- United States

- /

- Hotel and Resort REITs

- /

- NYSE:SHO

Sunstone Hotel Investors (SHO): Evaluating Valuation Following Upscale Property Expansions and International Travel Push

Reviewed by Simply Wall St

Sunstone Hotel Investors (NYSE:SHO) is making moves with new investments in high-end properties across popular U.S. destinations. By targeting international travelers and working with major airlines, the company is aiming to capitalize on renewed tourism momentum.

See our latest analysis for Sunstone Hotel Investors.

With Sunstone targeting international travelers and expanding in sought-after destinations, investors have been watching for signs of a turnaround. After a challenging year-to-date share price return of -21.89%, momentum recently showed a modest uptick with a 1.56% gain over the last 90 days. The 1-year total shareholder return remains at -8.52%.

If Sunstone’s premium pivot sparks your curiosity, now’s a compelling moment to discover fast growing stocks with high insider ownership.

With its shares still trading below analyst price targets and expansion strategies gaining steam, is Sunstone Hotel Investors undervalued at current levels, or are investors already factoring in all the upside from its growth plans?

Most Popular Narrative: 5.6% Undervalued

Sunstone Hotel Investors closed at $9.10, while the most followed narrative sets fair value at $9.64. This creates a small gap that could catch investors’ eyes. How does the narrative justify this edge? Here’s a direct quote from its central driver.

The company's renovated, high-end urban and resort properties in locations like Miami Beach, Wailea, and Wine Country are beginning to see stronger transient and group booking trends, particularly from luxury and experiential travelers, supporting potential acceleration in RevPAR and revenue growth through 2026.

Want to peek at the hidden engine behind this premium valuation? This narrative is built on bold revenue and profit growth plus margin jumps that most would not expect from a REIT. The assumptions are anything but typical. Uncover the surprising financial leap that makes this valuation possible.

Result: Fair Value of $9.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent softness in key markets or delays with renovated assets could threaten Sunstone’s earnings recovery and challenge the bullish outlook.

Find out about the key risks to this Sunstone Hotel Investors narrative.

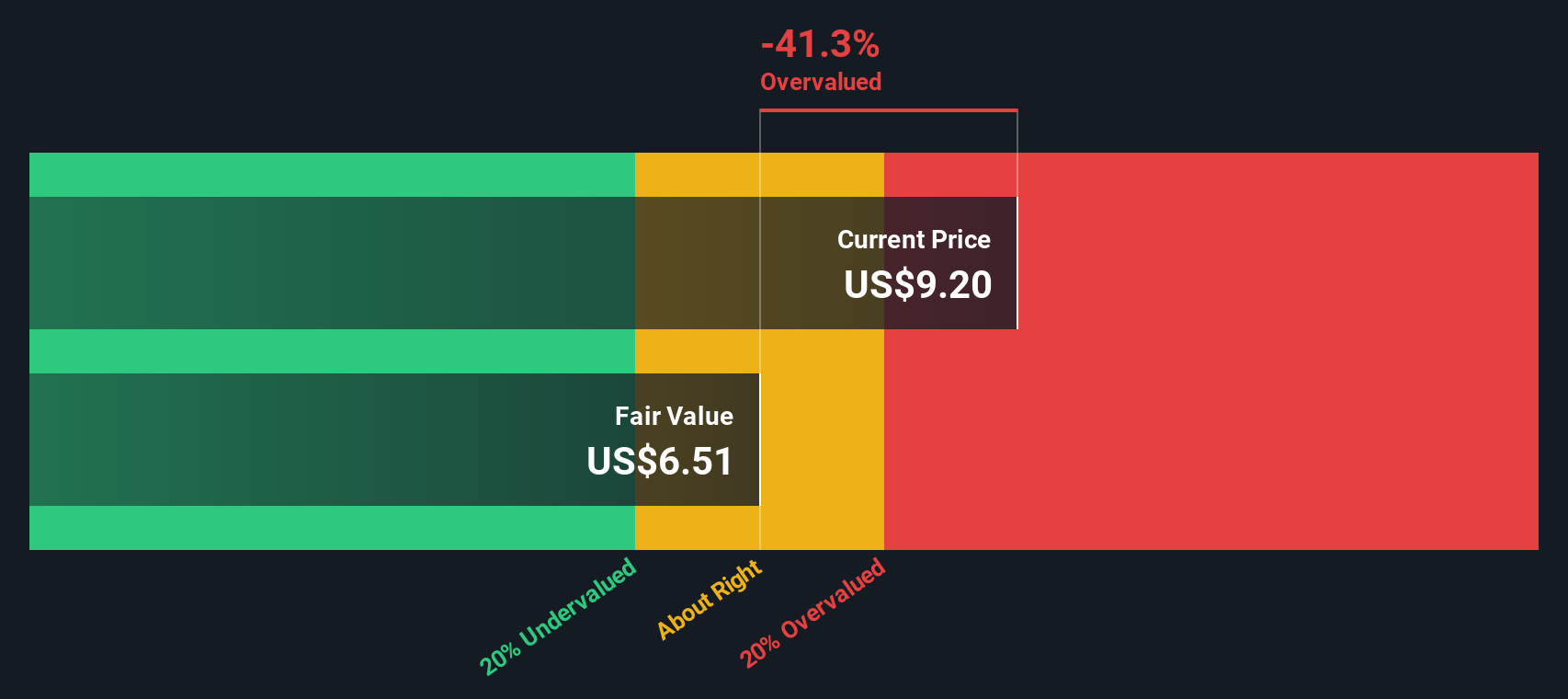

Another View: Discounted Cash Flow Suggests Overvaluation

While analyst consensus points to Sunstone Hotel Investors being slightly undervalued, our DCF model lands at a different conclusion. By projecting future cash flows, the SWS DCF model suggests a fair value closer to $6.49. This implies that shares could be trading above their intrinsic worth. Could market optimism be overestimating Sunstone’s recovery?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sunstone Hotel Investors for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sunstone Hotel Investors Narrative

If you have a different take or want to see where your own analysis leads, you can build a personalized narrative in just a few minutes. Do it your way.

A great starting point for your Sunstone Hotel Investors research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Sharpen your portfolio by uncovering investment angles most people overlook. Step ahead of the crowd with energizing screeners that surface exceptional stocks and fresh market opportunities you won't want to miss.

- Tap into hidden income potential by searching for solid yields with these 17 dividend stocks with yields > 3% among established companies designed to provide steady returns.

- Spot early trends and technological shifts by scanning these 27 AI penny stocks that power smart automation and reshape entire industries.

- Catch undervalued opportunities before the broader market notices by reviewing these 873 undervalued stocks based on cash flows which are primed for growth based on their fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHO

Sunstone Hotel Investors

A lodging real estate investment trust ("REIT") that as of the date of this release owns 14 hotels comprised of 6,999 rooms, the majority of which are operated under nationally recognized brands.

Slight risk with moderate growth potential.

Market Insights

Community Narratives