- United States

- /

- Health Care REITs

- /

- NYSE:SILA

How Investors May Respond To Sila Realty Trust (SILA) Reaffirming Dividend Amid Stable Earnings and Revenue

Reviewed by Sasha Jovanovic

- On November 3, 2025, Sila Realty Trust's Board approved a quarterly cash dividend of US$0.40 per share payable on December 4, 2025, and reported third quarter results with US$49.85 million in revenue and US$0.21 in diluted earnings per share from continuing operations, consistent with last year.

- A key insight is that Sila Realty Trust continues to show modest revenue growth alongside sustained earnings, while maintaining its dividend payout.

- We'll explore how reaffirming a US$0.40 dividend per share amid steady quarterly earnings shapes Sila Realty Trust's long-term investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Sila Realty Trust Investment Narrative Recap

To be a shareholder in Sila Realty Trust, you need confidence in the long-term demand for healthcare real estate, stable rent escalators, and the company's ability to maintain both occupancy and predictable dividends. The recent quarterly dividend affirmation and solid third quarter results offer little new information that would materially shift short-term catalysts such as continued outpatient facility growth, nor do they address the primary risk of rising interest expenses that could pressure margins if rates stay elevated.

Among recent announcements, Sila’s acquisition of two rehabilitation facilities in September for US$70.3 million stands out, supporting its catalyst of capturing healthcare demand in growing markets. This transaction ties directly into long-term revenue and margin stability, reinforcing the themes of patient demographic tailwinds and accretive portfolio expansion discussed around the latest earnings release.

Yet, in contrast to stable earnings and dividends, investors should be mindful of the continued risk posed by elevated interest expenses if...

Read the full narrative on Sila Realty Trust (it's free!)

Sila Realty Trust's outlook projects $243.6 million in revenue and $54.7 million in earnings by 2028. This assumes annual revenue growth of 8.7% and an earnings increase of $15.2 million from current earnings of $39.5 million.

Uncover how Sila Realty Trust's forecasts yield a $29.62 fair value, a 26% upside to its current price.

Exploring Other Perspectives

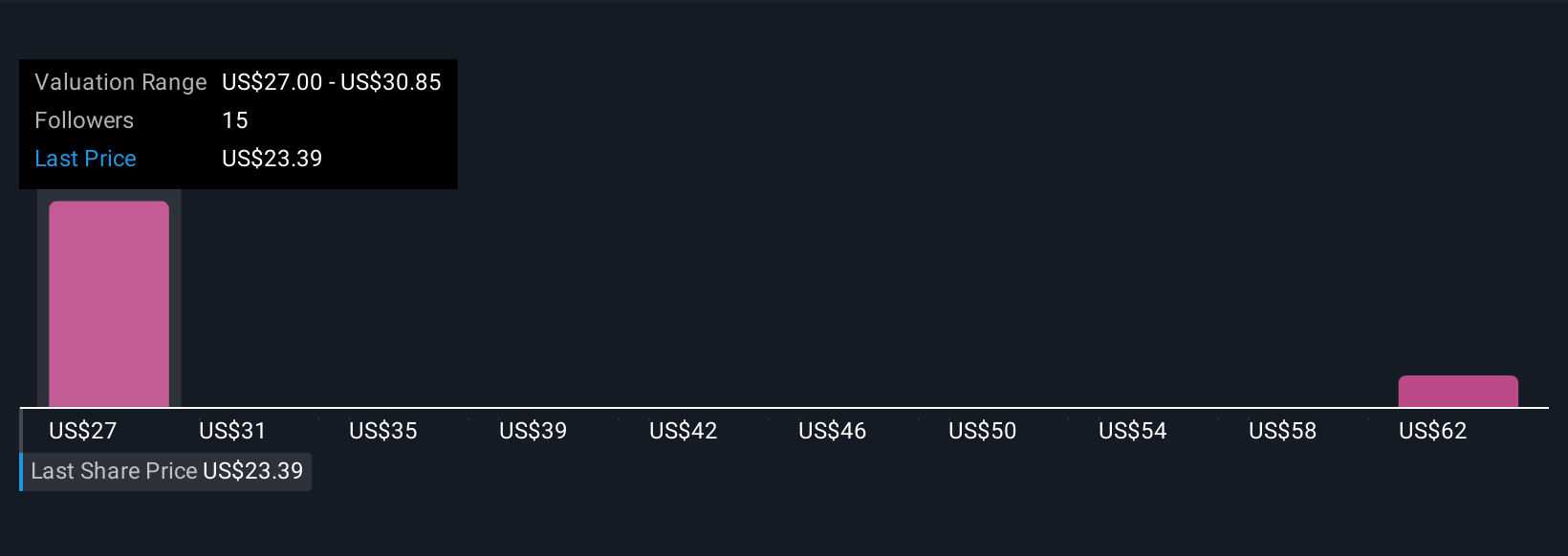

Three separate fair value estimates from the Simply Wall St Community span from US$27 to over US$65 per share. While many see upside, persistent concerns about margin pressure from higher interest costs remain an important consideration for the company’s future cash flow and dividend outlook.

Explore 3 other fair value estimates on Sila Realty Trust - why the stock might be worth just $27.00!

Build Your Own Sila Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sila Realty Trust research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sila Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sila Realty Trust's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SILA

Sila Realty Trust

Sila Realty Trust, Inc., headquartered in Tampa, Florida, is a net lease real estate investment trust with a strategic focus on investing in the growing and resilient healthcare sector.

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives