- United States

- /

- Industrial REITs

- /

- NYSE:PLD

Is Prologis Still Attractive After 23% Rally and Strategic Tenant Expansions?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Prologis stock is a hidden bargain or simply priced to perfection, you are in the right place.

- Prologis shares have climbed 22.9% year-to-date and posted a 4.7% gain in the last week. This highlights both growth potential and shifting market sentiment.

- Recently, Prologis has attracted attention with strategic acquisitions and high-profile tenant expansions. This has fueled both optimism and debate among investors about the company’s long-term prospects. Headlines have highlighted its continued role in supporting global supply chains, which remains relevant as the logistics property sector evolves.

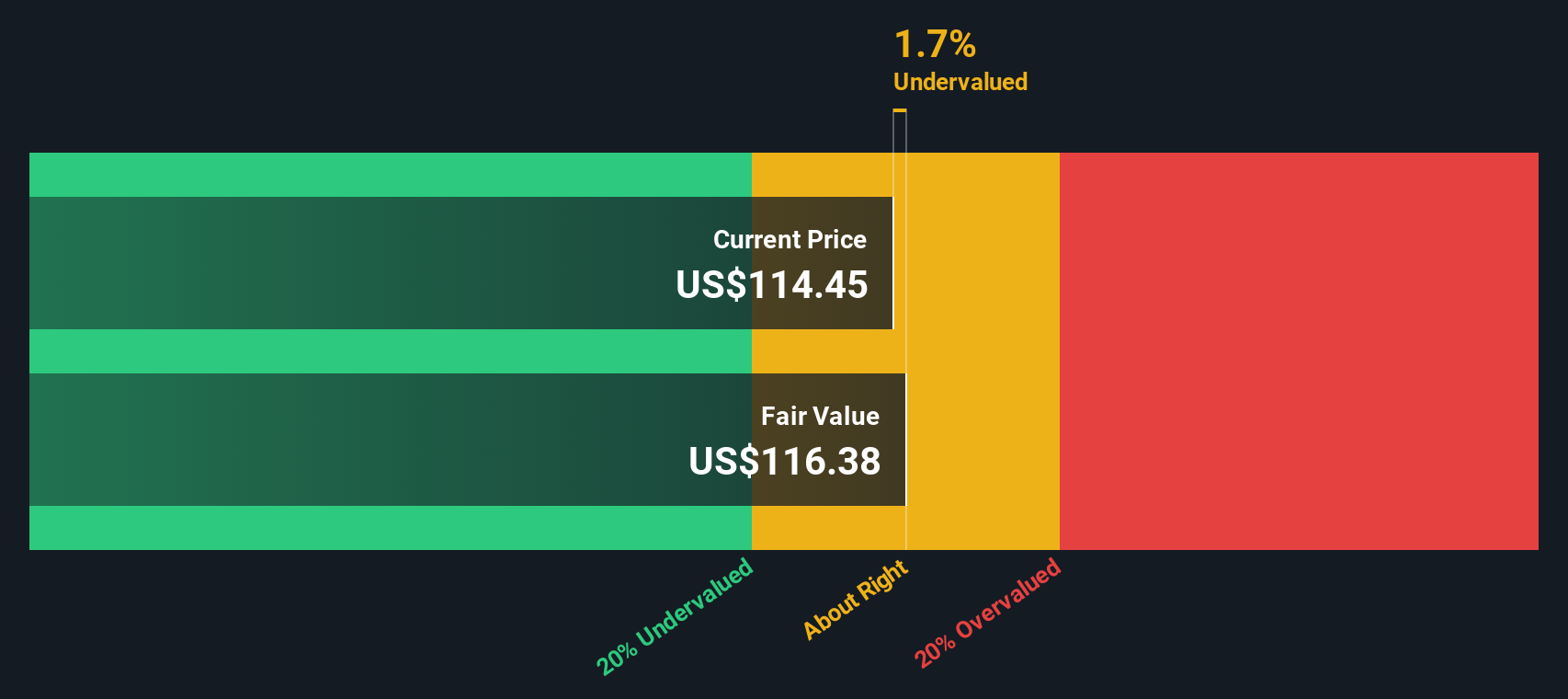

- Currently, Prologis has a 0 out of 6 valuation score, meaning it does not appear undervalued based on any of the standard checks. Let us break down the valuation methods used and also introduce a more nuanced way to gauge value that we will reveal later on.

Prologis scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Prologis Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future adjusted funds from operations and discounting those anticipated cash flows back to today's dollars. This approach helps investors gauge a stock’s intrinsic value based on the business’s ability to generate cash over time.

For Prologis, the current Free Cash Flow stands at $5.80 Billion. Analysts provide detailed projections for up to five years, after which future cash flows are extrapolated to estimate longer-term performance. According to Simply Wall St, the company’s free cash flow is expected to reach approximately $8.11 Billion by 2035, reflecting steady annual growth across the period. All figures reflect values in US dollars.

When these projections are discounted back to today’s value, the model produces an estimated intrinsic value for Prologis shares of $110.03. With shares currently trading above this level, the DCF suggests the stock is roughly 16.5% overvalued based on the available cash flow outlook and discount rate used.

In summary, Prologis stock currently appears to be trading above what its future cash flows justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Prologis may be overvalued by 16.5%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Prologis Price vs Earnings

The Price-to-Earnings (PE) ratio is often the preferred tool to value profitable companies, as it reflects what investors are willing to pay today for each dollar of current earnings. It helps retail investors quickly gauge whether a stock is priced attractively relative to its earnings, especially when the business has a consistent track record of profitability like Prologis.

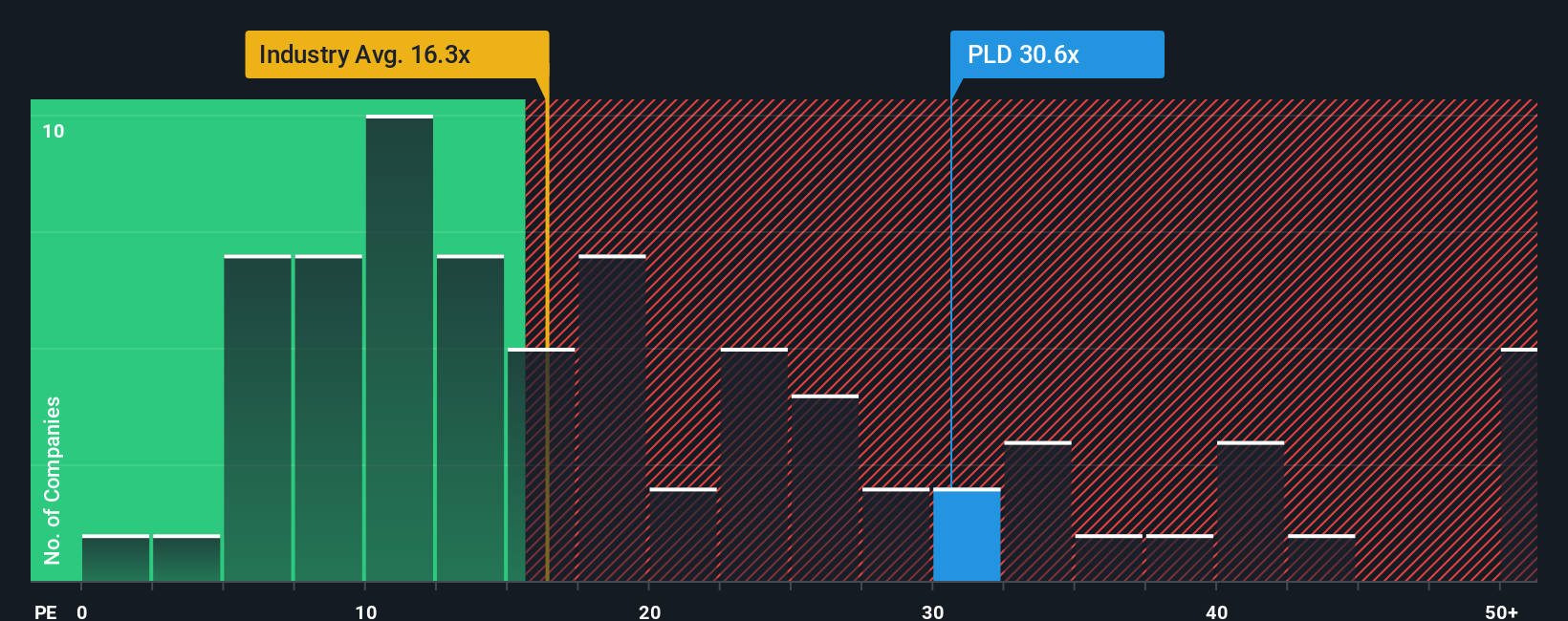

“Fair” or “normal” PE ratios are shaped by growth expectations and the perceived risk of a company. High-growth, stable companies tend to justify higher PE ratios, while riskier or slower-growing businesses command lower multiples. For Prologis, the current PE ratio stands at 37.18x, which is well above the Industrial REITs industry average of 16.34x and higher than the average of its peers at 32.76x.

Simply Wall St’s proprietary Fair Ratio for Prologis, at 33.94x, offers a more nuanced benchmark than simply using peers or industry averages. The Fair Ratio accounts for the specifics of the company, such as earnings growth, profit margins, industry position, market capitalization, and unique risk factors. This means it adapts to Prologis’s particular strengths and challenges, producing a benchmark that is more tailored than generic market multiples.

Comparing Prologis’s actual PE ratio (37.18x) to its Fair Ratio (33.94x), the stock is priced a bit above fair value but not dramatically so. The difference, at just about 3.2x, signals the shares are modestly overvalued on this basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose Your Prologis Narrative

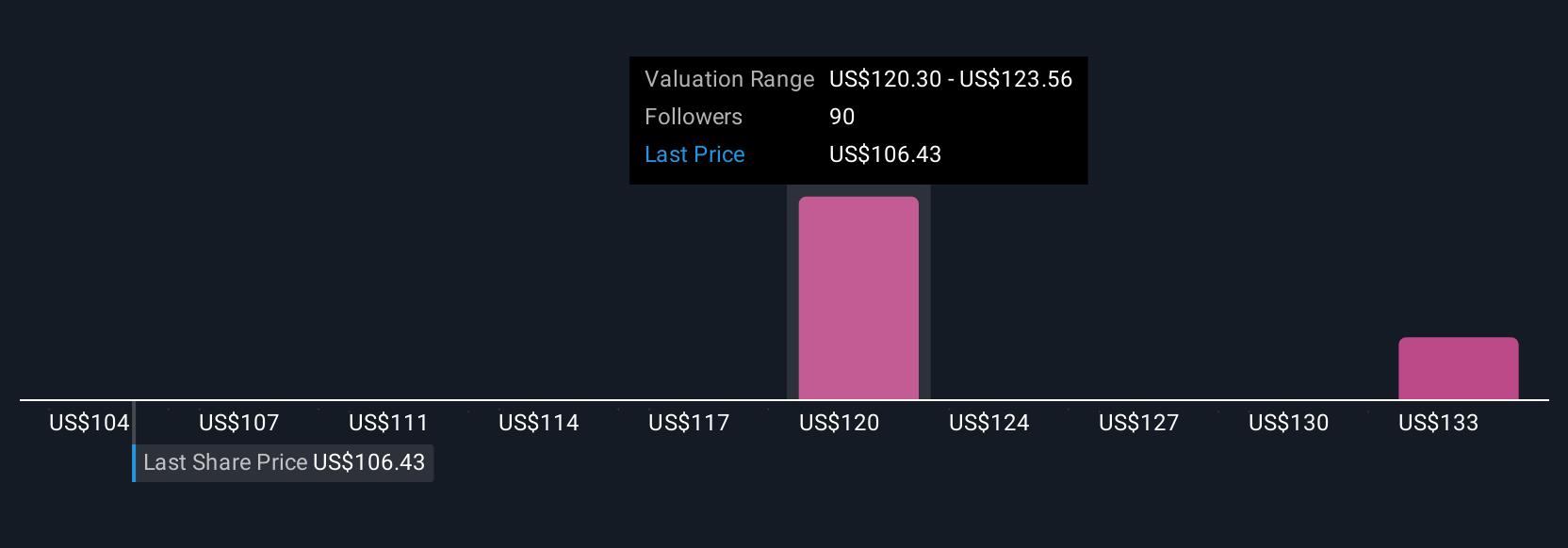

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your own story for a company: it is where you define what you think about Prologis’s prospects, set your assumptions for its future revenue, earnings, and margins, and end up with your personal fair value, all in one spot. Narratives bridge the gap between numbers and context by letting you ground your forecasts in real business drivers and then see the financial implications.

This tool is designed to be accessible to every investor. On Simply Wall St’s Community page, millions of investors are already building and sharing their Narratives. Narratives help you make smarter decisions by showing if your fair value matches up to the current share price, highlighting when it might be time to buy or sell. Each Narrative is automatically updated when the facts change, such as after news or earnings releases, so your view stays relevant.

For example, the most optimistic recent Narrative for Prologis (using bullish analyst price targets) values it as high as $140 per share, based on strong growth and rising margins. The most cautious Narrative values it at just $95, reflecting skepticism over leasing trends and profit risks. Whichever perspective you hold, Narratives let you see the assumptions behind every valuation and adapt your view as the story unfolds.

Do you think there's more to the story for Prologis? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLD

Prologis

Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets.

Established dividend payer with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success