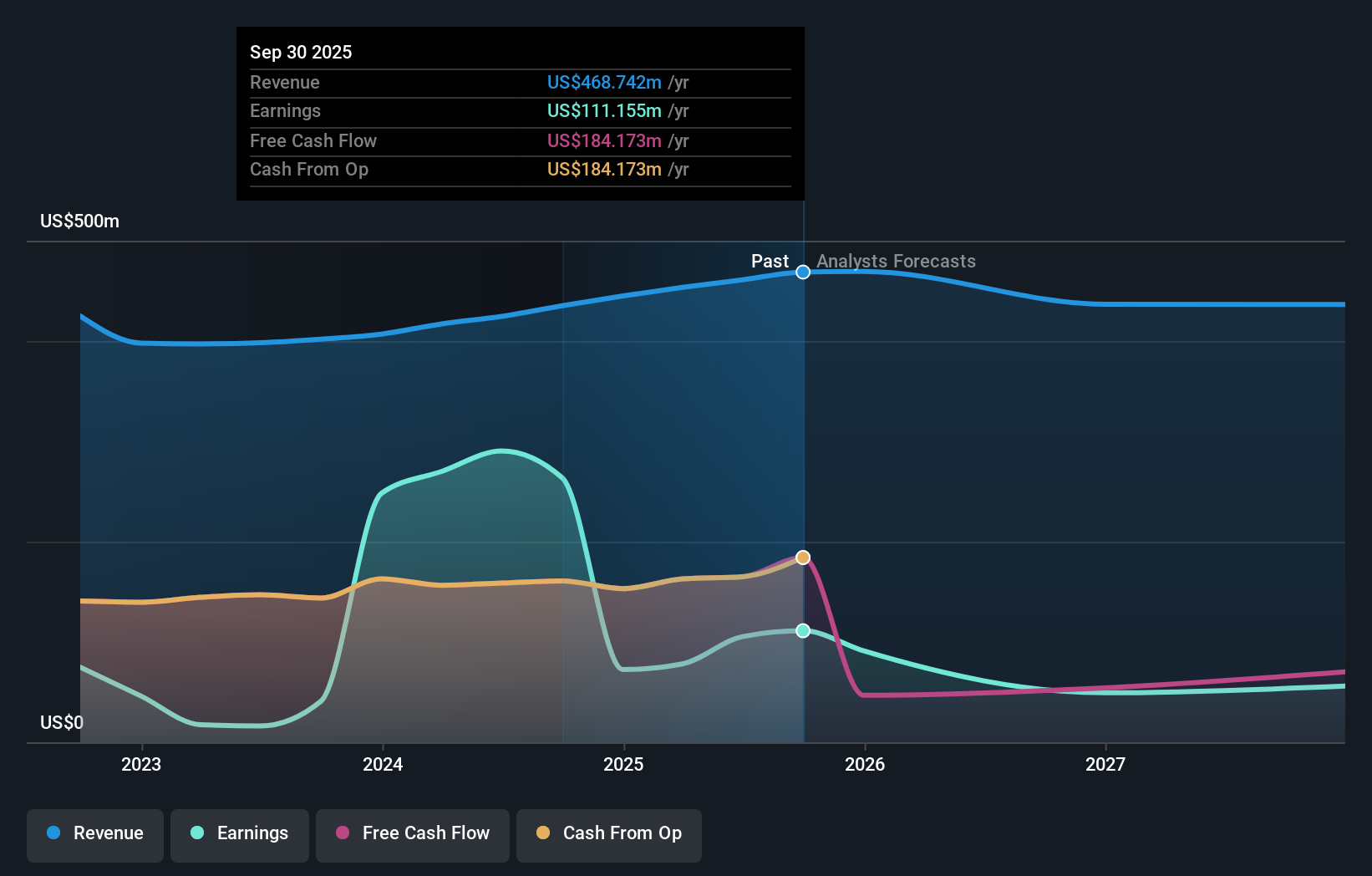

Urban Edge Properties is expected to reach $495.8 million in revenue and $36.9 million in earnings by 2028. This projection implies a 2.5% annual revenue growth rate, but a significant earnings decrease of $68.4 million from the current $105.3 million.

Uncover how Urban Edge Properties' forecasts yield a $22.80 fair value, a 19% upside to its current price.

Exploring Other Perspectives

All Simply Wall St Community fair value estimates cluster at US$22.80, with just one point of view represented. Given ongoing concerns over retail tenant stability, you are encouraged to compare multiple opinions to see how sentiment aligns or diverges.

Explore another fair value estimate on Urban Edge Properties - why the stock might be worth as much as 19% more than the current price!

Build Your Own Urban Edge Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Urban Edge Properties research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Urban Edge Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Urban Edge Properties' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UE

Urban Edge Properties

A NYSE listed real estate investment trust focused on owning, managing, acquiring, developing, and redeveloping retail real estate in urban communities, primarily in the Washington, D.C.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives