- United States

- /

- Industrial REITs

- /

- NYSE:PLD

Prologis (PLD): Evaluating Valuation After Analyst Upgrades and $700M Bond Deal

Reviewed by Simply Wall St

Prologis (PLD) has gotten fresh attention after several analysts raised their outlook, along with the company’s announcement of a C$700 million bond offering designed for general corporate use and debt repayment. This combination is setting the stage for investor discussions around financial flexibility and growth potential.

See our latest analysis for Prologis.

Prologis shares have been gaining momentum, rising nearly 16% over the past three months as upbeat analyst sentiment and the new bond offering reinforce confidence in the company’s growth prospects. In fact, Prologis sports a one-year total shareholder return of 13%, which signals steady progress for investors over the longer term.

If you want to find more companies that combine growth with strong management alignment, this is a great time to broaden your search and discover fast growing stocks with high insider ownership

With analyst upgrades and bond activity boosting optimism, the big question remains: Is Prologis undervalued at current prices, or has the market already accounted for the company’s future growth in its valuation?

Most Popular Narrative: 1.8% Undervalued

With Prologis closing at $125.72, the most widely followed narrative suggests a fair value of $128.05. The difference is slim and points to a market price that closely tracks analyst models and sector momentum.

Limited new supply and a significant spread between market and replacement cost rents (over 20%), combined with a depleting development pipeline, position Prologis for future periods of robust rent growth and improved net operating income as market vacancy normalizes and pricing power returns.

What is the secret behind this punchy valuation? It depends on bold growth assumptions and a future profit benchmark that puts most competitors in the shade. Want to see which revenue and margin bets tilt the scales? Click to uncover the full rationale and see what underpins that near-term fair value.

Result: Fair Value of $128.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high vacancy rates or a slowdown in leasing activity could limit Prologis’s near-term revenue growth and challenge the positive outlook.

Find out about the key risks to this Prologis narrative.

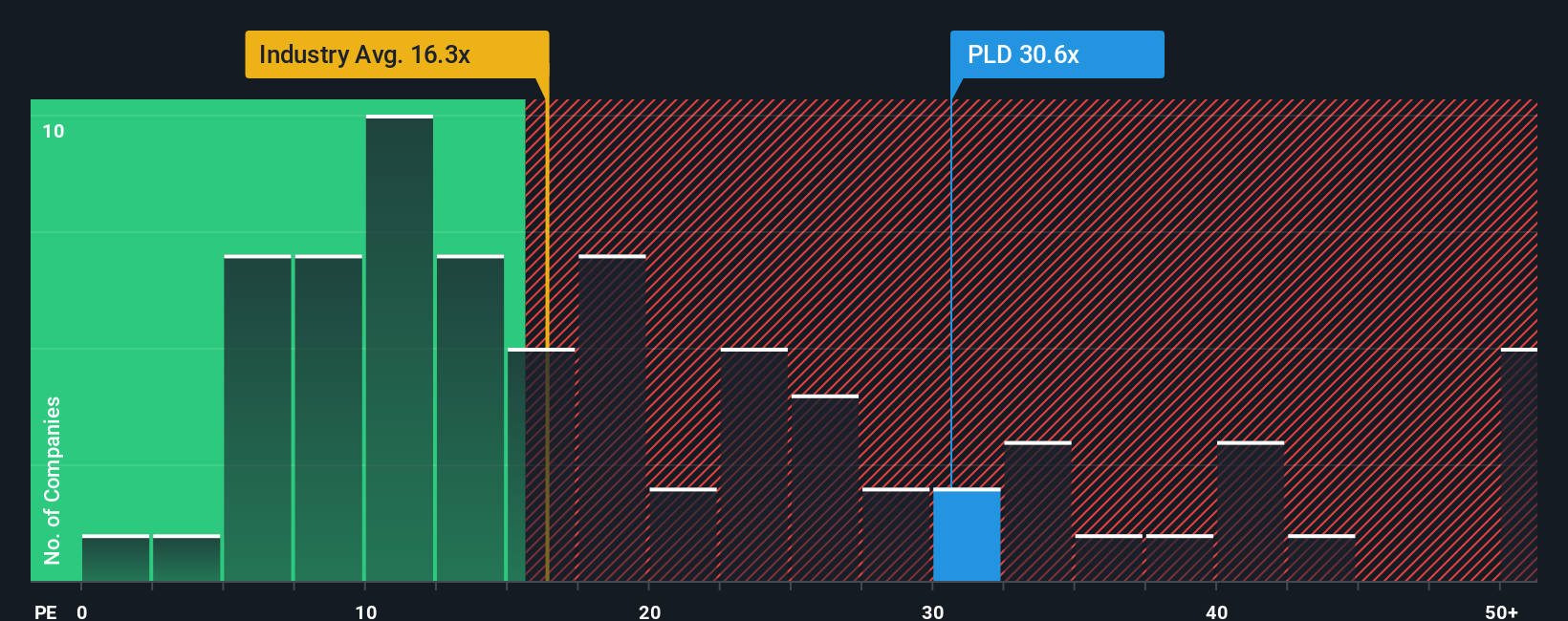

Another View: Peer and Industry Multiples Paint a Challenging Picture

While the current fair value estimate suggests Prologis is slightly undervalued, a look at its price-to-earnings ratio tells a different story. Prologis trades at 36.5x earnings, which is notably higher than both the global Industrial REITs industry average of 17.1x and its peers at 32.5x. The fair ratio, determined by regression analysis, stands at 37.7x. This figure is closer to the current level, but there may be less upside if market sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Prologis for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Prologis Narrative

If you have your own take or want to dig into the numbers yourself, it’s easy to craft a unique view in just a few minutes with Do it your way.

A great starting point for your Prologis research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Give your portfolio an edge by going beyond the obvious picks. Some of the biggest wins come from acting early on high-potential ideas. Here are three to start now:

- Capitalize on market mispricings and strengthen your strategy by evaluating these 866 undervalued stocks based on cash flows based on rigorous cash flow analysis.

- Boost your income by targeting consistent performers among these 21 dividend stocks with yields > 3% with yields over 3% and robust financials supporting those payments.

- Position yourself at the forefront of innovation by assessing these 26 AI penny stocks riding the surge in artificial intelligence adoption and disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLD

Prologis

Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives