- United States

- /

- Residential REITs

- /

- NYSE:SUI

Did Major Stake Sale and Analyst Support Just Shift Sun Communities' (SUI) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent days, COHEN & STEERS, INC. reduced its holdings in Sun Communities Inc by over 5.47 million shares, while Barclays reaffirmed an "Overweight" analyst rating as the broader analyst community continues to express confidence in the company.

- This shift comes as analysts highlight ongoing margin pressures and stalled RV developments, yet still recognize improvements in Sun's financial positioning and property portfolio.

- We'll explore how COHEN & STEERS' portfolio adjustment and analyst optimism impact Sun Communities' investment case and industry outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Sun Communities Investment Narrative Recap

To remain a Sun Communities shareholder, you need to believe in long-term demand for affordable, high-quality housing and RV sites, alongside the company's ability to manage operating headwinds and adapt as organic growth channels slow. The recent reduction in COHEN & STEERS' position is not likely to affect the key near-term catalyst, ongoing cost savings and improved occupancy, but also does little to ease the biggest risk of margin pressure from operating costs and a challenged RV segment.

Against this backdrop, Sun's Q3 impairment charges totaling $165.9 million for six underperforming RV properties underscore the pressures facing its RV business. This announcement directly relates to the primary risks surfaced by current analyst debates and the implications of COHEN & STEERS' portfolio adjustment, as impairment charges highlight uncertainty around asset values and the resiliency of RV-related income streams.

Yet in contrast to analyst optimism about portfolio quality, investors should be aware of persistent cost headwinds, as...

Read the full narrative on Sun Communities (it's free!)

Sun Communities' outlook points to $2.6 billion in revenue and $550.6 million in earnings by 2028. This is based on an annual revenue decline of 6.9% and a $629.9 million increase in earnings from the current level of -$79.3 million.

Uncover how Sun Communities' forecasts yield a $139.65 fair value, a 9% upside to its current price.

Exploring Other Perspectives

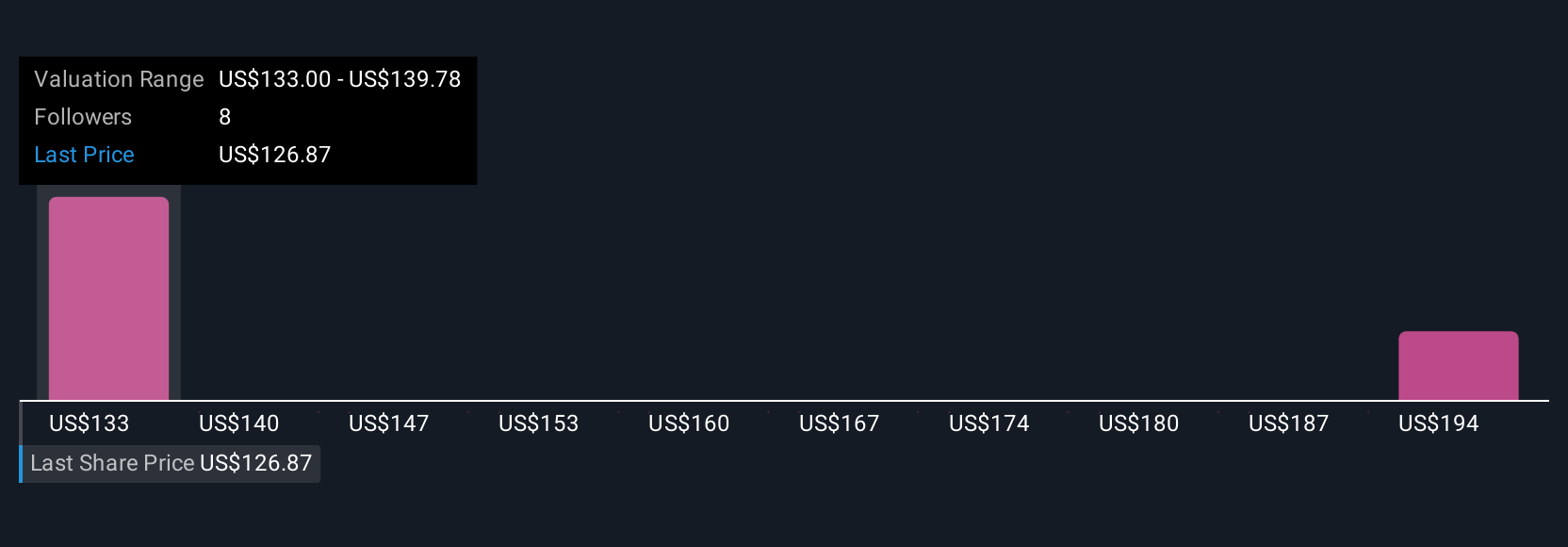

Three fair value estimates from the Simply Wall St Community span a wide range from US$133 to US$203.61 per share. Ongoing concerns about margin pressure and impaired RV assets could weigh on future performance, so consider multiple perspectives when deciding what matters most.

Explore 3 other fair value estimates on Sun Communities - why the stock might be worth as much as 58% more than the current price!

Build Your Own Sun Communities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sun Communities research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sun Communities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sun Communities' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SUI

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success