- United States

- /

- Hotel and Resort REITs

- /

- NYSE:RHP

Does the Ryman Stock Drop Signal a Fresh Opportunity After Recent Price Declines?

Reviewed by Bailey Pemberton

Thinking about what to do with Ryman Hospitality Properties stock? You are not alone. With the stock closing at $89.90, investors are weighing whether the recent downward trend signals risk or a potential opportunity. Over the last month, Ryman’s share price has dropped 10.8% and it is down 2.9% in just the past week. Year-to-date, the decline sits at 12.4%, and if you zoom out to a full year, shares are off 15.6%. At the same time, these numbers follow an impressive three-year gain of 32.1% and a five-year surge of 140.7%.

Why the turbulence? Part of the story is tied to broader market reactions, especially for companies with significant hospitality and property holdings. Investors have wrestled lately with shifting expectations around travel demand, interest rates, and economic cycles. These are all factors that impact the whole real estate investment trust sector, including Ryman.

Despite some recent negative momentum, Ryman Hospitality Properties sports a valuation score of 5 out of 6, meaning it screens as undervalued in five of the six major criteria analysts use to assess stocks like this. In other words, plenty of signs suggest the market may be missing something.

Let us break down how that score was calculated and walk through the classic valuation checks. Stay tuned, because we will finish with an even more insightful approach to judging Ryman’s value.

Why Ryman Hospitality Properties is lagging behind its peers

Approach 1: Ryman Hospitality Properties Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting future cash flows, in this case adjusted funds from operations, and discounting them back to today’s dollars. This method helps investors assess what a business is actually worth compared to its current market price.

For Ryman Hospitality Properties, recent data show current free cash flow of $527.8 Million. Analysts expect this figure to reach $562.6 Million by 2026. Because detailed analyst projections only extend five years forward, further out-year forecasts, reaching $766.5 Million in 2035, are extrapolated using conservative growth rates, with Simply Wall St providing these long-range estimates.

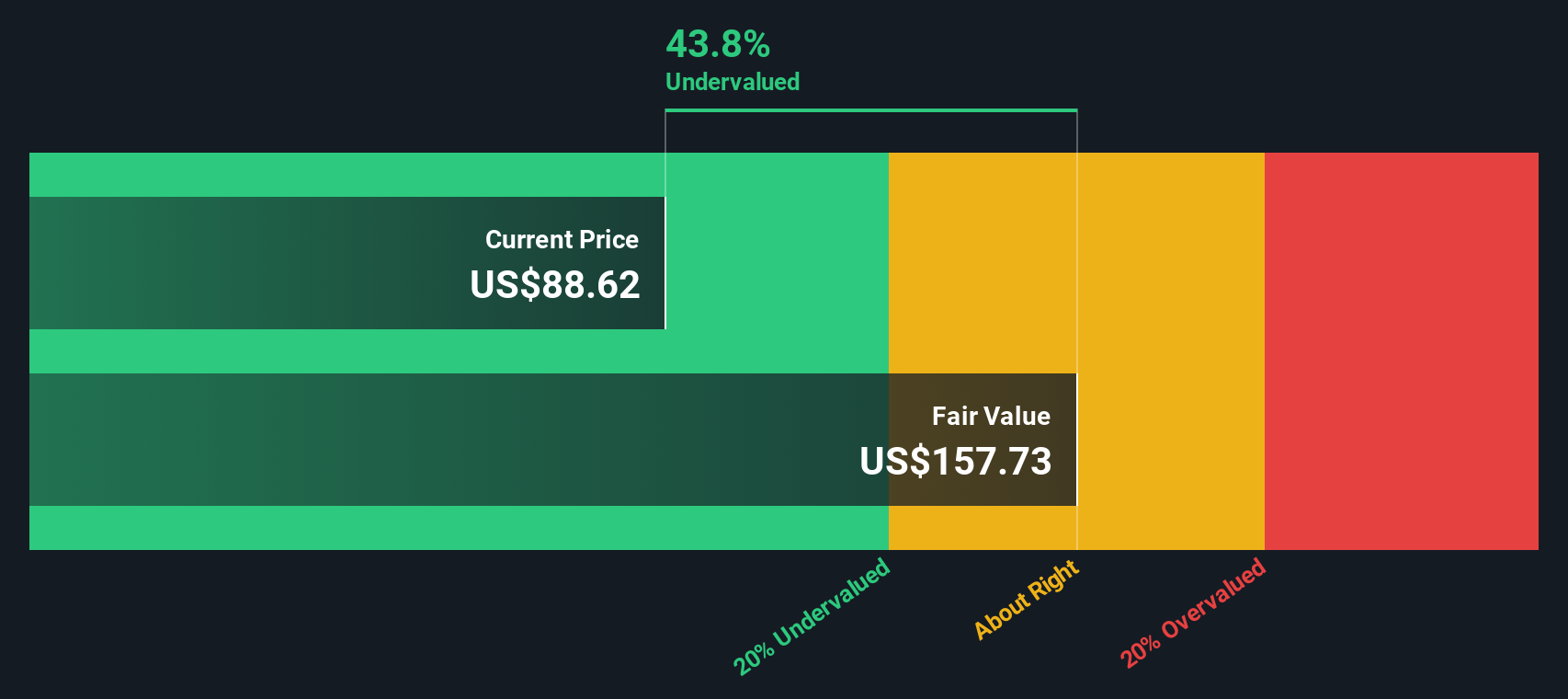

The entire series of projected cash flows is then discounted back using an appropriate rate to reflect the time value of money and risk. This results in a calculated intrinsic value per share of $157.63, far above the current market price of $89.90.

Based on this DCF analysis, Ryman Hospitality Properties appears to be trading at a 43% discount to its fair value. In straightforward terms, the stock is significantly undervalued according to this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ryman Hospitality Properties is undervalued by 43.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Ryman Hospitality Properties Price vs Earnings

The price-to-earnings (PE) ratio is a widely used metric for valuing profitable companies, since it directly compares a company's stock price to its per-share earnings. This makes it especially suitable for businesses like Ryman Hospitality Properties that generate meaningful profits, allowing investors to judge whether the current price accurately reflects future earning potential.

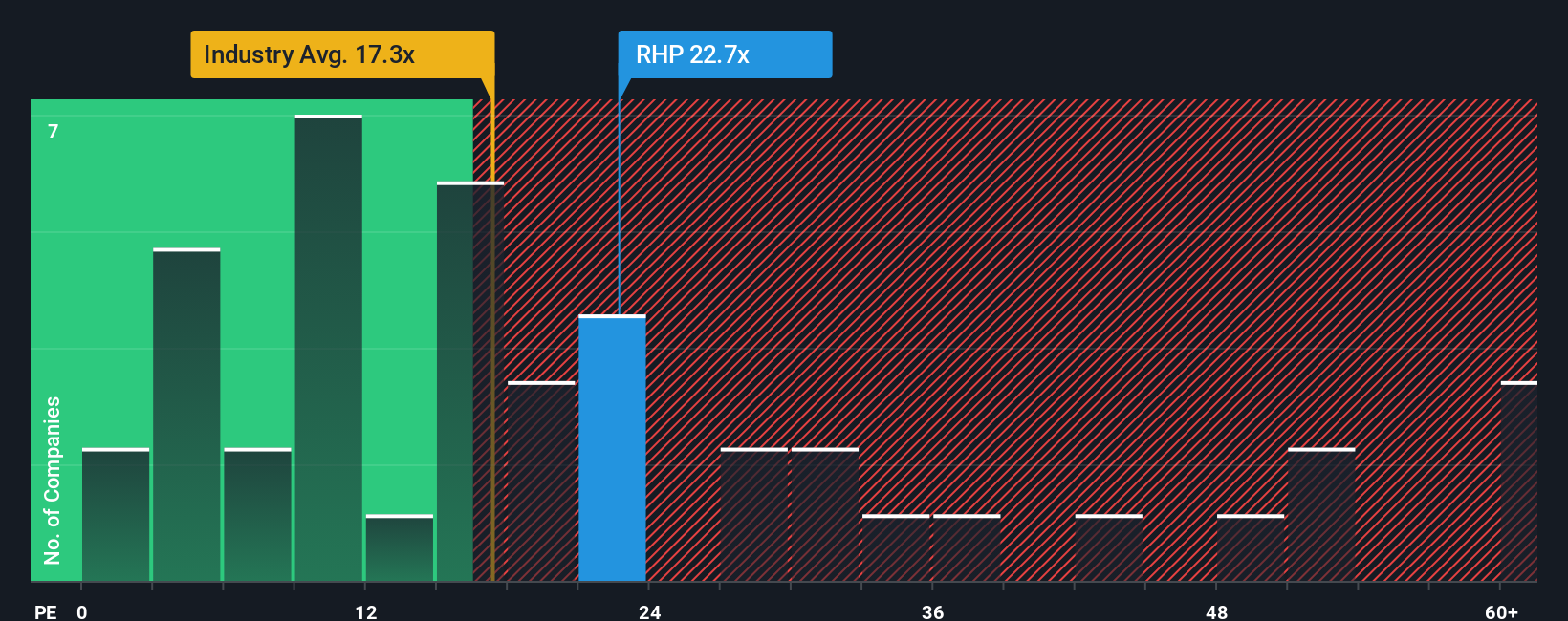

Determining what a fair PE ratio should be for a stock depends on both expectations of earnings growth and the risks surrounding those future profits. Higher growth prospects typically justify higher PE multiples, while greater uncertainty or risk leads to lower ones. Comparing a company’s PE to industry averages and peers helps frame what the "market" considers reasonable under current conditions.

Currently, Ryman Hospitality Properties trades at a PE ratio of 21.3x. This is higher than the industry average of 17.4x, but slightly below the average of its peers at 24.7x. To move beyond these blunt benchmarks, Simply Wall St calculates a unique "Fair Ratio" for each company. This reflects what a well-informed investor should be willing to pay given factors like Ryman's earnings growth, risk profile, market cap, profit margins, and specific industry dynamics. For Ryman, the Fair Ratio is estimated at 35.0x, notably above both its current PE and peer comparisons. Since Ryman's actual PE is significantly below the Fair Ratio, this points to the shares being attractively valued based on the earnings multiple approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ryman Hospitality Properties Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, personal story you create to express your perspective on Ryman Hospitality Properties, connecting your assumptions about future growth, earnings, and margins to what you believe is a fair value for the stock.

Instead of just relying on strict valuation models, a Narrative lets you link the company's story, including its strategy, risks, and future opportunities, to tangible financial forecasts and price targets. This tool, used by millions on Simply Wall St’s Community page, makes it easy for anyone to map out and update their investment view with just a few clicks.

Narratives are powerful because they help you decide when to buy or sell. You can compare your calculated fair value directly to the current share price and react as new earnings or news updates automatically refresh the numbers behind your Narrative. For example, some Ryman investors build optimistic Narratives based on strong Sunbelt market growth, leading them to target prices as high as $130 per share. Others focus on operating risks like higher costs or competition and estimate fair value closer to $106 per share.

Do you think there's more to the story for Ryman Hospitality Properties? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RHP

Ryman Hospitality Properties

Ryman Hospitality Properties, Inc. (NYSE: RHP) is a leading lodging and hospitality real estate investment trust that specializes in upscale convention center resorts and entertainment experiences.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

The "Rare Disease Monopoly" – Commercial Execution Play

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026