- United States

- /

- Health Care REITs

- /

- NYSE:SILA

Sila Realty Trust (SILA): Exploring Valuation Following a Period of Muted Trading

Reviewed by Kshitija Bhandaru

See our latest analysis for Sila Realty Trust.

Sila Realty Trust’s share price has seen only minor moves in recent weeks. However, when you widen the lens to the one-year mark, total shareholder return turns positive. This suggests investors are growing cautiously optimistic about potential upside despite a recent stretch of muted trading.

If you’re wondering where else momentum could be building, now is the perfect time to broaden your view and discover fast growing stocks with high insider ownership

With shares trading well below analyst targets and recent financials showing solid growth, the question remains: is Sila Realty Trust undervalued right now, or have investors already factored in its future prospects?

Most Popular Narrative: 19.2% Undervalued

Compared to the most widely followed narrative, Sila Realty Trust's fair value is positioned well above the latest share price. This creates an opportunity to examine the factors driving the valuation gap.

The continued expansion of outpatient and specialty care, as evidenced by recent acquisitions of high-utilization, specialized medical facilities and ambulatory surgery centers, positions Sila to capture demand as more procedures shift from traditional hospitals to outpatient settings. This shift could drive incremental rental income and portfolio yield.

Want to understand why this narrative is so bullish? One assumption stands out: the future earnings profile depends on bold growth in high-demand healthcare assets and a profit multiple that rivals industry averages. Curious about the aggressive forecasts and the strategic moves that power this fair value? The full narrative breaks down the projections driving the story.

Result: Fair Value of $29.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising interest expenses or unexpected tenant bankruptcies could quickly undermine Sila Realty Trust's positive outlook and put future earnings growth under pressure.

Find out about the key risks to this Sila Realty Trust narrative.

Another View: What Do the Multiples Say?

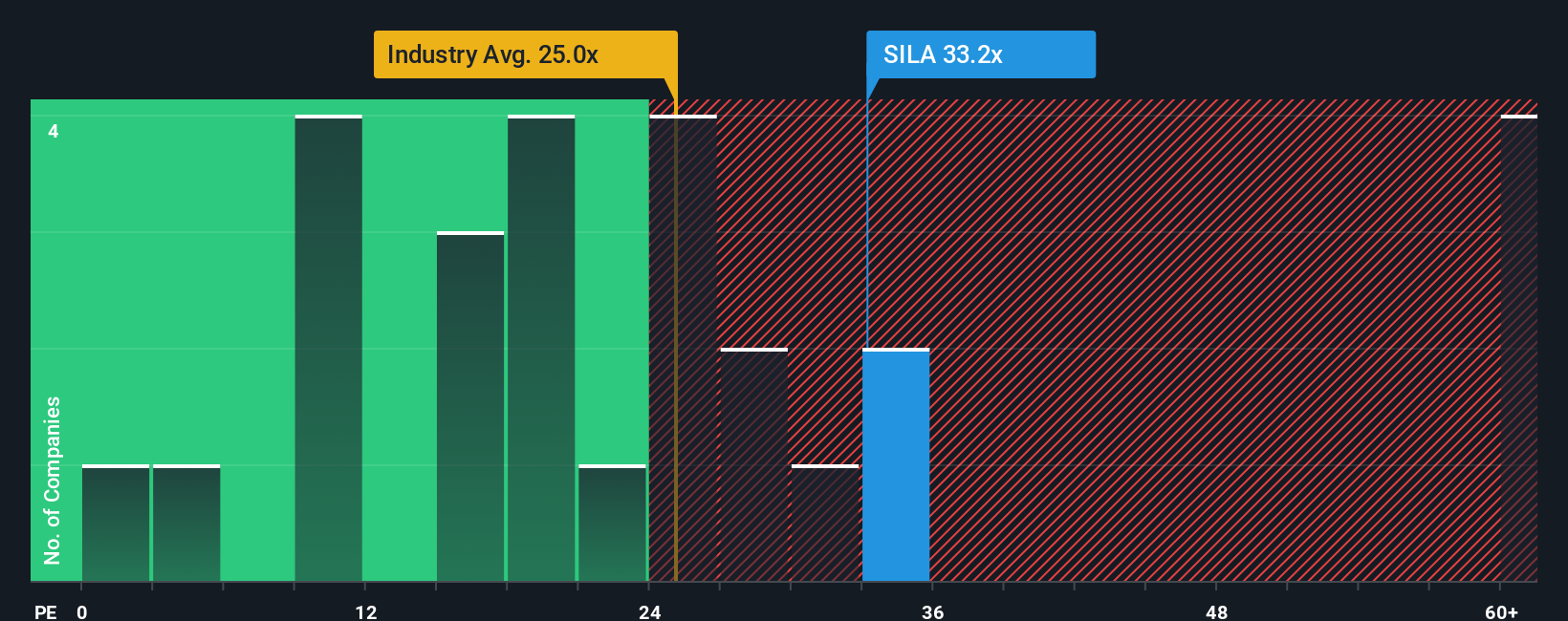

For a different angle, let's look at how Sila Realty Trust trades compared to its peers. Its price-to-earnings ratio of 33.4x is above the global Health Care REITs industry average of 24.3x but below the peer average of 42.5x. Interestingly, it sits just under the estimated fair ratio of 35.7x, suggesting that while the shares appear pricey relative to the industry, the market might be willing to pay up for its earnings.

Numbers can tell conflicting stories about value. Find out in our valuation breakdown: See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sila Realty Trust Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own narrative in just a few minutes, and Do it your way.

A great starting point for your Sila Realty Trust research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now to uncover exceptional opportunities. The right stock can make all the difference, so let Simply Wall Street’s curated ideas guide your next move.

- Uncover hidden potential by reviewing these 892 undervalued stocks based on cash flows, where market gems are priced below their true worth and waiting for recognition.

- Accelerate your returns by targeting growth with these 25 AI penny stocks, a list of innovative companies harnessing artificial intelligence to lead their sectors.

- Boost your income stream when you tap into these 19 dividend stocks with yields > 3%, which highlights opportunities with attractive yields above 3 percent to help strengthen your portfolio for the future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SILA

Sila Realty Trust

Sila Realty Trust, Inc., headquartered in Tampa, Florida, is a net lease real estate investment trust with a strategic focus on investing in the growing and resilient healthcare sector.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives