- United States

- /

- Specialized REITs

- /

- NYSE:RYN

How Investors May Respond To Rayonier (RYN) Reclassifying New Zealand Operations After Stake Sale

Reviewed by Sasha Jovanovic

- Rayonier Inc. recently revised its 2024 financial statements after selling its 77% stake in a New Zealand joint venture in June 2025, resulting in the reclassification of its New Zealand operations as discontinued and a realignment of its reportable segments.

- This move signals a shift in Rayonier’s business priorities and ensures adherence to SEC reporting standards amid evolving market strategies.

- We'll examine how the sale and segment restructuring may shift Rayonier's growth outlook and geographic diversification in its investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Rayonier Investment Narrative Recap

To hold Rayonier shares, investors need confidence in the company's ability to capitalize on land-based solutions like carbon capture and renewable projects while managing the unpredictable risks facing traditional timber markets. The recent exit from its New Zealand joint venture should be seen in the context of short-term revenue volatility from reduced geographic diversification, as well as the ongoing challenge of pulpwood demand decline and potential weather-related disruptions; the segment realignment and discontinued operations classification, while important for reporting, do not materially alter the key near-term catalysts or risks.

Of the recent company announcements, Rayonier's merger agreement with Potlatchdeltic Corporation stands out as most relevant, underscoring management's push for consolidation and operational scale in core geographies following the New Zealand divestiture. The combination may sharpen focus on US-based asset earnings, but investors should continue tracking how changes in timber demand and market pricing impact the business's ability to deliver consistent cash flow through cyclical swings.

But on the risk side, less international diversification now means Rayonier is more exposed if...

Read the full narrative on Rayonier (it's free!)

Rayonier's outlook projects revenues of $514.9 million and earnings of $105.0 million by 2028. This reflects a yearly revenue decline of 25.4% and a decrease in earnings of $263.6 million from current earnings of $368.6 million.

Uncover how Rayonier's forecasts yield a $29.33 fair value, a 36% upside to its current price.

Exploring Other Perspectives

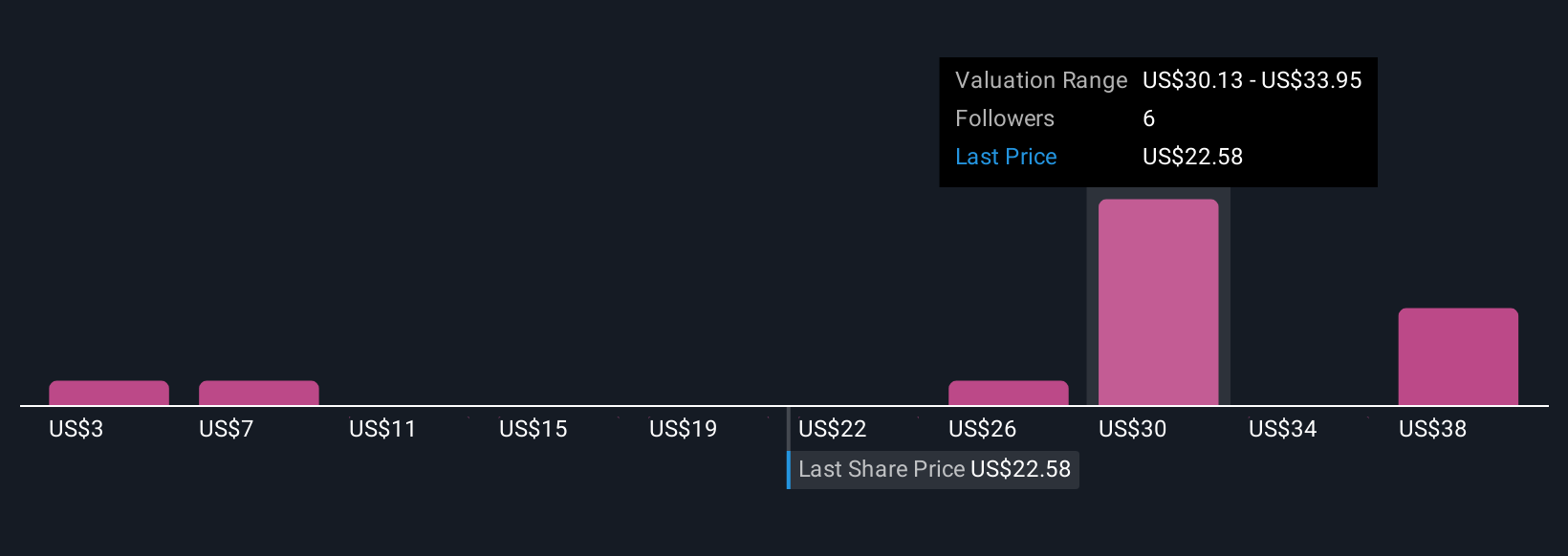

Five individual valuations from the Simply Wall St Community range from just US$3.37 to US$46.22 per share. While these span both low and high expectations, remember the company's reduced international footprint could increase exposure to regulatory and market-specific challenges. Explore more views to see how opinion varies.

Explore 5 other fair value estimates on Rayonier - why the stock might be worth over 2x more than the current price!

Build Your Own Rayonier Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rayonier research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Rayonier research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rayonier's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RYN

Rayonier

Rayonier is a leading timberland real estate investment trust with assets located in some of the most productive softwood timber growing regions in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success