- United States

- /

- Specialized REITs

- /

- NYSE:SMA

Is SmartStop Self Storage a Compelling Opportunity After Recent Price Dip in 2025?

Reviewed by Bailey Pemberton

If you have been eyeing SmartStop Self Storage REIT lately and wondering what your next move should be, you are certainly not alone. The stock recently closed at $35.94, and while it is up an impressive 9.7% year-to-date, the last month has seen some pullback with a 3.7% decline and a similar 3.5% dip just last week. These short-term moves may reflect not just shifting market sentiment but also investors reassessing risk and growth prospects as the broader real estate sector evolves. For long-term holders or new investors alike, questions about valuation remain top of mind, especially as the self-storage space adapts to changing consumer and commercial needs.

When we dig into how undervalued or overvalued SmartStop appears by conventional standards, the company holds a solid value score of 3 out of a possible 6. That means it passes half of the key undervaluation checks analysts typically rely on. But, as with most things in investing, a number only tells part of the story.

So how do these valuation methods stack up, and can they provide concrete guidance for your decision on SmartStop Self Storage REIT? Next, we will break down the main approaches that contribute to the value score. Later, we will explore an even more effective way to size up the company’s true worth.

Approach 1: SmartStop Self Storage REIT Discounted Cash Flow (DCF) Analysis

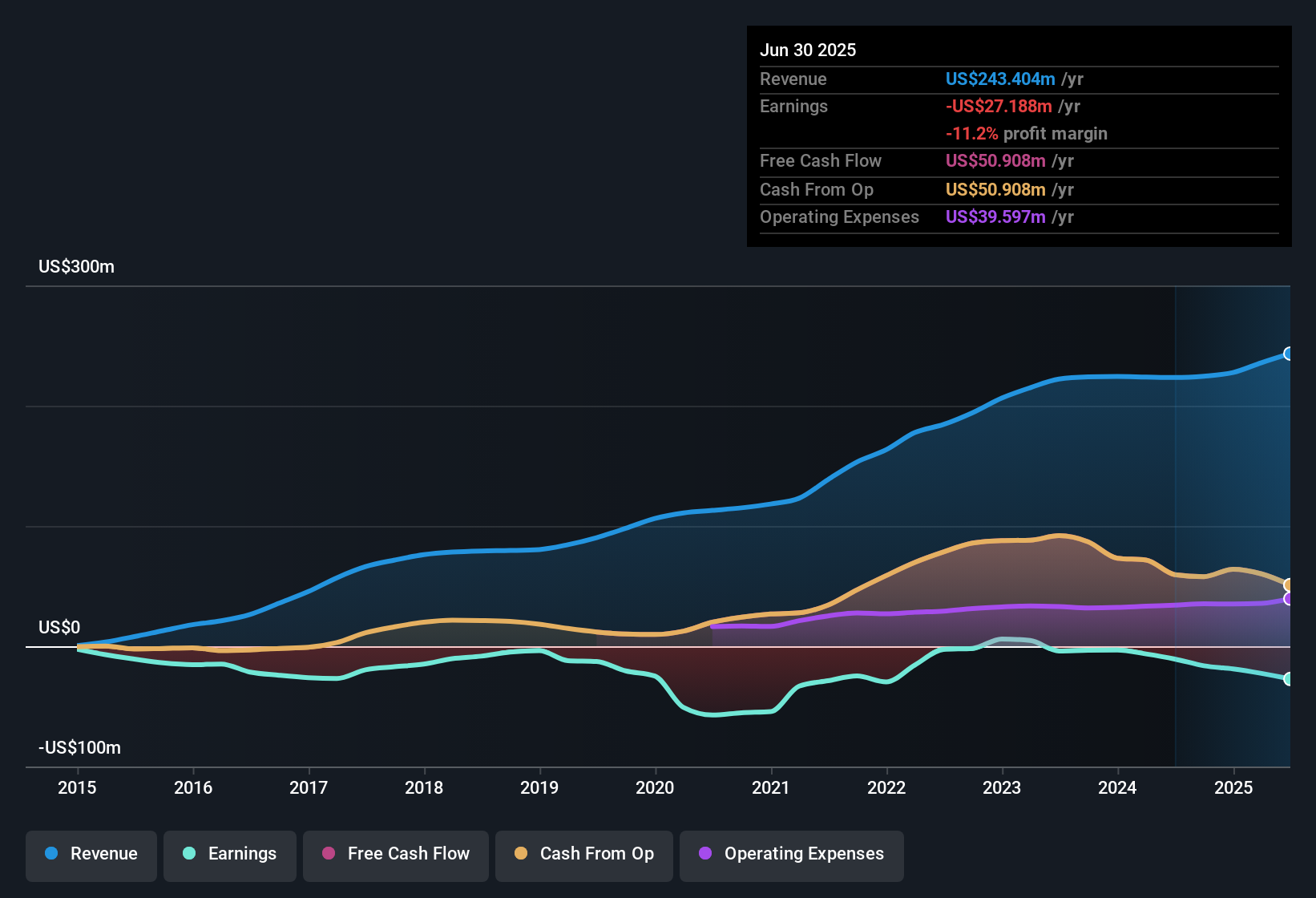

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows, adjusting those figures for how much money is worth today, and then combining them to arrive at a fair value. For SmartStop Self Storage REIT, this process focuses on “adjusted funds from operations,” which accounts for the company’s ongoing free cash flow to equity holders.

Currently, SmartStop generated $46.81 million in free cash flow over the last twelve months. Analyst forecasts extend out for five years, with projected free cash flow reaching $158.5 million by 2029. Beyond this, further projections provided by Simply Wall St see incremental growth each year through 2035. All cash flows are considered in US dollars.

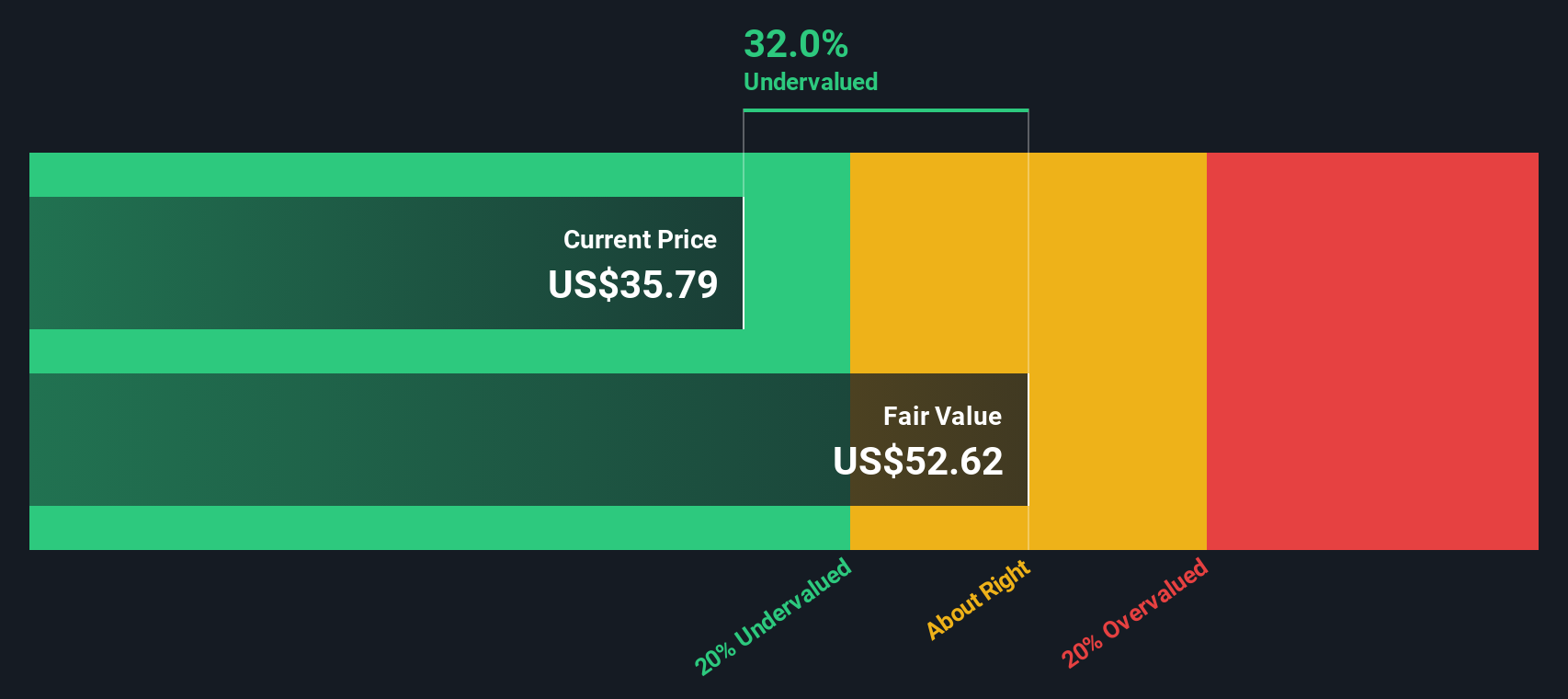

Based on these projections and after discounting those future cash flows back to today’s value, the DCF model calculates an intrinsic fair value of $52.80 per share. With SmartStop’s stock trading at $35.94, this implies the shares are currently trading at a 31.9% discount to their intrinsic value, according to the model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SmartStop Self Storage REIT is undervalued by 31.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: SmartStop Self Storage REIT Price vs Sales

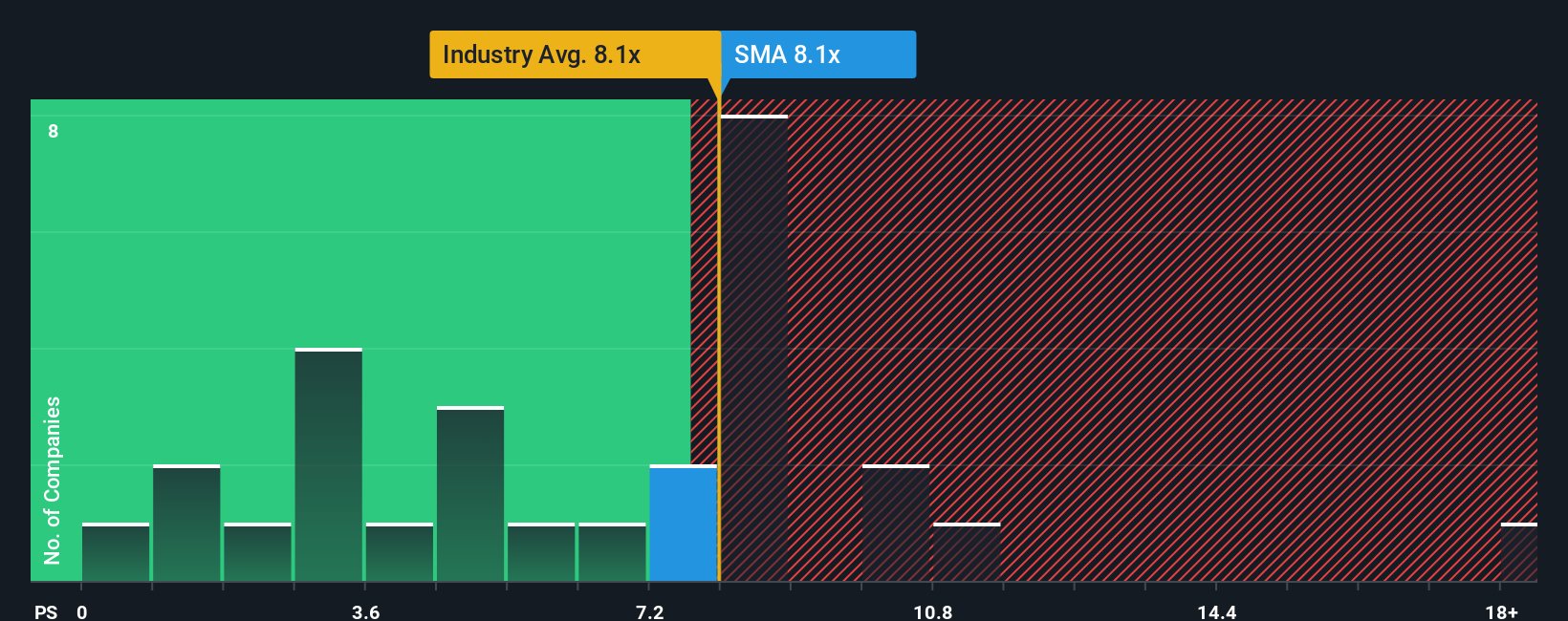

For companies where profitability may fluctuate or earnings can be affected by non-cash factors, the Price-to-Sales (P/S) ratio is often a preferred valuation multiple. It allows investors to gauge how much they are paying for each dollar of revenue, making it particularly useful for analyzing REITs like SmartStop Self Storage that can experience earnings volatility due to sector cycles or accounting treatments.

Growth expectations and perceived risk both play a role in determining what a "normal" or "fair" P/S ratio should be. High-growth companies or those with steady, recurring revenues typically command higher multiples. Elevated risk tends to push multiples lower.

Currently, SmartStop trades at a P/S ratio of 8.19x. This is closely aligned with the Specialized REITs industry average of 8.19x, but a bit above the peer group average of 6.25x. However, comparing raw multiples with broad benchmarks or peers can miss important nuances unique to each business.

This is where Simply Wall St's Fair Ratio comes in. The Fair Ratio, which is calculated to reflect factors such as growth prospects, profit margins, industry, company size, and risks, estimates that SmartStop’s appropriate P/S ratio should be around 4.81x. Because this model incorporates specific company characteristics, it gives a more tailored view than industry or peer averages alone.

Comparing the Fair Ratio (4.81x) to SmartStop’s current P/S multiple (8.19x) indicates the stock is trading above its model-derived fair value. This suggests investors are paying a significant premium for the shares at current levels.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SmartStop Self Storage REIT Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple and dynamic way to tell your story about a company, combining your own perspective on SmartStop Self Storage REIT with the hard numbers, like expected future revenue, profit margins, and a personally-calculated fair value.

Narratives connect what is happening in the business to your financial forecast, creating a clear path from your assumptions to an actionable estimate of fair value. Available right on Simply Wall St’s Community page, millions of investors already use Narratives as an accessible tool to frame their decisions.

They make choosing when to buy or sell easier by letting you compare your own Fair Value to the market price. Since Narratives update automatically when new news or earnings come in, you always have up-to-date insights. For example, some SmartStop REIT investors see strong future growth and set their fair value well above the current price, while others, expecting tougher times ahead, value it much lower. By creating and comparing Narratives, you can see different views and make investment decisions based on your own story and latest data.

Do you think there's more to the story for SmartStop Self Storage REIT? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMA

SmartStop Self Storage REIT

SmartStop Self Storage REIT, Inc. (“SmartStop”) (NYSE: SMA) is a self-managed REIT with a fully integrated operations team of more than 1,000 self-storage professionals focused on growing the SmartStop Self Storage brand.

Undervalued with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion