- United States

- /

- Industrial REITs

- /

- NYSE:PLD

Prologis (PLD): Assessing Valuation After a 27% One-Year Share Price Climb

Reviewed by Simply Wall St

Prologis (PLD) has quietly rewarded patient investors, with the stock up about 27% over the past year and roughly 23% year to date, as demand for logistics space continues to support its cash flows.

See our latest analysis for Prologis.

That steady climb in the share price to about $127.59, backed by an 11.49% 3 month share price return and a 1 year total shareholder return of 26.88%, suggests investors are steadily rewarding Prologis for its resilient logistics demand story rather than chasing short lived spikes.

If Prologis has you rethinking where durable growth might come from next, it could be worth exploring fast growing stocks with high insider ownership as a way to uncover other under the radar compounders.

Yet with Prologis trading near its analyst price target and sporting steady, not explosive, growth, the key question is whether the current valuation understates its long term potential or already reflects tomorrow’s gains.

Most Popular Narrative Narrative: 3.3% Undervalued

With fair value pegged just above the latest $127.59 close, the most followed narrative frames Prologis as modestly mispriced rather than obviously stretched.

Limited new supply and a significant spread between market and replacement cost rents (over 20%) combined with a depleting development pipeline position Prologis for future periods of robust rent growth and improved net operating income as market vacancy normalizes and pricing power returns.

Curious why a mature REIT gets a growth style valuation multiple, built on steady revenues, resilient margins, and ambitious long term earnings targets. See what that implies.

Result: Fair Value of $131.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower leasing and elevated vacancies could cap rent growth, challenging assumptions about Prologis’ pricing power and long term earnings trajectory.

Find out about the key risks to this Prologis narrative.

Another Angle on Valuation

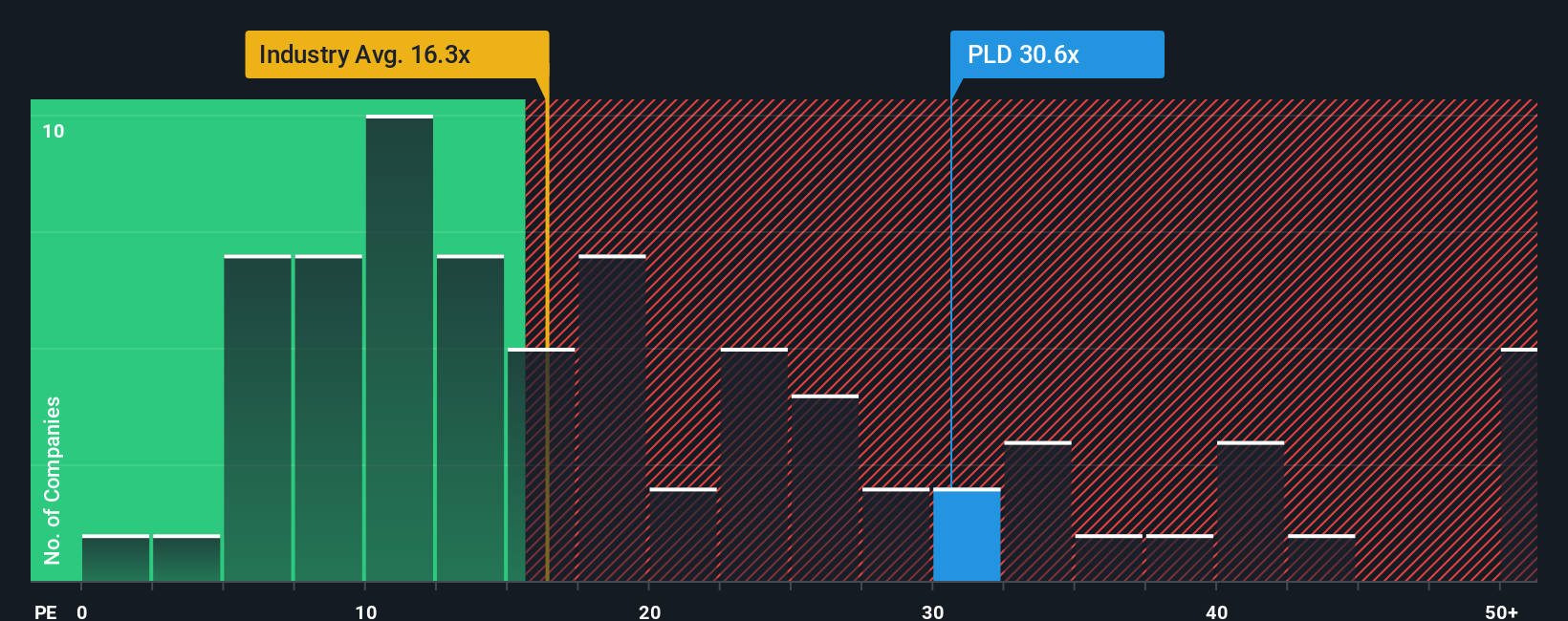

While the narrative leans on fair value around $131.90, the price to earnings lens paints a tougher picture. At 37 times earnings, Prologis trades well above the Industrial REITs industry at 16.3 times and peers at 32.1 times, and even above its 32.4 times fair ratio, leaving less room for error if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prologis Narrative

If you see the story playing out differently or simply want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Prologis research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Do not stop at one idea. Use the Simply Wall Street Screener to uncover targeted opportunities that match your strategy before others spot them.

- Capture potential mispricings early by scanning these 898 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Turbocharge your growth watchlist by hunting through these 24 AI penny stocks positioned at the forefront of the artificial intelligence wave.

- Lock in potential income streams by reviewing these 10 dividend stocks with yields > 3% that offer higher yields with the support of solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLD

Prologis

Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets.

Established dividend payer with very low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion