- United States

- /

- Health Care REITs

- /

- NYSE:SILA

Sila Realty Trust: Exploring Valuation After Q3 Earnings and New Dividend Announcement

Reviewed by Simply Wall St

Sila Realty Trust just shared its third-quarter earnings, reporting higher revenue than last year along with a modest dip in net income. The company also announced a new quarterly cash dividend of $0.40 per share.

See our latest analysis for Sila Realty Trust.

After a steady stream of updates from the company, Sila Realty Trust’s share price has drifted slightly lower, with a 1-year total shareholder return of -0.5%. While earnings and dividends continue to make headlines, recent price momentum suggests investor enthusiasm is muted for now.

If you’re weighing your next move beyond Sila Realty Trust, now is a great time to expand your search and discover fast growing stocks with high insider ownership

With shares trading below analyst price targets, investors may wonder whether the recent pullback has created a genuine buying opportunity or if the market is already factoring in all of Sila Realty Trust’s future growth prospects.

Most Popular Narrative: 20.7% Undervalued

With Sila Realty Trust’s most followed narrative assigning a fair value of $29.62, there is a notable gap compared to the last close at $23.50. This sets the scene for a story of potential upside, hinging on the REIT’s growth engines and strategic moves profiled in the consensus narrative.

Sila's disciplined portfolio pruning, exemplified by the demolition and redevelopment plans for underperforming assets such as Stoughton, should reduce expense leakage and free up capital for reinvestment in higher-yield properties. This can enable margin expansion and earnings growth.

Curious why analysts believe Sila’s real strength comes from reinvesting in the right properties at the right time? The full narrative reveals the key growth assumptions, carefully balanced earnings forecasts, and a bold profit multiple that have pushed the fair value higher. If you want to uncover the numbers driving this valuation, don’t miss what’s behind the headline figure.

Result: Fair Value of $29.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising interest expenses or tenant distress could disrupt Sila Realty Trust’s expected growth and present real challenges to the bullish narrative.

Find out about the key risks to this Sila Realty Trust narrative.

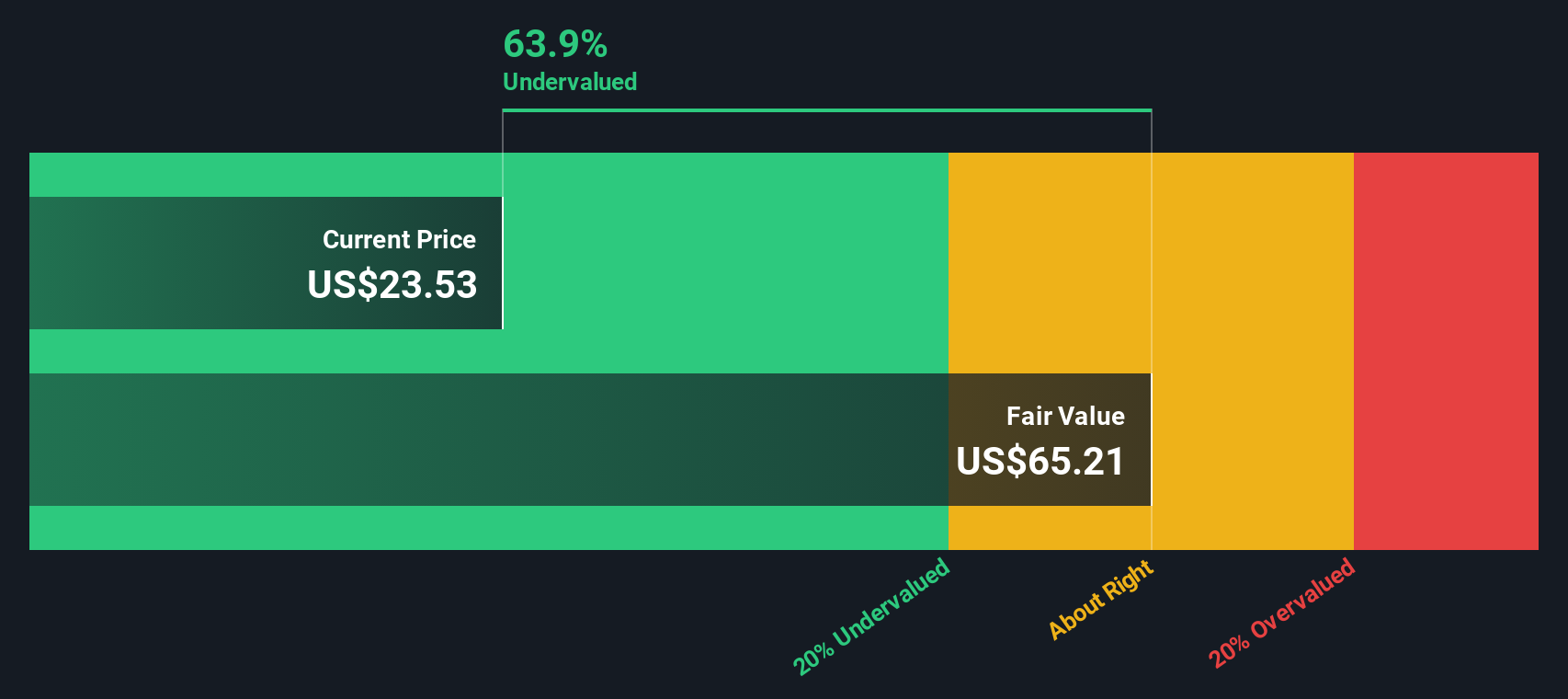

Another View: Our DCF Model Paints a Different Picture

While the market-based valuation focuses on current earnings multiples, the SWS DCF model estimates Sila Realty Trust’s fair value at $64.07, which is far above its recent trading price. This suggests a significantly undervalued stock and raises the question of whether the market may be overlooking the company’s long-term cash flow potential.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sila Realty Trust Narrative

If you see the story differently or want to dig into the data yourself, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your Sila Realty Trust research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Serious investors never settle for a single opportunity. There are countless smart ways to put your capital to work right now. Get ahead of the curve and see what’s possible when you broaden your horizons with Simply Wall St's premium tools.

- Benefit from consistent income and growth by selecting these 18 dividend stocks with yields > 3%, featuring outstanding yields above 3%.

- Capitalize on innovations in the healthcare sector by analyzing these 31 healthcare AI stocks where cutting-edge medical technology meets artificial intelligence.

- Stay ahead of disruptive trends by tapping into these 82 cryptocurrency and blockchain stocks and pinpointing companies building the future of digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SILA

Sila Realty Trust

Sila Realty Trust, Inc., headquartered in Tampa, Florida, is a net lease real estate investment trust with a strategic focus on investing in the growing and resilient healthcare sector.

Solid track record average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success