- United States

- /

- Retail REITs

- /

- NYSE:SPG

Is Simon Property Group a Bargain After Mixed-Use Investments and Recent Price Swings in 2025?

Reviewed by Bailey Pemberton

- Curious if Simon Property Group is delivering real value for your money, or if the share price is already reflecting all the good news? Let's break down what savvy investors need to know.

- The stock has been a rollercoaster lately. It dropped 3.0% this week and 7.6% over the past month, but it is still up 7.6% in the last year and 81.6% over three years.

- Market chatter has focused on how Simon Property Group is navigating the rapidly changing retail landscape, especially following its recent investments in mixed-use developments and strategic partnerships. These moves are seen as responses to new retail trends and shifting consumer behavior, which likely fueled some of the recent price swings.

- The company scores a 4 out of 6 on our valuation checklist. This suggests it could offer solid value but may not tick every box. We'll look at what this score means using a range of valuation methods, and at the end, we'll also reveal a smarter approach to determine fair value.

Approach 1: Simon Property Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future adjusted funds from operations and then discounting those cash flows to reflect today's value. This approach gives investors an idea of what Simon Property Group may truly be worth based on ongoing and future potential for shareholder returns.

Currently, Simon Property Group generates free cash flow of roughly $4.36 billion. According to analyst estimates, this figure is expected to steadily rise, reaching about $4.85 billion by the end of 2029. Beyond that, cash flow projections continue to increase, crossing the $5.9 billion mark in 2035, as Simply Wall St extrapolates from existing trends. All projections and current cash flows are denominated in U.S. dollars.

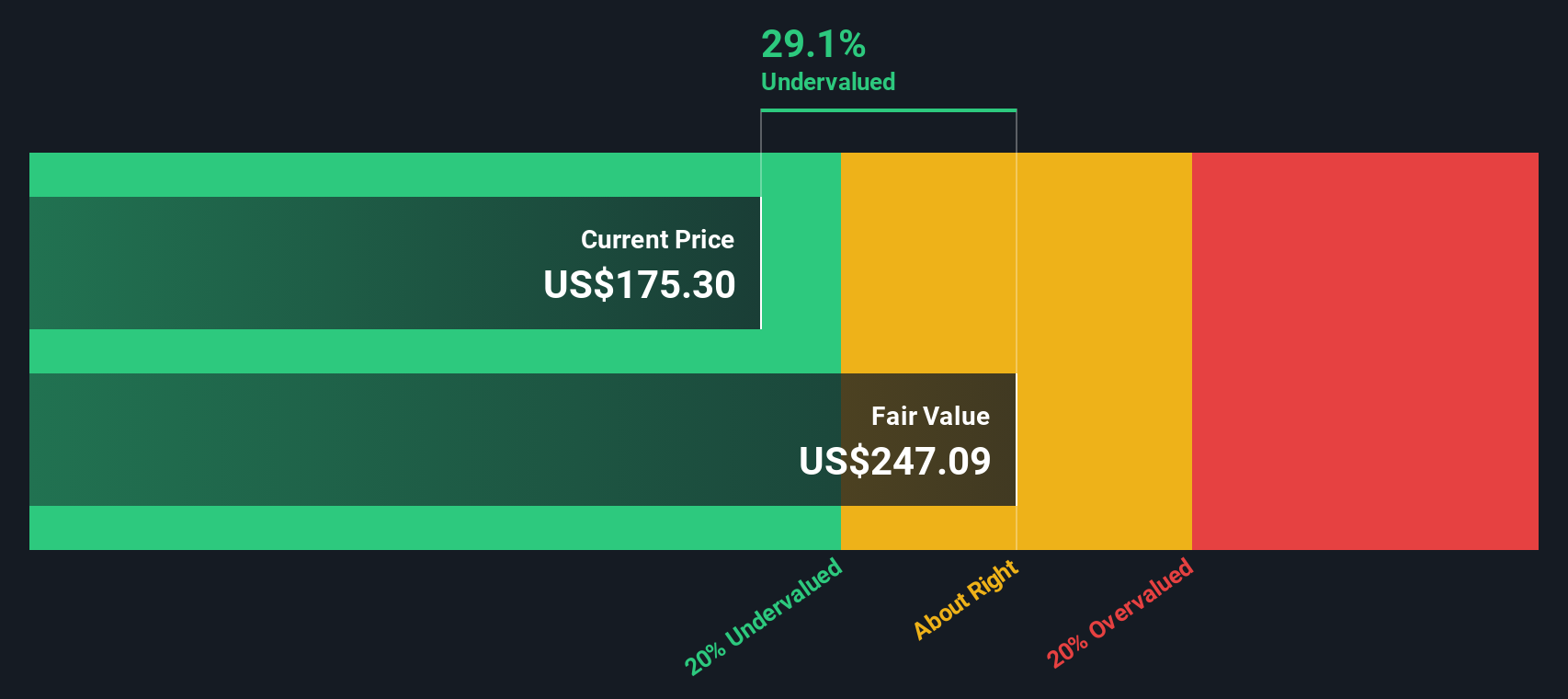

When these future cash flows are discounted back to present value, the calculated intrinsic value for Simon Property Group stock stands at $247.38 per share. This implies the stock is trading at a 29.9% discount to its fair value, suggesting the market may be underestimating the company's long-term cash generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Simon Property Group is undervalued by 29.9%. Track this in your watchlist or portfolio, or discover 851 more undervalued stocks based on cash flows.

Approach 2: Simon Property Group Price vs Earnings

The Price-to-Earnings (PE) ratio is the go-to valuation metric for profitable companies like Simon Property Group because it directly compares a company’s stock price to its per-share earnings. When a business generates consistent profits, the PE ratio quickly reveals how the market values those earnings relative to competitors and the broader industry.

A “normal” or “fair” PE ratio reflects not only the company’s current earnings but also investors’ expectations for future growth and perceived risk. Higher growth prospects or lower risk typically justify a higher PE, while slower growth or added uncertainty should see a lower multiple. This context is vital in deciding whether a stock’s current PE signals opportunity or caution.

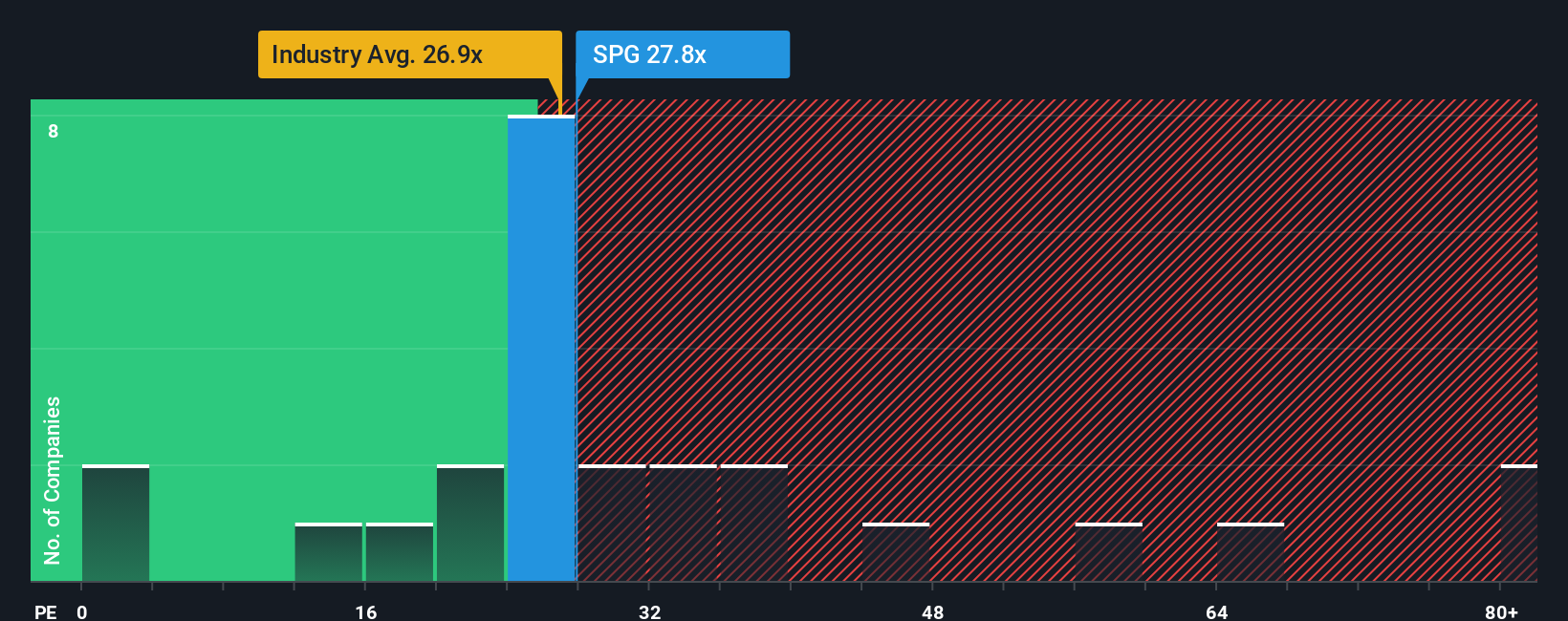

Right now, Simon Property Group trades at a PE ratio of 26.8x. This is slightly above the industry average of 26.1x for Retail REITs, yet significantly below the average among its closest peers at 34.9x. To provide a more tailored benchmark, Simply Wall St calculates a proprietary “Fair Ratio” of 35.0x for Simon Property Group. Unlike simple industry or peer comparisons, this Fair Ratio considers factors like the company’s specific mix of growth, profit margins, market cap, industry characteristics and risk profile. This gives a nuanced view of what the business truly deserves.

With Simon Property Group’s current PE well below its Fair Ratio, the shares appear undervalued by this measure. This suggests investors may not be fully appreciating the company’s underlying strengths and outlook relative to its fair value multiple.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Simon Property Group Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique story about a company, bringing together the big picture (such as Simon Property Group’s strategic moves) with your own forecasts for revenue, earnings, and profit margins to arrive at a fair value you believe is justified.

Unlike relying solely on ratios or analyst targets, Narratives connect what is happening in a business to numbers and then to an actionable “fair value,” making your investment reasoning both evidence-based and easy to share on Simply Wall St’s Community page, a tool trusted by millions of investors. With Narratives, you can decide whether to buy or sell by comparing your Fair Value (grounded in your assumptions) to the current Price. Narratives stay up-to-date automatically whenever new information, news, or earnings are released.

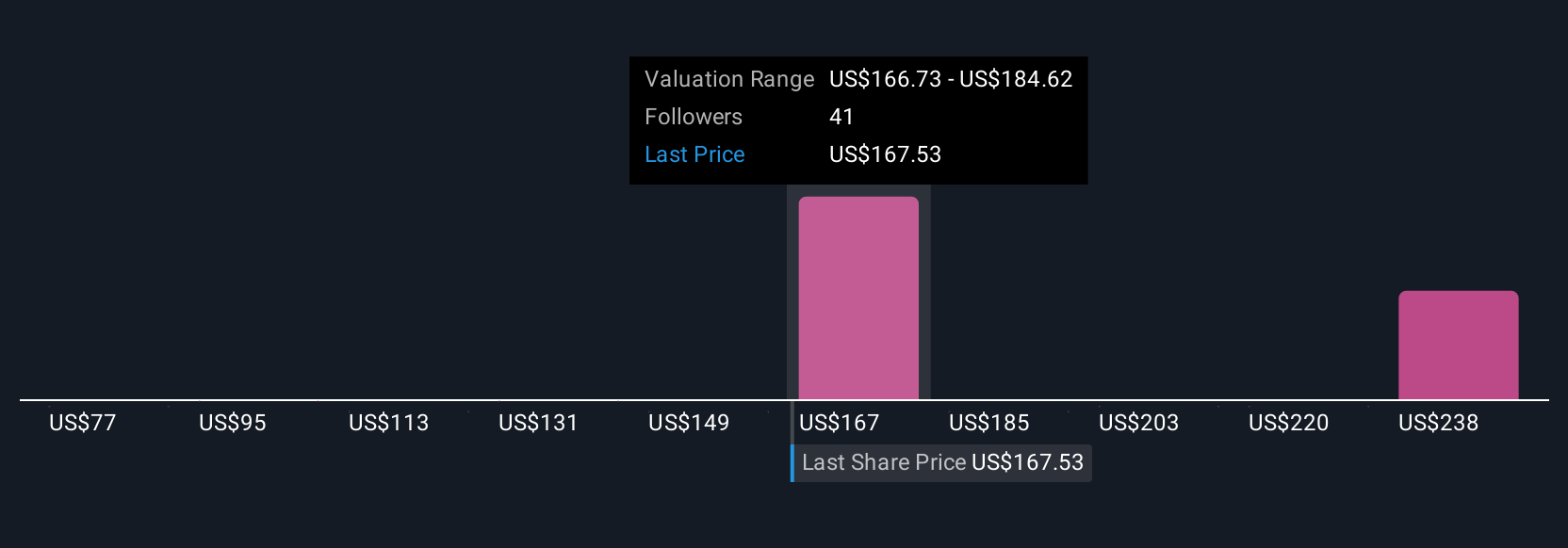

For example, in the Community, some investors see Simon Property Group’s premium locations and redevelopment success driving future earnings and price targets as high as $225.0, while others focus on retail headwinds or rising costs and estimate values as low as $169.0. This demonstrates how Narratives help you back up your view (whether it is bullish or cautious) with data-driven logic tailored to your research.

Do you think there's more to the story for Simon Property Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPG

Simon Property Group

Simon Property Group, Inc. (NYSE:SPG) is a self-administered and self-managed real estate investment trust (“REIT”).

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives