- United States

- /

- Hotel and Resort REITs

- /

- NYSE:RLJ

RLJ Lodging Trust (RLJ): Valuation in Focus as Q3 Earnings and Dividend Sustainability Face Analyst Scrutiny

Reviewed by Simply Wall St

Investors are keeping a close eye on RLJ Lodging Trust (RLJ) this week, with its third-quarter earnings on tap and extra attention on the company's high dividend yield. The stakes feel especially high as scrutiny from analysts is intensifying.

See our latest analysis for RLJ Lodging Trust.

RLJ Lodging Trust’s share price has come under renewed pressure lately, sliding to $6.80 as investors anticipate its earnings update and weigh a one-year total shareholder return of -17.14%. Momentum has faded over the past several months, reflecting shifting expectations around dividend risk and ongoing uncertainty about the company’s turnaround prospects.

If recent setbacks in hotel REITs have you rethinking your strategy, this could be the perfect time to branch out and discover fast growing stocks with high insider ownership

With shares trading at a steep discount to analyst targets and an eye-catching 8.7% dividend yield, the real question is whether RLJ Lodging Trust is undervalued or if the market has already priced in every risk and future slowdown.

Price-to-Earnings of 32.1x: Is it justified?

At $6.80 per share, RLJ Lodging Trust is trading at a lofty price-to-earnings (P/E) ratio of 32.1x, far above both its immediate peers and the wider industry benchmarks. Despite a steep decline from its highs, the current market price reflects a substantial premium relative to typical sector multiples.

The P/E ratio gauges how much investors are paying for each dollar of current earnings, making it a widely used yardstick for hotel REIT valuations. A higher ratio might be justified for companies with strong growth and margin prospects. For RLJ, this figure signals that the market still places considerable hope in the company’s forward profit trajectory, or that earnings themselves are presently depressed.

However, context changes the picture. RLJ’s P/E stands out as expensive when stacked against its peer group’s average of 20.9x, and even further above the global Hotel and Resort REITs average of 16.1x. Relative to our fair value estimate, where a ratio of 15.6x would be more justifiable, current levels appear stretched. This suggests a material risk of the market reassessing RLJ’s premium valuation.

Explore the SWS fair ratio for RLJ Lodging Trust

Result: Price-to-Earnings of 32.1x (OVERVALUED)

However, sustained net income declines and ongoing share price weakness could quickly shift sentiment. This may challenge expectations for any near-term turnaround at RLJ Lodging Trust.

Find out about the key risks to this RLJ Lodging Trust narrative.

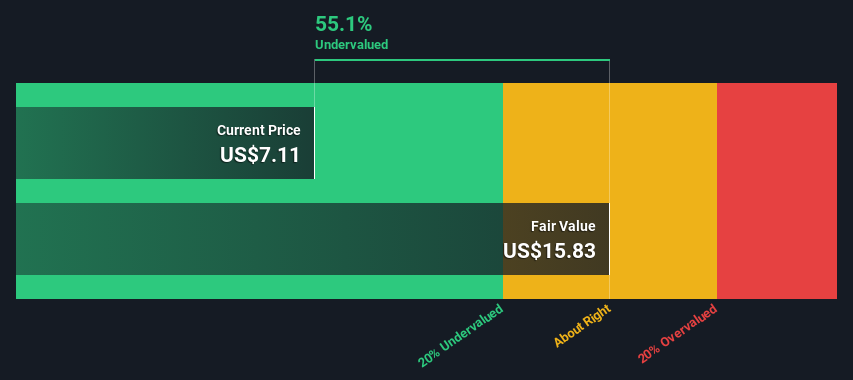

Another View: Our DCF Model Paints a Different Picture

While the price-to-earnings ratio signals that RLJ Lodging Trust might be overvalued, our SWS DCF model tells a contrasting story: shares are trading at $6.80, which is well below the calculated fair value of $14.45. This points to possible undervaluation. Which result will the market ultimately trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out RLJ Lodging Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 836 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own RLJ Lodging Trust Narrative

If you’d rather rely on your own analysis or take a different view, you can explore the numbers and shape your perspective in just minutes. Do it your way

A great starting point for your RLJ Lodging Trust research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock fresh opportunities with powerful tools designed to help you outpace the market. Don’t wait to see which stocks are primed for breakthroughs next quarter.

- Accelerate your search for high-potential companies with these 836 undervalued stocks based on cash flows, a resource poised to benefit from solid fundamentals and overlooked growth stories.

- Capitalize on powerful trends by checking out these 27 AI penny stocks, which highlight innovations in artificial intelligence, robotics, and next-generation automation.

- Boost your income strategy by targeting these 20 dividend stocks with yields > 3%, a selection featuring robust yields and stable payout histories for steady cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RLJ

RLJ Lodging Trust

RLJ Lodging Trust ("RLJ") is a self-advised, publicly traded real estate investment trust that owns 94 premium-branded, rooms-oriented, high-margin, urban-centric hotels located within the heart of demand locations.

Average dividend payer with low risk.

Market Insights

Community Narratives