- United States

- /

- Retail REITs

- /

- NYSE:SKT

Tanger (SKT): Reassessing Valuation After Citi Downgrade and Evolving Analyst Expectations

Reviewed by Simply Wall St

This week, Tanger (SKT) appeared on investors’ radar after a leading Citi analyst shifted their stance from buy to hold. This change reflects a reevaluation of the company’s performance expectations in the near term.

See our latest analysis for Tanger.

While news of the downgrade made some waves, Tanger’s stock has held relatively steady, closing at $32.87 recently. Despite a muted year-to-date share price return, the company’s long-term story stands out. The three-year total shareholder return is above 90%, and the five-year number is even more impressive at 309%, reflecting confidence in its long-term potential even as short-term sentiment shifts.

If shifting outlooks have you looking for your next idea, why not see what turns up with our fast growing stocks with high insider ownership?

With the recent downgrade and muted share price movement, the big question now is whether Tanger’s current valuation still leaves room for upside, or if the market has already priced in all foreseeable growth.

Most Popular Narrative: 9.6% Undervalued

At $32.87, Tanger’s last close still sits noticeably below the most widely followed narrative’s fair value of $36.36. This suggests potential for further upside as long as key trends hold. Investors are watching whether steady earnings gains and updated sector forecasts can continue to translate into share price momentum.

*Limited new outlet retail supply, due to development constraints nationwide, makes existing high-performing centers increasingly valuable. This scarcity strengthens Tanger's bargaining position on lease terms and rental rate increases, positively impacting future base rents and earnings.*

Want to unlock the assumptions powering this valuation? One bold growth projection and an ambitious profit outlook combine to shape the story. Discover what market-shifting financial forecasts support this target and what could potentially make it reality.

Result: Fair Value of $36.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a persistent shift toward e-commerce or changes in leasing stability could quickly reverse Tanger’s positive momentum and put pressure on future earnings growth.

Find out about the key risks to this Tanger narrative.

Another View: Multiples Send a Caution Signal

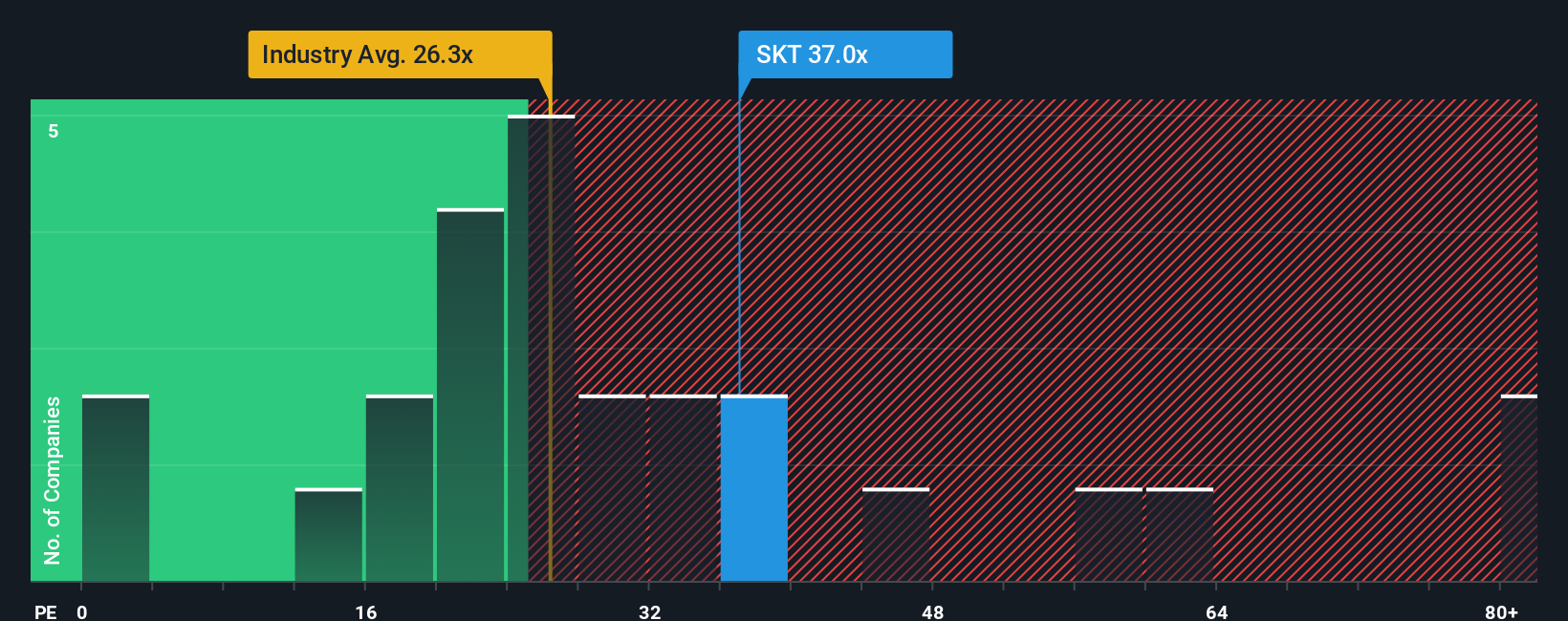

Looking at valuation through the lens of our price-to-earnings comparison, Tanger appears expensive relative to both its industry and its fair ratio. With a P/E of 35.4x, it is well above the US Retail REITs average of 26.7x and even its own fair ratio of 34.8x, signaling limited margin for upside. Does this suggest investors are banking on robust future momentum, or are risks being underestimated?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tanger Narrative

If you have a different perspective or want to interpret the numbers yourself, you can craft your own narrative from scratch in just a few minutes. Do it your way.

A great starting point for your Tanger research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let great opportunities pass you by. Give yourself an edge and uncover new stocks that fit your investment strategy with these hand-picked ideas:

- Boost your income and prioritize steady returns, starting with these 16 dividend stocks with yields > 3% offering yields above 3%.

- Capitalize on innovation by exploring these 25 AI penny stocks, where emerging leaders are at the forefront of artificial intelligence breakthroughs.

- Tap the upside by screening for value with these 925 undervalued stocks based on cash flows that have strong underlying cash flows yet remain attractively priced by the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tanger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SKT

Tanger

Tanger Inc. (NYSE: SKT) is a leading owner and operator of outlet and open-air retail shopping destinations, with over 44 years of expertise in the retail and outlet shopping industries.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives