- United States

- /

- Specialized REITs

- /

- NYSE:RYN

Does the Recent 19% Price Drop Signal an Opportunity in Rayonier?

Reviewed by Bailey Pemberton

- If you have ever found yourself wondering whether Rayonier is a hidden gem or a value trap, you are in exactly the right place for answers.

- The share price has slid recently, dropping 6.4% over the past week and nearly 19% in the last month. This movement may have opened the door for value seekers or signaled caution to others.

- Headlines have focused on Rayonier’s latest moves in timberland acquisitions and shifting portfolio strategies, with analysts debating how these investments may influence long-term returns. This news has contributed to the stock’s recent price swings and prompted investors to re-examine what the underlying value could be.

- On our scale for value, Rayonier scores a strong 6 out of 6. This means it is undervalued in every one of our valuation checks. Next, we will explore the methods behind these numbers and introduce an additional way to look at value at the end.

Find out why Rayonier's -19.3% return over the last year is lagging behind its peers.

Approach 1: Rayonier Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a core valuation approach that estimates a company’s worth by projecting its future cash flows and discounting them back to today’s value. For Rayonier, this involves looking ahead at expected cash flows over the next decade and evaluating what those are worth in present terms.

As of the latest 12 months, Rayonier’s Free Cash Flow stands at about -$60 million. Analysts forecast a positive reversal, estimating Free Cash Flow to reach $231 million by the end of 2027. These projections continue to grow over the next 10 years, with extrapolations showing Free Cash Flow could surpass $460 million by 2035. All figures are presented in US dollars.

Using the 2 Stage Free Cash Flow to Equity model and factoring in this growth, the DCF model estimates Rayonier’s intrinsic value at $46.72 per share. Compared to the recent market price, this suggests that Rayonier is trading at a 53.4% discount to its intrinsic value. This indicates that Rayonier may be significantly undervalued according to this analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rayonier is undervalued by 53.4%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: Rayonier Price vs Earnings

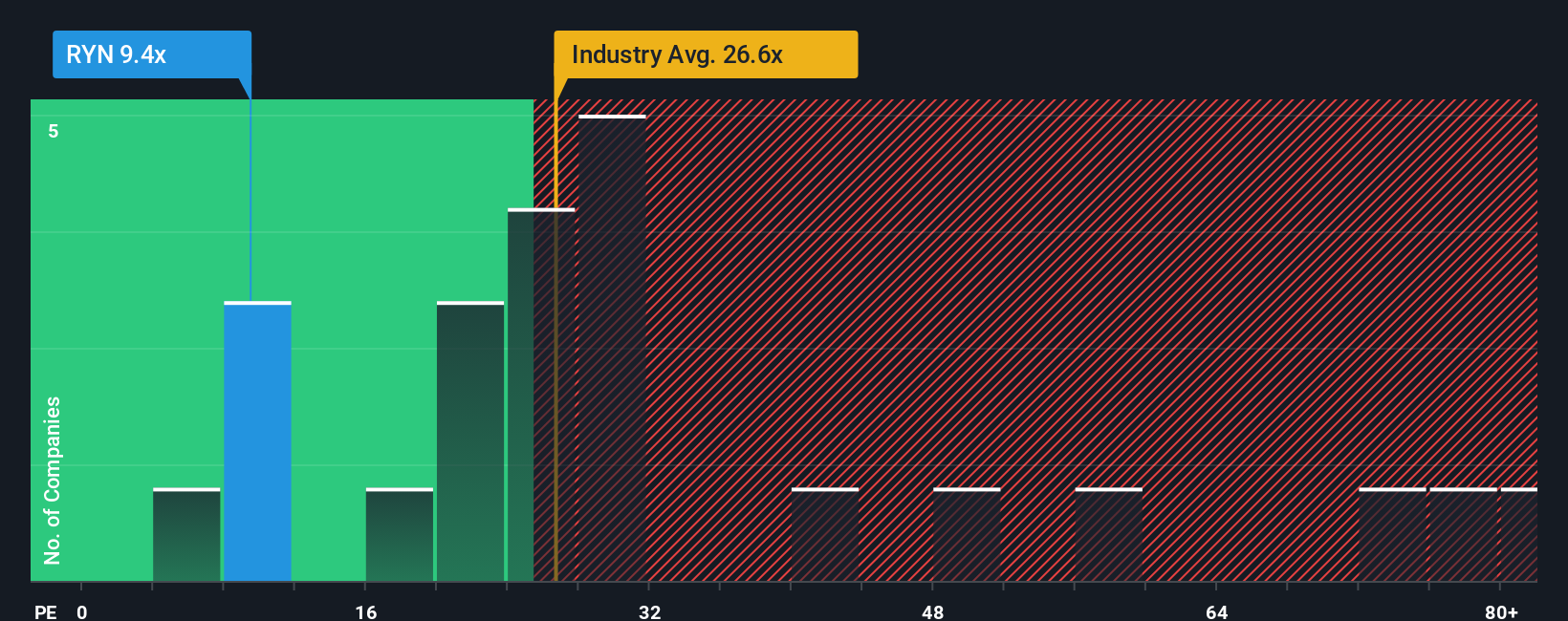

The Price-to-Earnings (PE) ratio is a well-established method for valuing profitable companies, as it relates the company’s share price to its actual earnings. This makes it especially useful for evaluating businesses like Rayonier, which is consistently generating profits, and helps investors gauge whether the stock trades at an attractive valuation compared to marketplace norms.

It is important to remember that growth prospects and risk play a big role in what counts as a “fair” PE ratio. Higher expected growth or lower risk often justifies a higher multiple, while slower growth or heightened risks typically push that multiple down.

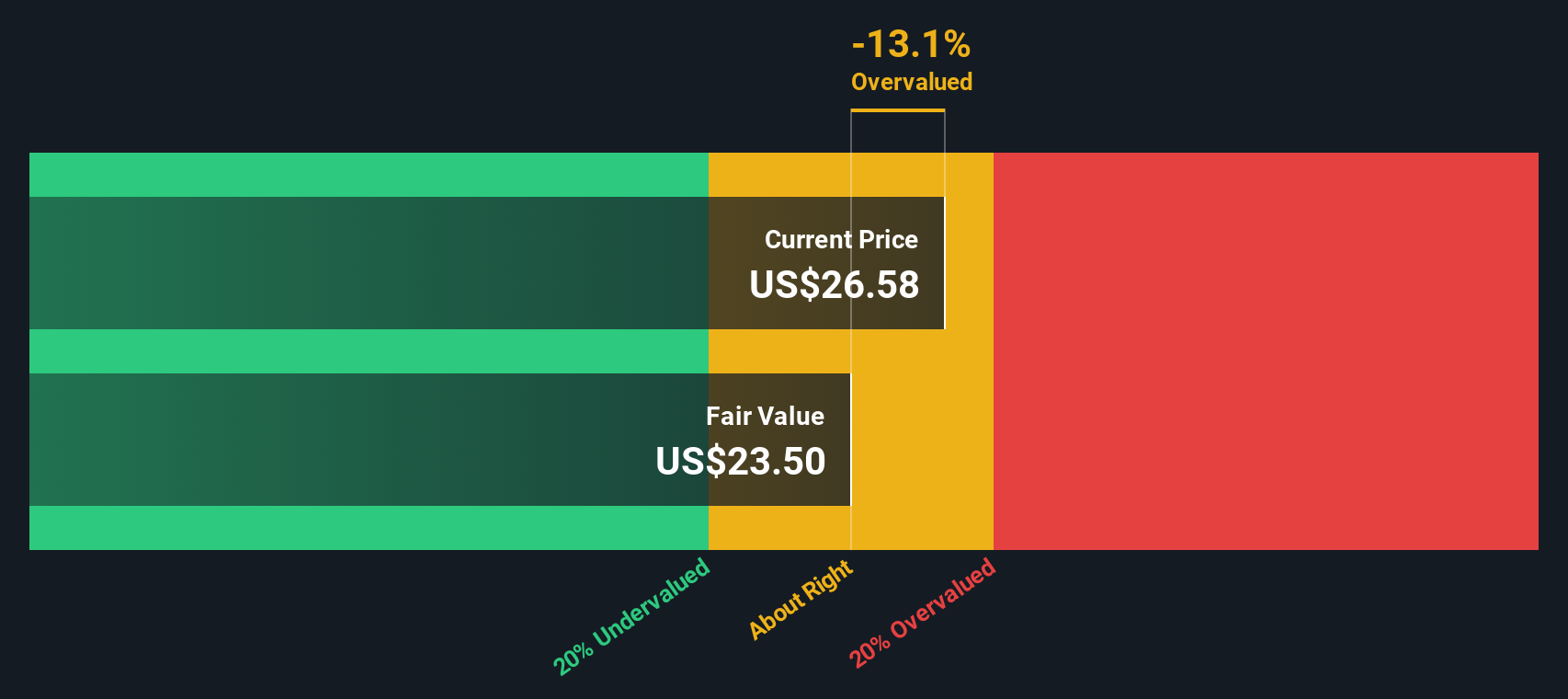

Right now, Rayonier trades at a PE ratio of 9.1x, which is notably lower than both its industry average of 17.3x and its peer group average of 35.2x. At first glance, this suggests the stock may be undervalued relative to similar companies in the Specialized REITs space.

However, instead of relying solely on simple comparisons, Simply Wall St’s proprietary “Fair Ratio” digs deeper. By accounting for Rayonier’s earnings growth outlook, industry characteristics, margins, company size, and associated risks, the Fair Ratio (13.3x) provides a tailored benchmark for what Rayonier’s PE should be. This is a more nuanced and accurate method than a basic industry or peer comparison, as it reflects Rayonier’s unique situation rather than broad averages.

Comparing Rayonier’s actual PE of 9.1x to its Fair Ratio of 13.3x suggests the shares are meaningfully undervalued on this metric, giving further support to the case for value investors taking a closer look.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rayonier Narrative

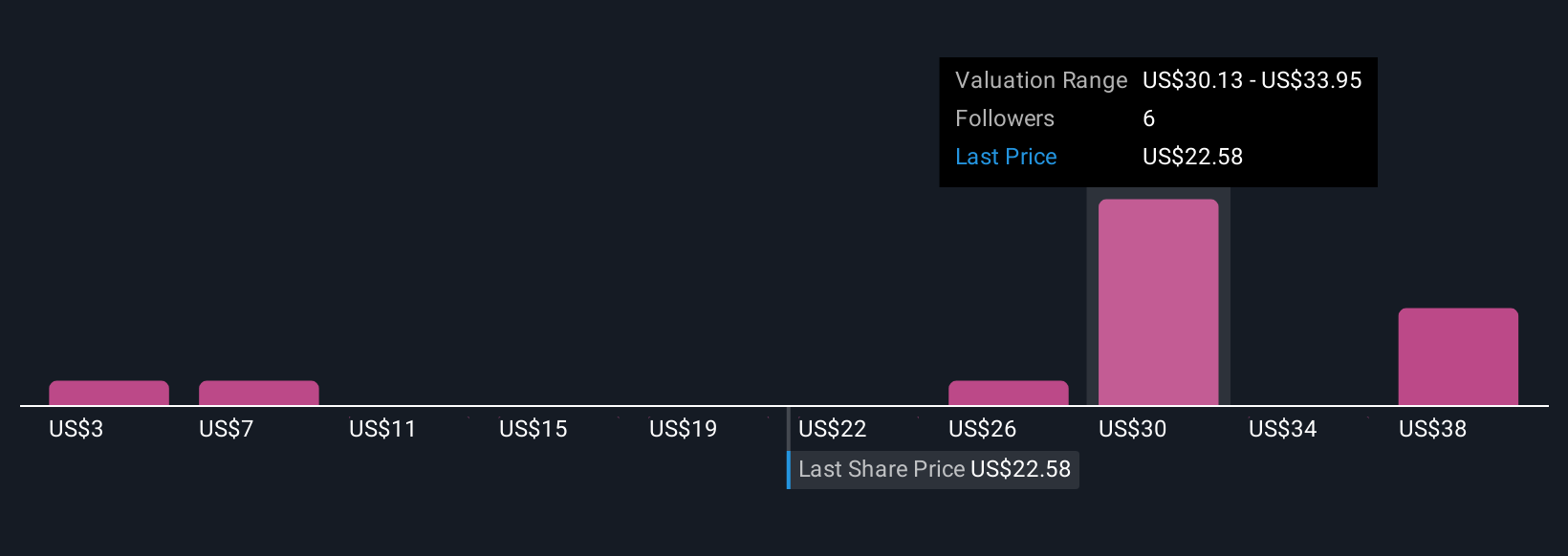

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives.

A Narrative is a simple, intuitive story that you can create about a company’s future, connecting your perspective on its business trends and strategic moves to your own forecast of its future revenue, earnings and margins.

Rather than just looking at numbers, Narratives link Rayonier’s actual business story, such as expansion into renewables, climate risks, or changing timber markets, to a financial forecast and then to a calculated fair value.

Narratives are easy to build on Simply Wall St’s Community page, where millions of investors regularly share and compare their perspectives. This makes the tool accessible regardless of your investing experience.

By matching your fair value estimate to Rayonier’s current price, you can decide with more conviction if it’s time to buy, sell, or hold. Because Narratives update automatically when key news or earnings come in, your view stays relevant as the story unfolds.

For example, one investor might believe Rayonier is worth $37 because renewables and real estate will outweigh climate risks, while another might set a fair value as low as $27, focusing on shrinking margins and geographic concentration. This shows how your Narrative directly shapes your investment decisions.

Do you think there's more to the story for Rayonier? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RYN

Rayonier

Rayonier is a leading timberland real estate investment trust with assets located in some of the most productive softwood timber growing regions in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives