- United States

- /

- Industrial REITs

- /

- NYSE:PLD

Does Prologis’ Upward Earnings Guidance Raise the Bar for Growth Despite Lower Profits (PLD)?

Reviewed by Sasha Jovanovic

- Prologis, Inc. recently reported its third quarter and nine-month 2025 results, with revenue increasing to US$2.21 billion for the quarter but net income declining to US$764.27 million compared to the prior year.

- Despite the dip in profitability, Prologis raised its full-year 2025 earnings guidance, highlighting management’s continued confidence in forward performance.

- We'll explore how Prologis’ upward revision of earnings guidance affects its investment narrative and outlook for future growth.

Find companies with promising cash flow potential yet trading below their fair value.

Prologis Investment Narrative Recap

To be a shareholder in Prologis, you need to believe in the company’s ability to turn a robust pipeline of logistics assets into steady, long-term growth, especially as demand for supply chain infrastructure continues. The recent uplift in full-year earnings guidance is a positive signal for near-term momentum, but it does not fully offset the importance of monitoring slower leasing activity and elevated vacancy rates, which remain key short-term catalysts and risks for the business.

Among recent announcements, Prologis’ raised 2025 earnings guidance stands out as the most relevant. It reinforces management’s confidence despite recent declines in net income and profit margins, suggesting that recurring revenue streams and customer commitments continue to anchor the outlook, important given ongoing tenant caution and deliberate leasing decisions.

On the flip side, investors should be aware that while guidance has improved, elevated market vacancy rates could...

Read the full narrative on Prologis (it's free!)

Prologis' narrative projects $9.7 billion revenue and $3.6 billion earnings by 2028. This requires 3.0% yearly revenue growth and a $0.2 billion increase in earnings from $3.4 billion.

Uncover how Prologis' forecasts yield a $128.05 fair value, in line with its current price.

Exploring Other Perspectives

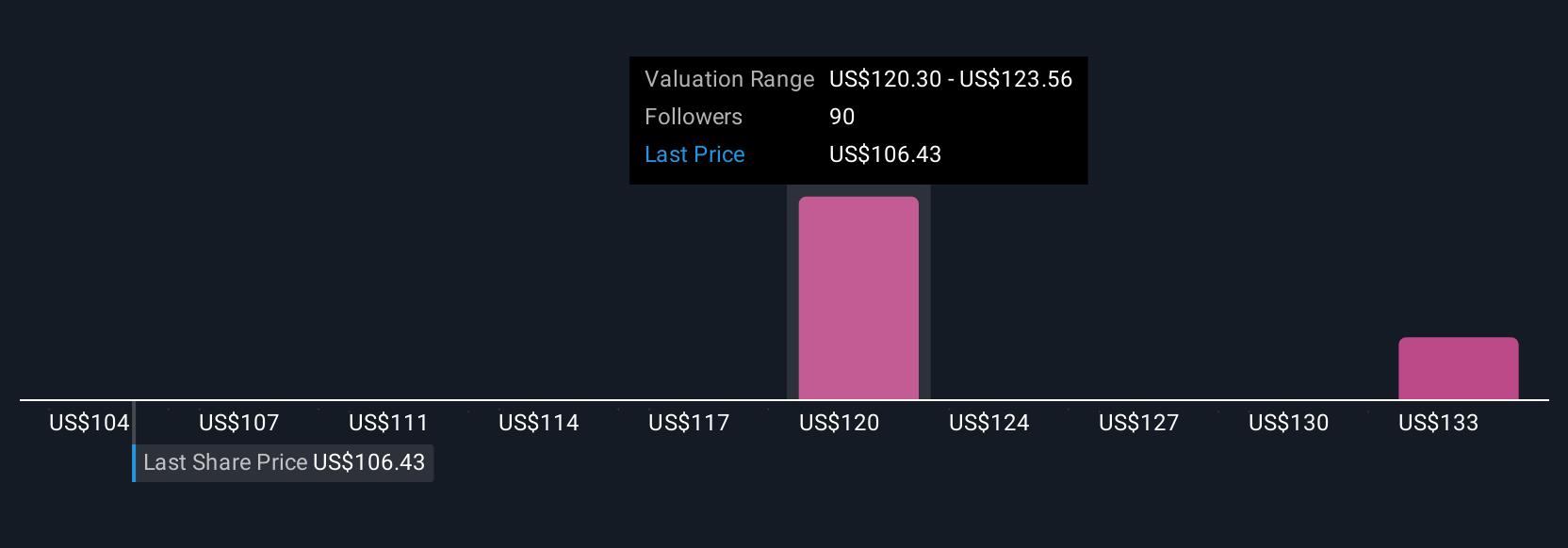

Six members of the Simply Wall St Community provided fair value estimates for Prologis, ranging from US$104 to US$128.05. While these figures reflect a wide spectrum of opinion, the slower pace of new leasing remains a core issue with implications for near-term revenue growth and future returns.

Explore 6 other fair value estimates on Prologis - why the stock might be worth as much as $128.05!

Build Your Own Prologis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Prologis research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Prologis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Prologis' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLD

Prologis

Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives