- United States

- /

- Hotel and Resort REITs

- /

- NYSE:RHP

Ryman Hospitality Properties (RHP): Valuation in Focus as Investors Await Quarterly Earnings and Analyst Optimism Grows

Reviewed by Simply Wall St

Ryman Hospitality Properties (RHP) heads into its upcoming earnings report with investors paying close attention, as forecasts point to a 4% revenue bump and earnings of $0.50 per share.

See our latest analysis for Ryman Hospitality Properties.

Ryman Hospitality Properties’ share price recently closed at $86.91, reflecting a year-to-date decline of 15.28%. While short-term price momentum has been lackluster as investors await the earnings report, the company’s 5-year total shareholder return of 142.29% shows its longer-term growth story is still intact.

If you’re curious about what else is moving in the market, it’s a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With analysts projecting growth and the stock trading well below its price target, investors may wonder whether the recent pullback is a true buying opportunity or if the market is already factoring in the company’s future performance.

Most Popular Narrative: 23.6% Undervalued

With the most popular narrative estimating Ryman Hospitality Properties' fair value well above its last close of $86.91, there is a strong sense that the market is underappreciating the company’s potential. This sets up a revealing quote from the prevailing analysis.

Recent acquisitions and ongoing capital investments (for example, JW Marriott Desert Ridge and meeting space upgrades at Gaylord properties) put Ryman in a strong position to capitalize on renewed appetite for large-scale experiential travel and gatherings, supporting revenue growth and long-term cash flow. Visible increases in advance group booking activity and a robust pipeline for 2026 and 2027 indicate sustained demand for destination meetings and conventions as organizations prioritize periodic large-scale events, providing predictability for future revenues and earnings.

Want to crack the formula behind Ryman’s striking fair value? The narrative is built on bullish signals from group bookings and ambitious future projections. Ready to find out which assumptions power this call? The full story exposes the boldest financial bets.

Result: Fair Value of $113.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as rising competition and persistent cost pressures could challenge Ryman’s optimistic outlook and threaten the company’s projected growth trajectory.

Find out about the key risks to this Ryman Hospitality Properties narrative.

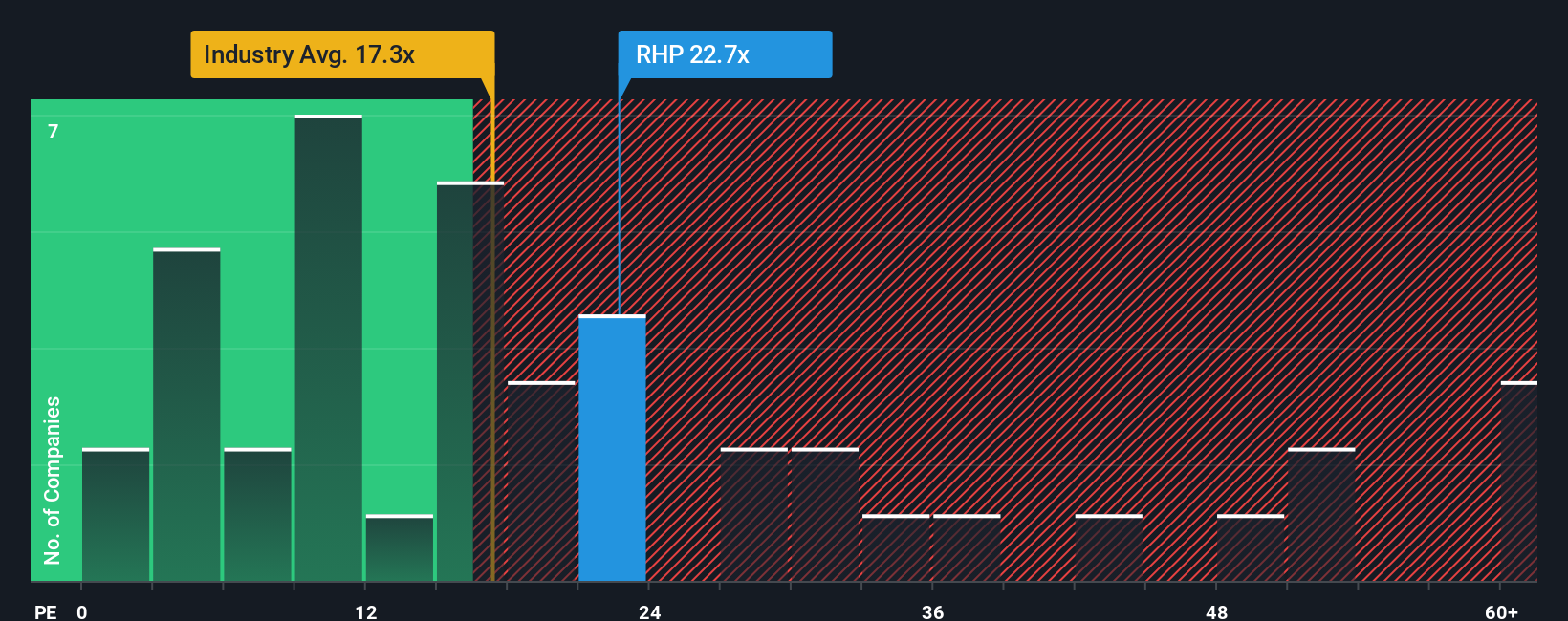

Another View: A Look Through Market Ratios

While the SWS DCF model suggests Ryman Hospitality Properties is deeply undervalued, the market’s go-to valuation ratio tells a slightly different story. RHP trades at a price-to-earnings ratio of 20.6x, which is higher than both its global industry average (16.1x) and that of its peers (20x). Despite this, the fair ratio for Ryman is 33.7x, which suggests there could be further upside if the market shifts its expectations. Are investors missing a hidden opportunity, or is current pricing already accounting for most of the optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ryman Hospitality Properties Narrative

If you prefer to dig into the numbers on your own or see things differently, you can easily shape your perspective in just a few minutes. Do it your way

A great starting point for your Ryman Hospitality Properties research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always have their eyes on the next opportunity. Don’t stick with just one stock when you could tap into new growth stories right now using the Simply Wall Street Screener.

- Capture the momentum of artificial intelligence by fueling your portfolio with these 26 AI penny stocks as they set new benchmarks in innovation.

- Benefit from stable income and compounding returns by exploring these 22 dividend stocks with yields > 3% with strong yields built for long-term wealth generation.

- Ride the next big wave in cutting-edge finance by stepping ahead with these 81 cryptocurrency and blockchain stocks powering the transformation in blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RHP

Ryman Hospitality Properties

Ryman Hospitality Properties, Inc. (NYSE: RHP) is a leading lodging and hospitality real estate investment trust that specializes in upscale convention center resorts and entertainment experiences.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives