- United States

- /

- Specialized REITs

- /

- NYSE:SMA

SmartStop Self Storage REIT (SMA): Examining Current Valuation Following Recent Growth Slowdown

Reviewed by Simply Wall St

See our latest analysis for SmartStop Self Storage REIT.

After a run of double-digit annual revenue growth, SmartStop Self Storage REIT has seen its momentum cool a bit, with a 30-day share price return of -8.1% and year-to-date performance hovering just below flat. Despite this, the stock’s steady fundamentals suggest investors are watching for signs of renewed upside or shifting risk appetite.

If you’re curious about what else could be gaining traction, now is a good moment to see which companies are catching investor attention via our fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst price targets, investors are left to ask: Is SmartStop currently undervalued, or is the market already accounting for all future growth potential?

Price-to-Sales of 10.3x: Is it justified?

SmartStop Self Storage REIT is currently trading at a price-to-sales ratio of 10.3x, well above both industry and peer averages, even as shares sit below analyst targets. At yesterday’s close of $32.71, investors are paying a considerable premium compared to other specialized REITs in the market.

The price-to-sales (P/S) ratio measures how much investors are paying for each dollar of the company’s revenue. In real estate, where profits may fluctuate due to factors like property values and interest rates, the P/S ratio offers insight into how revenue generation is being valued relative to other business models in the sector. Here, a higher-than-average P/S could signal the market is rewarding recurring growth or, conversely, overlooking near-term losses in hope of a future turnaround.

Compared to the US Specialized REITs industry average of 7.1x and a peer average of 5.8x, SmartStop’s valuation stands out as especially expensive. Even relative to the estimated fair P/S ratio of 4.7x, the current level is stretched, setting a high bar if fundamentals or growth forecasts do not accelerate.

Explore the SWS fair ratio for SmartStop Self Storage REIT

Result: Price-to-Sales of 10.3x (OVERVALUED)

However, ongoing net losses and the steep valuation could pressure shares further if growth or profitability does not improve in the near term.

Find out about the key risks to this SmartStop Self Storage REIT narrative.

Another View: Discounted Cash Flow Suggests Upside

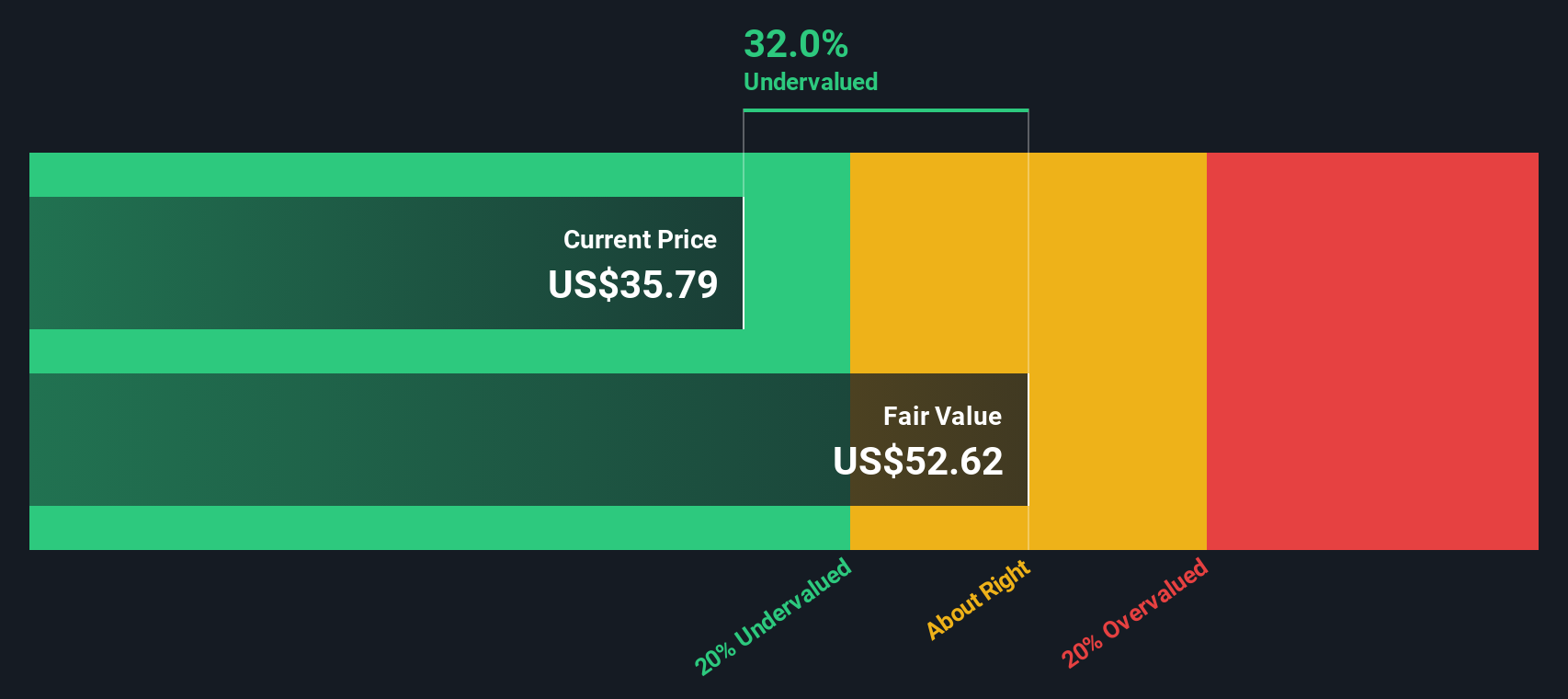

While SmartStop Self Storage REIT looks expensive when measured by price-to-sales, our DCF model tells a different story. It puts fair value at $53.60 per share, which is nearly 39% above the current price. Could the market be overlooking deeper long-term value here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SmartStop Self Storage REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SmartStop Self Storage REIT Narrative

If you want to dig into the details firsthand or have your own take on SmartStop Self Storage REIT, you can craft a personalized analysis in just a few minutes. Do it your way

A great starting point for your SmartStop Self Storage REIT research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

If you want a fresh angle on potential winners, now is the time to check out strategies others are using to profit in today’s market. Don’t leave opportunities on the table. These handpicked lists could spark your next great idea.

- Catch industry-changing innovation in medicine when you evaluate the newest leaders in artificial intelligence-powered healthcare companies via these 31 healthcare AI stocks.

- Power up your returns by targeting reliable yield. Scan these 16 dividend stocks with yields > 3% with payouts above 3% to bring steady income into your portfolio.

- Capitalize on trending breakthroughs and market buzz by tapping into these 25 AI penny stocks making headlines in the world of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMA

SmartStop Self Storage REIT

SmartStop Self Storage REIT, Inc. (“SmartStop”) (NYSE: SMA) is a self-managed REIT with a fully integrated operations team of more than 1,000 self-storage professionals focused on growing the SmartStop Self Storage brand.

Fair value with moderate growth potential.

Market Insights

Community Narratives