- United States

- /

- Industrial REITs

- /

- NYSE:REXR

Assessing Rexford’s Share Value After Year-to-Date Gains and Sun Belt Logistics News

Reviewed by Bailey Pemberton

- Wondering if Rexford Industrial Realty is a smart buy right now? Let’s break down what actually matters when you’re sizing up this stock’s value.

- While the share price is up 7.6% year-to-date, investors have seen a slight dip of -2.7% over the past week, reflecting some short-term uncertainty in sentiment.

- This comes amid headlines about increased demand for logistics and warehouse properties across the Sun Belt, with institutional investors eyeing Rexford’s portfolio as a potential beneficiary. At the same time, recent analyst commentary has focused on interest rate fluctuations and the broader impact on REITs. This has added to the short-term volatility.

- According to Simply Wall St’s checklist, Rexford Industrial Realty is undervalued in 3 out of 6 valuation checks, giving it a score of 3/6. However, that is not the whole valuation story. In the next section, we’ll compare different approaches to valuation, and there will be an even more insightful way to understand a real estate stock’s worth at the end.

Approach 1: Rexford Industrial Realty Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth by extrapolating its future cash flows, in this case, adjusted funds from operations, and then discounting those amounts back to today's value. For Rexford Industrial Realty, this approach uses a 2 Stage Free Cash Flow to Equity method, with current and projected cash flows in US dollars.

Rexford’s latest twelve months free cash flow stands at $543.16 million. According to analyst estimates, free cash flow is expected to steadily grow, reaching $662.29 million in 2029. Beyond that, projections for the next decade show incremental improvements, with Simply Wall St extending these estimates based on reasonable growth assumptions.

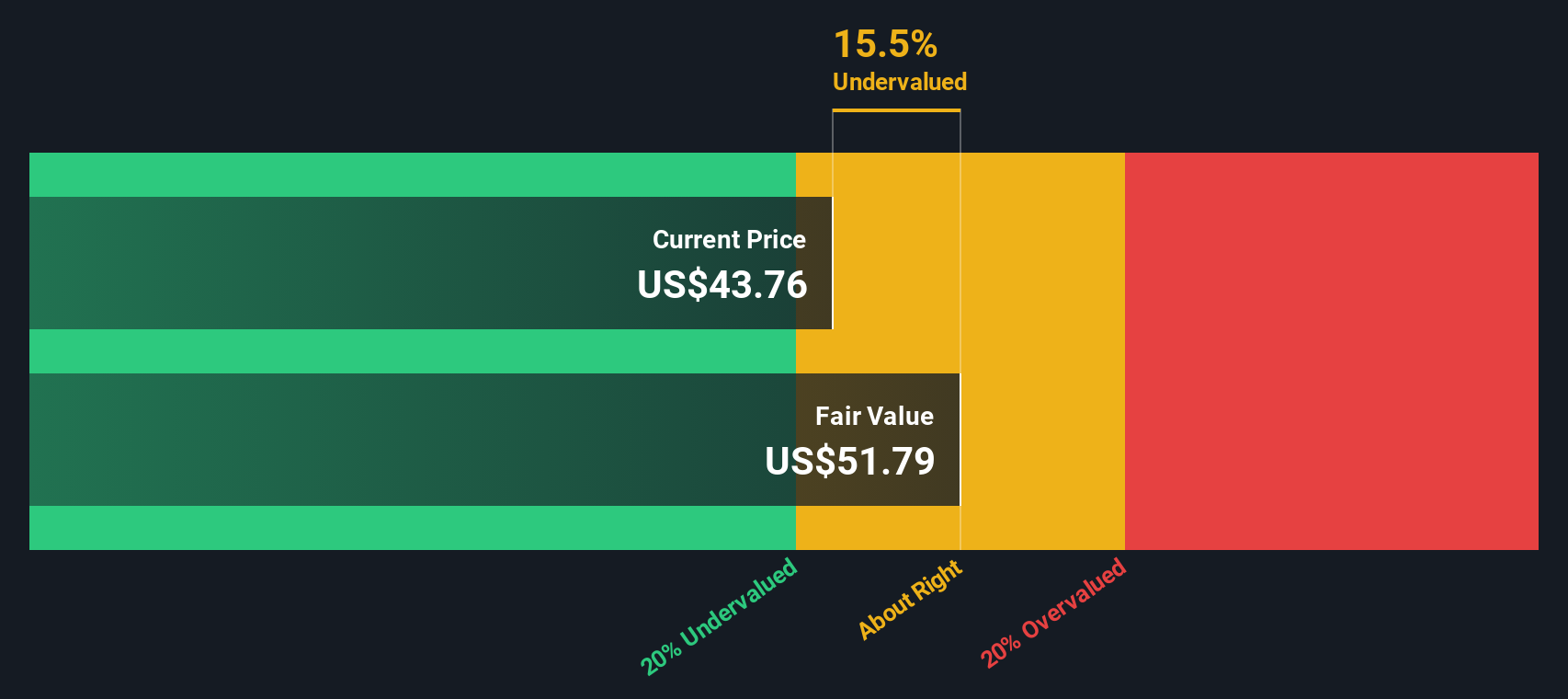

Based on this trajectory, the DCF model calculates an estimated intrinsic fair value of $47.91 per share. As of now, this suggests the stock is trading at a 13.7% discount to its calculated fair value, pointing to Rexford Industrial Realty being undervalued compared to what its future cash generation might be worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rexford Industrial Realty is undervalued by 13.7%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Rexford Industrial Realty Price vs Earnings

For companies that are steadily profitable, the Price-to-Earnings (PE) ratio is often the go-to valuation metric. It shows how much investors are willing to pay for each dollar of earnings and is especially useful when comparing companies within the same sector. The appropriate “normal” or “fair” PE ratio depends on how quickly a company is expected to grow, how stable its profits are, and the risks involved. Higher growth and lower risk typically justify a higher PE ratio, while slower growth and higher risks result in a lower figure.

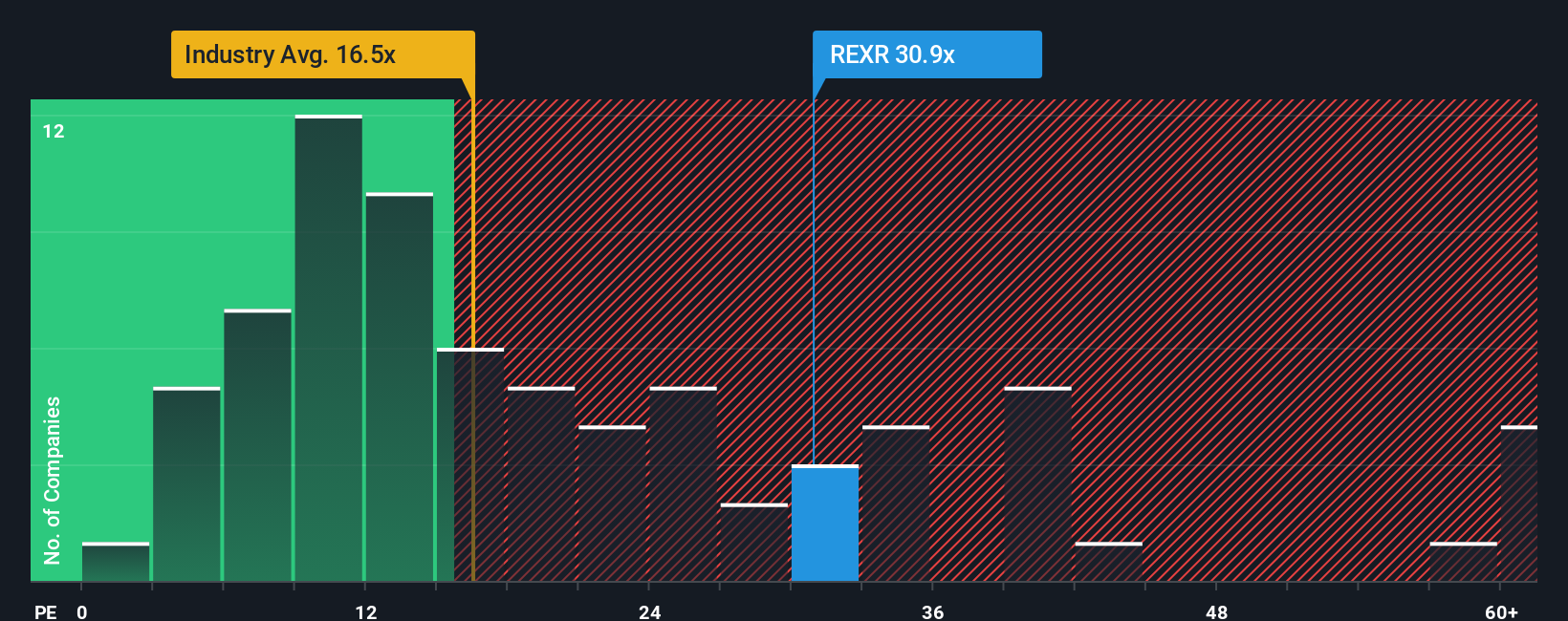

Rexford Industrial Realty currently trades at a PE ratio of 29.3x. This is slightly below its peer group average (30.5x) but well above the Industrial REITs sector average (17.1x), reflecting its solid earnings growth and market confidence. However, direct comparisons to peers or industry averages can overlook some important factors about what is actually fair for Rexford.

That is where Simply Wall St’s “Fair Ratio” comes in. This metric calculates a company-specific fair PE multiple, taking into account not just industry and size, but also growth prospects, risks, and profitability. For Rexford, the Fair Ratio is 29.5x. This means the current PE is almost perfectly aligned with what would be expected for a company with Rexford’s fundamentals, not just within its sector, but given its unique risk and growth profile.

With the share price trading near its Fair Ratio, Rexford Industrial Realty appears fairly valued on earnings multiples.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rexford Industrial Realty Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personalized story behind the numbers, allowing you to combine your unique perspective on Rexford Industrial Realty’s business outlook with your forecasts for revenue, earnings, profit margins, and ultimately, fair value.

Unlike static metrics, a Narrative connects the company's story—its strategy, risks, and catalysts—to a dynamic forecast, showing you how changes in these factors could impact Rexford’s fair value over time. This approach empowers you to go beyond industry averages and analyst predictions, making investment decisions that reflect your real views and assumptions.

On Simply Wall St’s Community page, used by millions of investors, Narratives are an intuitive and accessible feature. They help you decide when to buy or sell by visually comparing your fair value to the current share price, so you can see at a glance if Rexford is under- or over-valued based on your own analysis, not just consensus estimates.

What’s more, Narratives are dynamic. They automatically update with the latest news or earnings releases, meaning your investment story is always current. For example, one investor may build a bullish Narrative with a price target of $44.00, reflecting confidence in redevelopment growth and market scarcity. Another might set a more cautious value at $35.00 to account for rent pressures and geographic risks. Narratives reveal how assumptions drive value, so you can invest with clarity and conviction.

Do you think there's more to the story for Rexford Industrial Realty? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:REXR

Rexford Industrial Realty

Rexford Industrial creates value by investing in, operating and redeveloping industrial properties throughout infill Southern California, the world's fourth largest industrial market and consistently the highest-demand with lowest-supply major market in the nation over the long term.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives