- United States

- /

- Hotel and Resort REITs

- /

- NYSE:SHO

How Sunstone’s Expansion Into Premium Hotels and Airline Partnerships May Impact SHO Investors

Reviewed by Sasha Jovanovic

- In recent weeks, Sunstone Hotel Investors expanded its portfolio by acquiring premium hotels in major U.S. destinations including Miami Beach, San Diego, and Washington D.C., and forged partnerships with leading airlines to support rising international tourism from Canada, Mexico, and the United Kingdom.

- This targeted expansion in high-demand travel corridors not only strengthens Sunstone’s footprint in the luxury hospitality sector, but also aligns the company with the growing cross-border tourism trend that is reshaping U.S. travel patterns.

- We’ll now examine how Sunstone’s latest focus on airline partnerships and premium properties could influence its longer-term investment outlook.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Sunstone Hotel Investors Investment Narrative Recap

To be a shareholder in Sunstone Hotel Investors, you need to believe in the resilience and growth potential of the premium U.S. hospitality market, especially in top-tier urban and resort destinations. While the recent acquisitions and airline partnerships may help drive more traffic to Sunstone’s properties in the near term, they do not immediately resolve the largest short-term catalyst: delivering faster revenue and profit recovery at major renovated or recently acquired hotels, nor do they materially reduce the risk posed by local market volatility in high-concentration assets. Sunstone’s latest credit agreement, increasing borrowing capacity to US$1.35 billion and extending debt maturities, is most relevant here as it enhances financial flexibility just as the company is pursuing higher-end property investments. This enables continued asset upgrades and supports liquidity, which will be important if newly acquired or renovated hotels take longer to achieve expected ramp-up in occupancy and earnings. However, investors should also be aware that if localized weakness or slow market recovery persists, particularly in cities like Washington D.C. or at recently expanded assets, then ...

Read the full narrative on Sunstone Hotel Investors (it's free!)

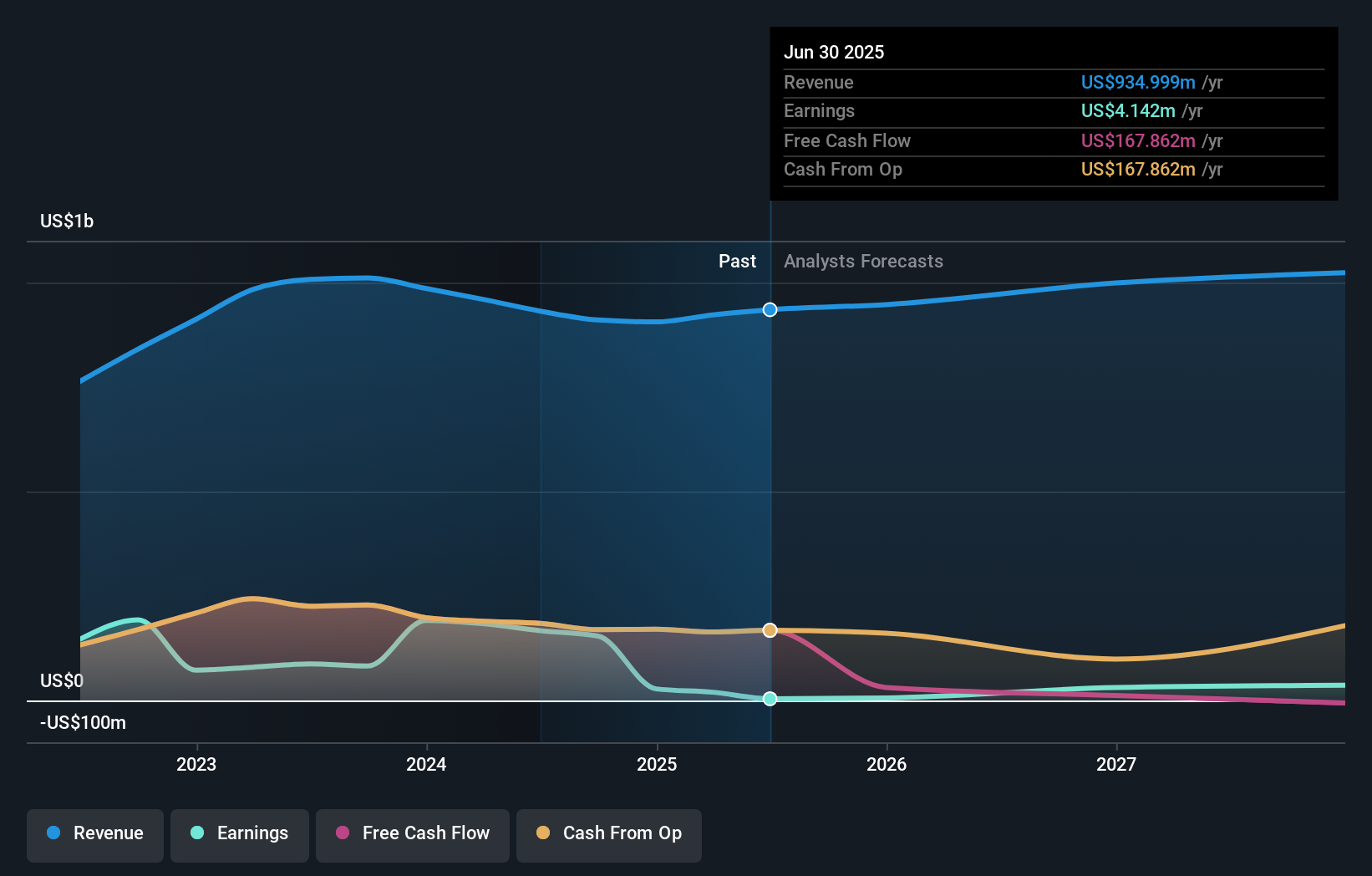

Sunstone Hotel Investors is projected to reach $1.1 billion in revenue and $67.9 million in earnings by 2028. This forecast is based on an expected annual revenue growth rate of 4.0% and represents an increase in earnings of $63.8 million from the current level of $4.1 million.

Uncover how Sunstone Hotel Investors' forecasts yield a $9.64 fair value, a 6% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s single fair value estimate of US$6.49 is well below the current share price, suggesting some see significant overvaluation. Yet with events like Sunstone’s push toward luxury markets and more flexible financing, shifting market dynamics may hold a range of outcomes for company performance. Consider reviewing other community viewpoints to see how your perspective compares.

Explore another fair value estimate on Sunstone Hotel Investors - why the stock might be worth as much as $6.49!

Build Your Own Sunstone Hotel Investors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunstone Hotel Investors research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Sunstone Hotel Investors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunstone Hotel Investors' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHO

Sunstone Hotel Investors

A lodging real estate investment trust ("REIT") that as of the date of this release owns 14 hotels comprised of 6,999 rooms, the majority of which are operated under nationally recognized brands.

Slight risk with moderate growth potential.

Market Insights

Community Narratives