- United States

- /

- Hotel and Resort REITs

- /

- NYSE:SHO

Does Sunstone Hotel Investors’ (SHO) Steady Guidance and Dividends Signal Enduring Cash Flow Strength?

Reviewed by Sasha Jovanovic

- Sunstone Hotel Investors, Inc. recently reported its third quarter and nine-month 2025 results, revealing modest revenue growth year-over-year but a decline in net income; the company also maintained its annual earnings guidance and authorized cash dividends for both common and preferred stock, payable in January 2026.

- Despite lower quarterly profits, Sunstone's decision to reaffirm full-year guidance and dividends may reflect management's confidence in operational stability and future cash flows.

- We'll examine how Sunstone's maintenance of full-year earnings guidance impacts its investment narrative moving forward.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Sunstone Hotel Investors Investment Narrative Recap

To be a shareholder in Sunstone Hotel Investors, you need to believe in the revival of high-end travel demand across Sunstone’s urban and resort properties, and trust that recent property investments and operational decisions will translate into sustained cash flow and shareholder returns. This quarter’s revenue growth was modest, and while management reaffirmed guidance and maintained dividends, the results did not materially alter the most important short-term catalyst, recovery in key leisure and business travel markets, nor did they significantly mitigate the ongoing risks tied to geographic concentration and uncertain demand in core locations.

Of the recent announcements, the decision to maintain cash dividends for both common and preferred stock stands out. This move, even amid shrinking net income, signals a commitment to returning capital to shareholders, making it particularly relevant for those watching near-term catalysts like occupancy recovery and demand normalization, which ultimately underpin the company’s ability to sustain such payouts.

Yet, despite a stabilizing dividend, investors should be aware that underlying risks, especially related to Sunstone’s geographic exposure and ongoing softness in Washington D.C. markets, could...

Read the full narrative on Sunstone Hotel Investors (it's free!)

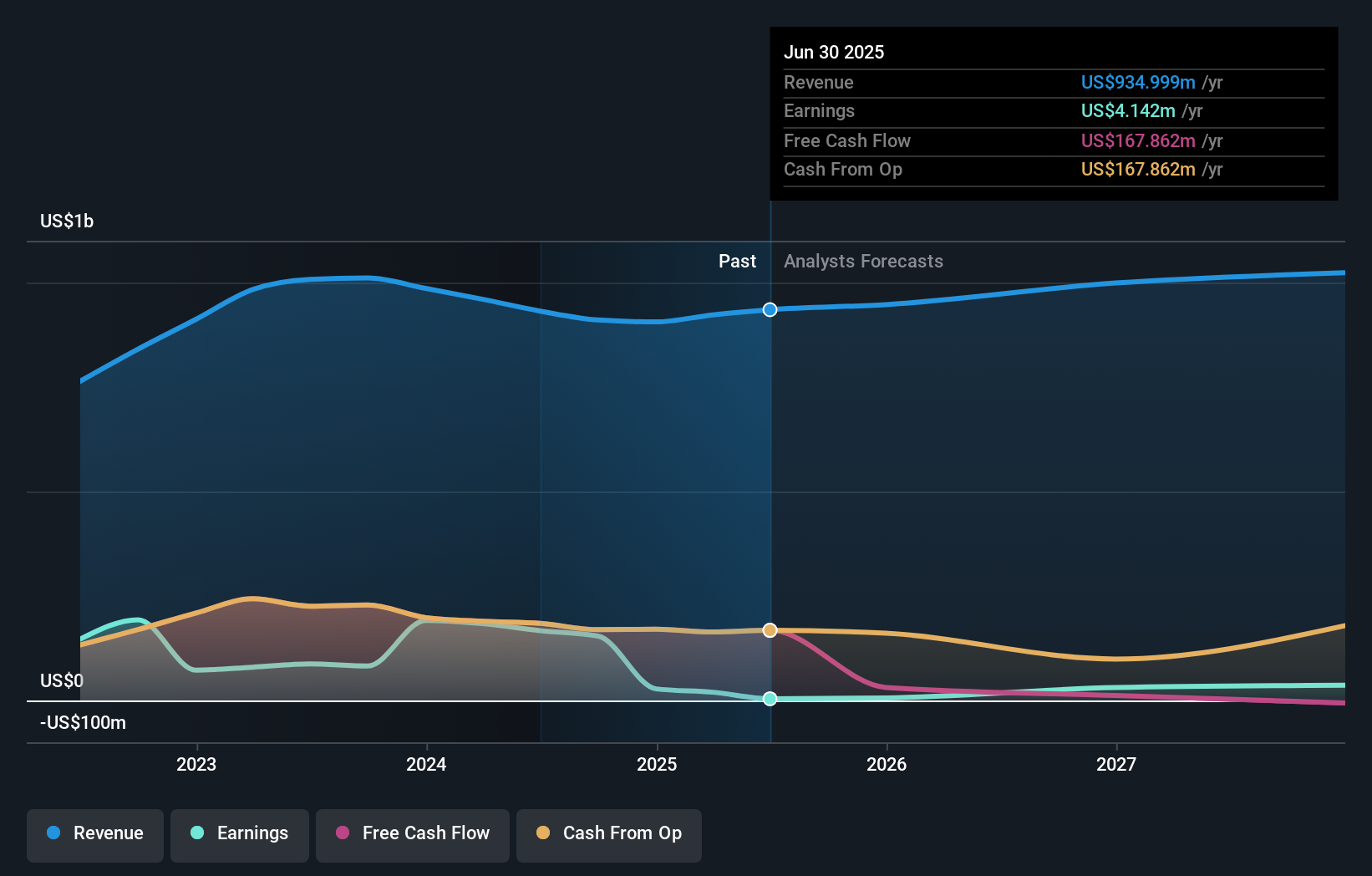

Sunstone Hotel Investors' outlook anticipates $1.1 billion in revenue and $67.9 million in earnings by 2028. This reflects a 4.0% annual revenue growth rate and a $63.8 million increase in earnings from the current level of $4.1 million.

Uncover how Sunstone Hotel Investors' forecasts yield a $9.64 fair value, in line with its current price.

Exploring Other Perspectives

All fair value estimates by the Simply Wall St Community sit at US$5.59, reflecting a consensus but limited diversity with just one viewpoint represented. With management maintaining guidance amid flat growth and critical geographic risks, it's essential to consider a range of opinions and remain alert to shifts in Sunstone's recovery narrative.

Explore another fair value estimate on Sunstone Hotel Investors - why the stock might be worth 41% less than the current price!

Build Your Own Sunstone Hotel Investors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunstone Hotel Investors research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Sunstone Hotel Investors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunstone Hotel Investors' overall financial health at a glance.

No Opportunity In Sunstone Hotel Investors?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHO

Sunstone Hotel Investors

A lodging real estate investment trust ("REIT") that as of the date of this release owns 14 hotels comprised of 6,999 rooms, the majority of which are operated under nationally recognized brands.

Slight risk with moderate growth potential.

Market Insights

Community Narratives