- United States

- /

- Industrial REITs

- /

- NYSE:PLD

Did Lower 2025 Earnings Guidance Just Shift Prologis' (PLD) Investment Narrative?

Reviewed by Simply Wall St

- Prologis recently lowered its 2025 earnings guidance, now expecting diluted earnings per share attributable to common stockholders in the range of US$3.00 to US$3.15, compared to its prior forecast of US$3.45 to US$3.70.

- This shift in expectations highlights how revised forward-looking statements can play a significant role in shaping market perceptions of a company's prospects.

- We'll explore how this downward revision in earnings outlook may affect Prologis' long-term investment case and growth narrative.

Prologis Investment Narrative Recap

Prologis shareholders generally buy into the view that demand for modern logistics space will continue as urbanization and e-commerce accelerate. The recently lowered 2025 earnings guidance does raise questions about short-term profit expansion, though the main catalyst of urban consumption-centric warehousing is largely intact; however, downside risks from economic or policy shocks may feel more immediate after this revision.

One recent development of interest is Prologis’ addition to the Russell 1000 Value-Defensive Index on June 28. While this move reinforces its reputation as a defensive holding, it doesn’t directly offset investor concerns tied to the temporary contraction in earnings outlook and ongoing macro risks that could pressure occupancy and rent growth.

On the other hand, investors should not overlook the potential impact of trade policy disruptions, particularly for tenants relying on China-based production, as...

Read the full narrative on Prologis (it's free!)

Prologis is projected to generate $9.4 billion in revenue and $3.4 billion in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 2.6% and a decrease in earnings of $0.3 billion from the current $3.7 billion.

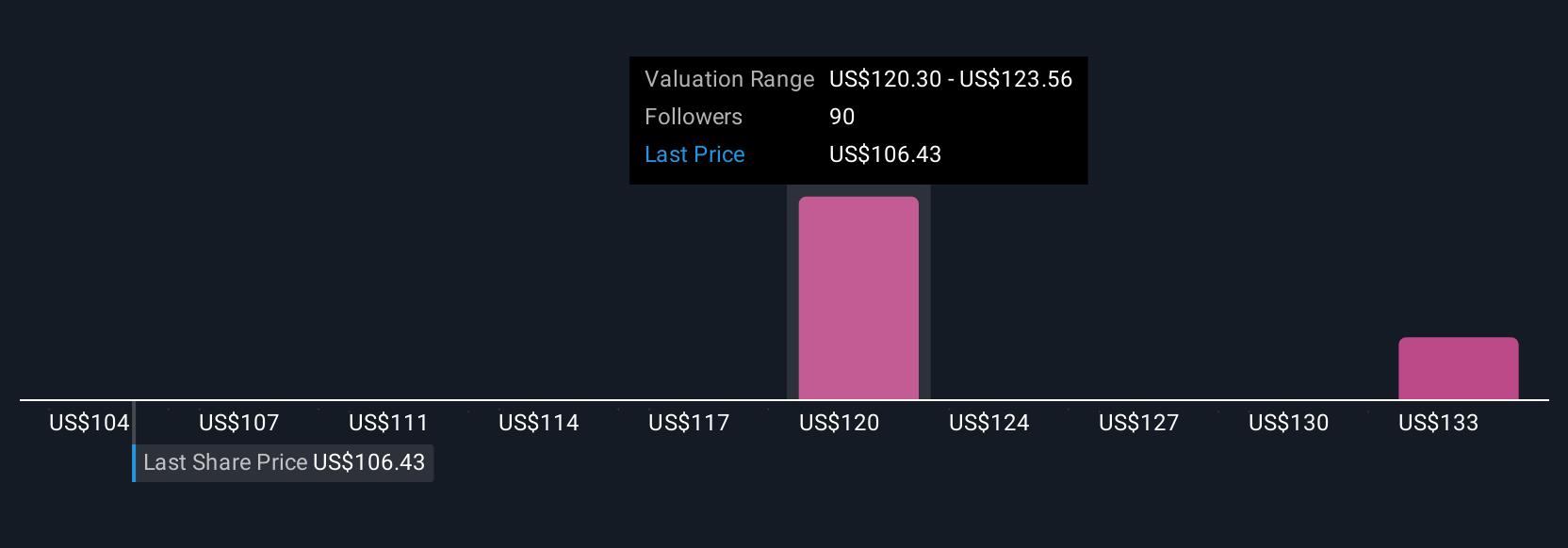

Uncover how Prologis' forecasts yield a $120.38 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Seven private investors in the Simply Wall St Community have estimated Prologis’ fair value from US$104 to US$153, reflecting wide-ranging viewpoints. These opinions contrast with concerns about earnings resilience, highlighting why it’s essential to consider multiple perspectives as you weigh future risks and opportunities.

Build Your Own Prologis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Prologis research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Prologis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Prologis' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLD

Prologis

Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives