- United States

- /

- Specialized REITs

- /

- NYSE:RYN

The Bull Case For Rayonier (RYN) Could Change Following Q3 Earnings Surge in Real Estate and Timber

Reviewed by Sasha Jovanovic

- Rayonier Inc. reported strong third quarter results on November 5, 2025, with net income rising to US$43.2 million and adjusted EBITDA nearly doubling compared to the prior year.

- A standout insight is the performance surge in Rayonier's Real Estate and Southern Timber segments, which significantly contributed to the company's improved financial results.

- We'll explore how Rayonier's robust segment performance this quarter could reshape expectations for its investment outlook and future growth drivers.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Rayonier Investment Narrative Recap

To be a shareholder in Rayonier, you have to believe in the long-term value of high-quality timberland, the monetization of real estate, and the company's ability to create new revenue streams through environmental services projects. The latest results spotlight stronger earnings in key segments and may prompt some upward momentum in the short-term, but they do not materially shift the biggest short-term catalyst, the pace of high-value real estate transactions, or the principal risk, which remains exposure to adverse weather and climate events in the U.S. South.

The recently announced merger of equals with PotlatchDeltic is the most relevant development, as it is expected to optimize Rayonier’s capital structure and improve access to capital for future growth. This upcoming corporate combination stands to support catalysts related to capital flexibility and investment in new projects, although successful execution will be key to realizing these potential benefits.

Yet, with climate-related risks persisting in the U.S. South, investors should be aware of the unpredictability that frequent severe weather events could introduce to Rayonier’s future earnings...

Read the full narrative on Rayonier (it's free!)

Rayonier is forecast to generate $514.9 million in revenue and $105.0 million in earnings by 2028. This outlook implies a 25.4% annual decline in revenue and a $263.6 million decrease in earnings from the current $368.6 million.

Uncover how Rayonier's forecasts yield a $30.29 fair value, a 37% upside to its current price.

Exploring Other Perspectives

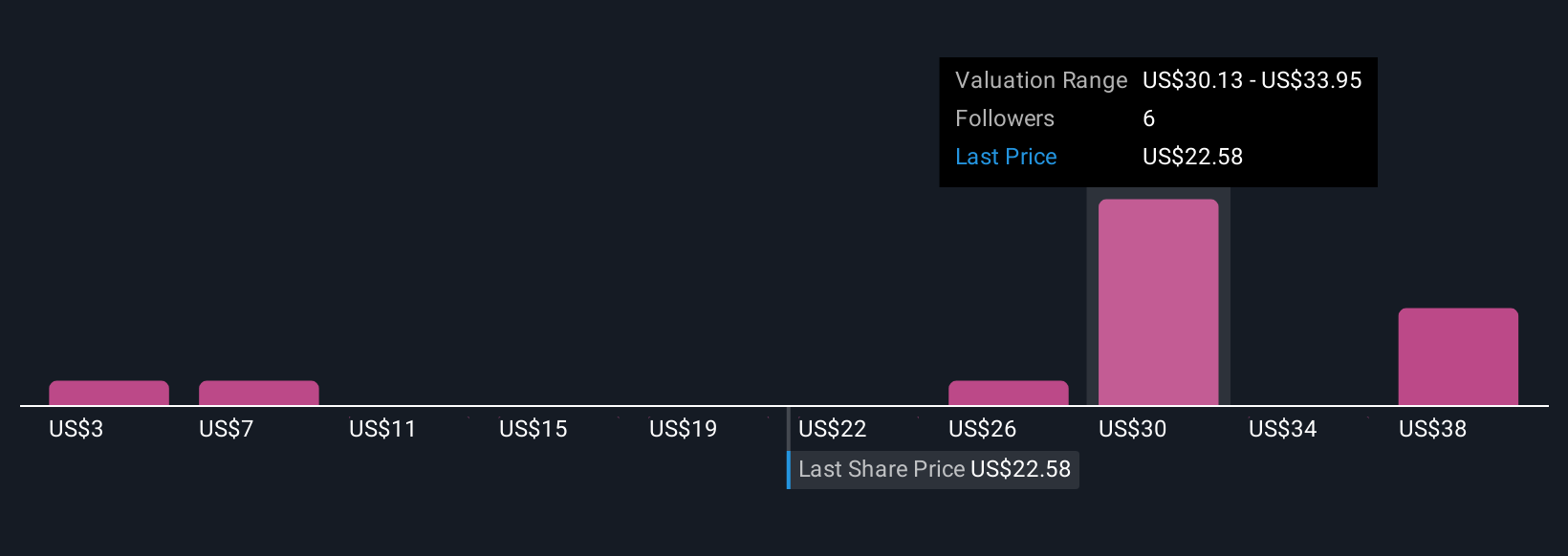

Five members of the Simply Wall St Community estimated Rayonier’s fair value anywhere between US$3.37 and US$46.76 per share. While these opinions differ widely, the company’s meaningful growth in real estate and Southern Timber segments may influence how you view Rayonier’s opportunity and risk.

Explore 5 other fair value estimates on Rayonier - why the stock might be worth less than half the current price!

Build Your Own Rayonier Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rayonier research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Rayonier research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rayonier's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RYN

Rayonier

Rayonier is a leading timberland real estate investment trust with assets located in some of the most productive softwood timber growing regions in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives