- United States

- /

- Retail REITs

- /

- NYSE:SPG

Simon Property Group (NYSE:SPG) Declines 8% After Announcing Shopify Collaboration

Reviewed by Simply Wall St

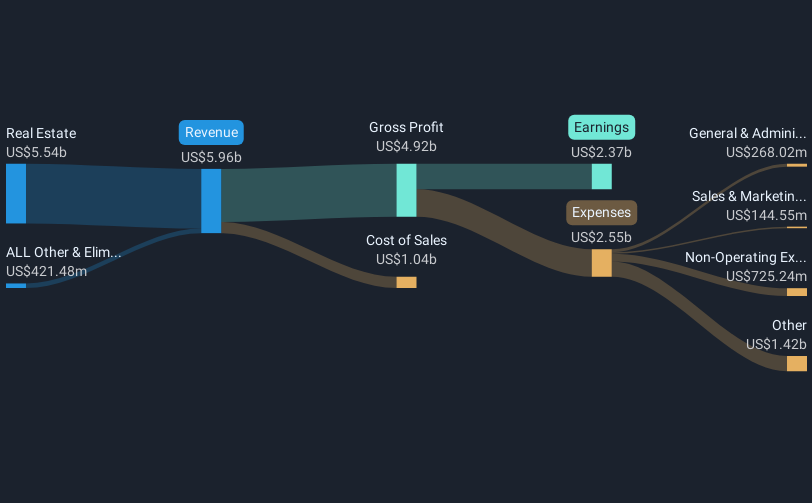

Simon Property Group (NYSE:SPG) recently announced an innovative partnership with Shopify and Leap to enhance e-commerce brand solutions, aiming to strengthen physical retail setups. Despite this forward-thinking collaboration, SPG saw a share price decline of 7.78% over the last quarter, which can partly be attributed to the broader market trends. During this period, the Dow Jones and S&P 500 experienced declines of 1.2% and 0.8%, respectively, amid increased market volatility due to tariff announcements from the Trump administration. The sluggishness in the retail sector, combined with broader economic uncertainties, likely impacted SPG's performance. Moreover, the company declared a 7.7% increase in its quarterly dividend, reflecting confidence in its financial health amid a challenging environment. While the collaboration with Shopify and Leap reflects potential growth opportunities, the immediate market reaction was overshadowed by broader concerns impacting investor sentiment.

Click here and access our complete analysis report to understand the dynamics of Simon Property Group.

Simon Property Group's shares have achieved impressive total returns of 233.36% over the past five years, a testament to its robust performance in the retail real estate sector. In comparison, over the past year, SPG outpaced both the broader US market and the Retail REITs industry, which is indicative of its competitive positioning. One factor was the strategic alliances with companies like Shopify, Leap, and Mercedes-Benz HPC North America, enhancing both e-commerce integration and customer experiences at its properties. Additionally, consistent revenue growth, despite recent dips in net income, and significant dividend increases have also bolstered investor confidence.

In the past year, despite some earnings guidance revisions and leadership changes, SPG maintained its focus on expansion, as seen with developments like the Nashville Premium Outlets slated for future construction. Although SPG's earnings growth has somewhat slowed, it remains undervalued relative to industry averages and broader market forecasts, reflecting its potential for sustained shareholder value generation amid evolving retail landscapes.

- See how Simon Property Group measures up with our analysis of its intrinsic value versus market price.

- Assess the potential risks impacting Simon Property Group's growth trajectory—explore our risk evaluation report.

- Have a stake in Simon Property Group? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPG

Simon Property Group

Simon Property Group, Inc. (NYSE:SPG) is a self-administered and self-managed real estate investment trust (“REIT”).

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives